Will CRWV Stock Stay Below $100 This Time Amid Weak CoreWeave Q2, CORZ Deal?

Despite record-breaking revenue growth from surging AI demand, CoreWeave’s aggressive expansion, costly acquisition plans, and insider...

Quick overview

- CoreWeave's stock has dropped over 50% since June due to investor concerns over its aggressive expansion and acquisition plans.

- The company's Q2 earnings report showed revenue more than doubled year-over-year to $1.21 billion, driven by strong AI demand.

- Despite record revenue, CoreWeave reported widening net losses of $290.5 million, raising questions about its long-term sustainability.

- Insider selling and governance issues have added to investor unease, as the company navigates a challenging market landscape.

Despite record-breaking revenue growth from surging AI demand, CoreWeave’s aggressive expansion, costly acquisition plans, and insider selling have rattled investors, sending shares sharply lower.

Stock Pressure Amid Governance and Market Concerns

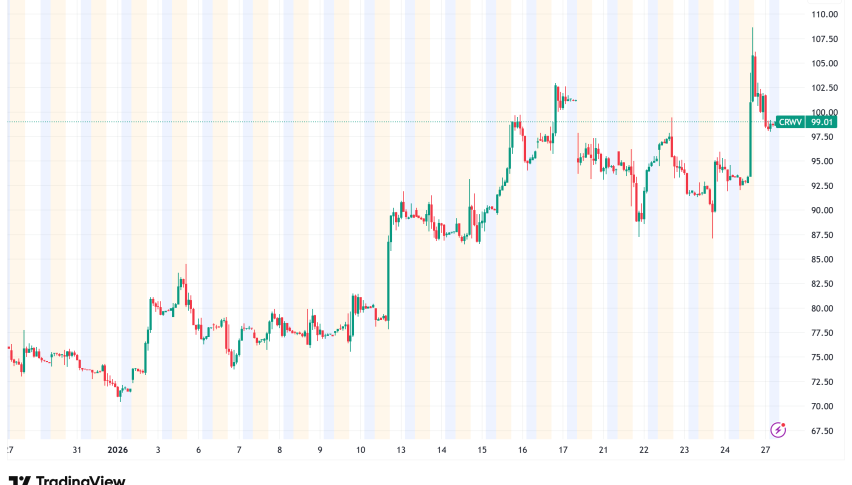

In August, Super Micro Computer (NASDAQ: SMCI) and its peer CoreWeave Inc. both faced heavy selling pressure, reflecting broader unease in the AI-driven infrastructure space. CoreWeave, once trading above $187 in June, has since tumbled more than 50%, opening below $100 and extending losses with a further 7% drop in recent sessions.

At the center of investor unease is CoreWeave’s pursuit of Core Scientific, a $9 billion acquisition that has been losing value as negotiations drag on. Shareholders of Core Scientific are now pressing for better terms, raising fresh questions over CoreWeave’s deal strategy.

CRWV Chart Weekly – The 20 SMA Has been Broken

Adding to the unease, CEO Michael N. Intrator sold 50,000 shares on August 27 at an average price of $95.65, totaling nearly $4.8 million. The SEC filing disclosing the sale deepened concerns about leadership’s confidence in the company’s near-term trajectory.

Record Revenue Growth Driven by AI Demand

Despite the turbulence, CoreWeave’s Q2 earnings report highlighted the extraordinary pace of AI adoption. Revenue more than doubled year-over-year to $1.21 billion, supported by heavy workloads from major clients such as Microsoft and OpenAI.

The surge underscores CoreWeave’s central role in powering next-generation AI services and reflects its ability to secure long-term demand. The company reported a $30.1 billion backlog, signaling strong contracted commitments for future workloads.

Expanding Losses From High Capital Spending

However, rapid growth has come at a steep cost. Net losses widened to $290.5 million in Q2, largely due to $2.9 billion in capital expenditures. Management outlined plans to spend $20–23 billion annually on infrastructure to sustain growth and meet rising demand.

The proposed acquisition of Core Scientific is part of this expansion, but investors are weighing whether the cost outweighs the benefits. Critics argue that overreliance on a handful of strategic partners could magnify risks if relationships shift or contracts are renegotiated.

Following the results, CoreWeave’s stock fell another 10%, as concerns about financing, profitability, and long-term sustainability overshadowed revenue milestones.

Balancing Opportunity and Risk

CoreWeave is at a crossroads: on one hand, it is a critical AI infrastructure provider with surging revenue and deep ties to industry leaders. On the other, its mounting losses, insider sales, and reliance on costly acquisitions present significant risks. Unless the company can strike a balance between growth and discipline, investors may remain wary despite record demand.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM