Bitcoin ETFs Wins over Ethereum ETFs in inflows

Spot Bitcoin ETFs had more than $333 million in net inflows on Tuesday, outperforming Ethereum ETFs, which experienced $135 million...

Quick overview

- Spot Bitcoin ETFs saw over $333 million in net inflows on Tuesday, significantly outperforming Ethereum ETFs, which faced $135 million in withdrawals.

- Fidelity's FBTC and BlackRock's IBIT were major contributors to Bitcoin's inflows, while Fidelity's FETH accounted for most of Ethereum's losses.

- Despite recent outflows, Bitcoin's resurgence as 'digital gold' is attracting institutional investment, with total crypto inflows reaching $2.48 billion last week.

- Economists predict that the current inflow trends could support Bitcoin's price around $108,000, while Ethereum's structure may keep it competitive.

Spot Bitcoin ETFs had more than $333 million in net inflows on Tuesday, outperforming Ethereum ETFs, which experienced $135 million in withdrawals amid continued market uncertainty.

According to SoSoValue statistics, spot bitcoin ETFs saw $332.7 million in net inflows on Tuesday, driven by $132.7 million into Fidelity’s FBTC and $72.8 million into BlackRock’s IBIT. Grayscale, Ark & 21Shares, Bitwise, VanEck, and Invesco all had reported additional inflows yesterday.

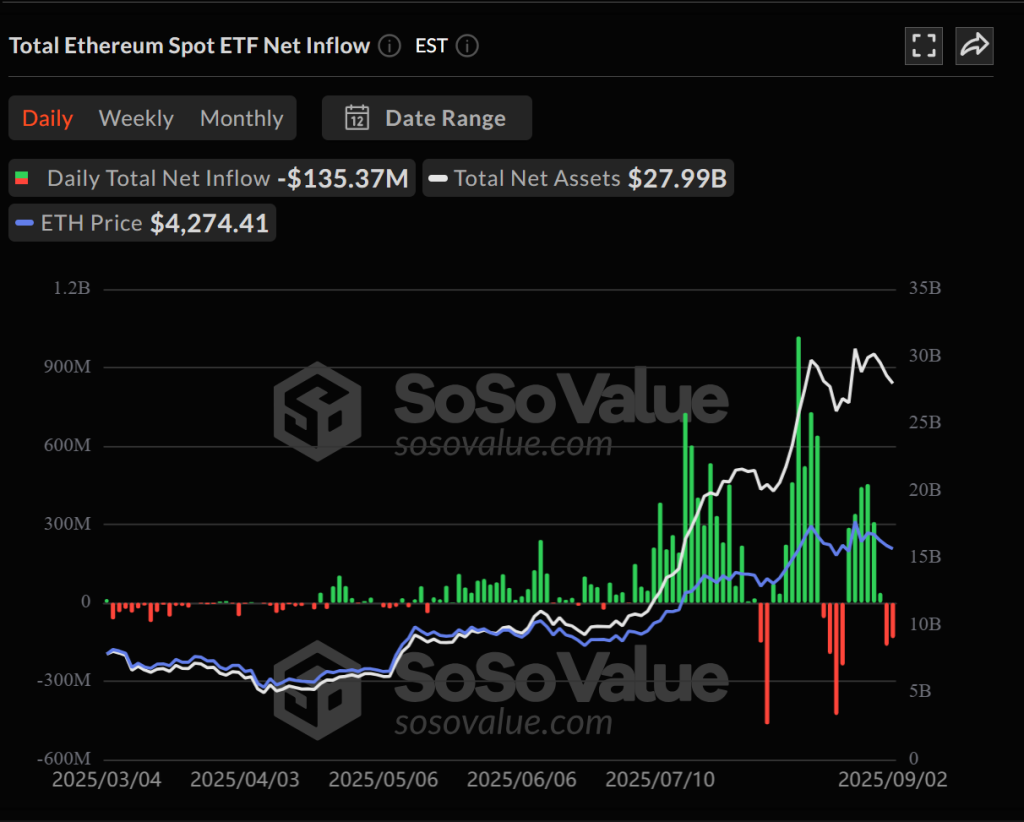

Meanwhile, spot Ethereum ETFs saw a total daily net outflow of $135.3 million. Fidelity’s FETH absorbed the majority of the loss, losing $99.2 million, while Bitwise’s ETHW lost $24.2 million. On Friday, ether ETFs experienced outflows of $164 million.

https://sosovalue.com/assets/etf/us-btc-spot/

The reversal followed a robust August for Ethereum funds, with $3.87 billion in inflows compared to $751 million outflows from Bitcoin (BTC) ETFs.

The increased surge in spot Bitcoin ETFs coincides with the resurgence of Bitcoin’s “digital gold” story. ” Bitcoin is once again drawing institutional investment as the digital gold story gathers traction.

Crypto funds recover with $2.48 billion in weekly inflows.

As previously reported, crypto investment products recovered last week, bringing in $2.48 billion in net inflows after a $1.4 billion outflow the week before.

August ended with $4.37 billion in inflows. Year-to-date inflows are already at $35.5 billion, up 58% from the same period in 2024. Total assets under management fell 7% week on week to $219 billion.

In the medium term, economists believe this flow will support Bitcoin’s price around $108,000 and reduce selling pressure. However, experts believe Ethereum’s revenue-generating structure and extended digital asset holdings will keep it ahead of the competition through the end of the year.

Currently, Bitcoin price is at $111,047, down 0.16% from the previous day, while Ethereum is trading at $4,323, down 0.07%.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM