CRWV Stock Rebounds 10%, Yet CoreWeave Profitability Concerns Remain

CoreWeave's ambitious expansion strategy and leadership decisions have disturbed markets and left investors divided over the company's...

Quick overview

- CoreWeave's stock has experienced a significant decline of over 55% since its peak in June, closing at $84.50 last week.

- Investor concerns are mounting over the company's aggressive $9 billion acquisition strategy and insider selling by CEO Michael N. Intrator.

- Despite strong revenue growth of $1.21 billion in Q2, the company faces challenges with widening net losses and high capital expenditures.

- The market remains cautious as CoreWeave's future hinges on its ability to balance rapid expansion with financial sustainability.

CoreWeave’s ambitious expansion strategy and leadership decisions have disturbed markets and left investors divided over the company’s future direction, despite record-breaking AI-driven sales growth.

Stock Performance: From Highs to Lows

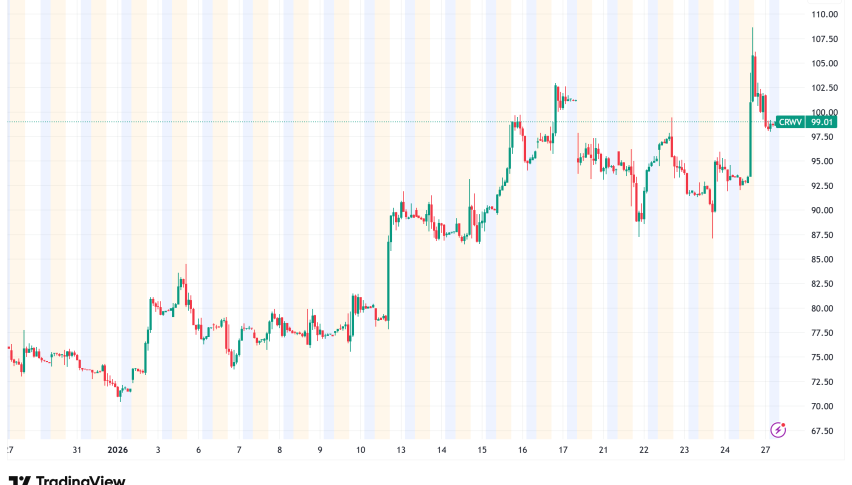

CoreWeave Inc. (NASDAQ: CRWV) has endured a turbulent summer. After peaking in late June, the stock collapsed by more than 55%, shedding over $100 per share to close at $84.50 by last Friday. While the past two sessions saw a modest 10% rebound, the recovery remains shallow compared to the sharp decline. Analysts note that for sentiment to decisively shift back to bullish territory, CRWV would need to climb above its August high near $150. Until then, the stock remains stuck below the $100 threshold, signaling caution among investors.

CRWV Chart Daily – Still Too Little for A Bullish Reversal

The broader AI-infrastructure space also showed cracks in August, with CoreWeave and rival Super Micro Computer (NASDAQ: SMCI) both suffering heavy selling pressure. This hints at broader market unease rather than company-specific weakness alone.

Acquisition Ambitions Under Scrutiny

At the center of investor concern is CoreWeave’s proposed $9 billion acquisition of Core Scientific. The deal has been plagued by delays, as Core Scientific shareholders push for better terms, raising questions about whether the acquisition is being pursued too aggressively and at too high a price.

Adding to the complexity, CoreWeave announced on September 3 that it finalized terms for acquiring OpenPipe, a niche player in AI agent training. However, details remain scarce, and with speculation that CoreWeave might rely on additional stock sales to finance both deals, worries about dilution for current shareholders have intensified. Critics argue that the company’s willingness to issue new shares suggests management believes its stock was overvalued, further unsettling investor confidence.

Insider Selling Raises Red Flags

Leadership behavior has added fuel to the uncertainty. On August 27, CEO Michael N. Intrator sold 50,000 shares, pocketing nearly $4.8 million at an average price of $95.65. While insider selling does not always imply a loss of confidence, the timing—amid steep declines and ongoing funding concerns—has heightened market unease about management’s outlook on short-term performance.

Strong Revenue Growth, Weak Profitability

Despite these headwinds, CoreWeave’s Q2 earnings underscored the explosive growth of AI infrastructure demand. With Microsoft and OpenAI among its biggest clients, revenue surged to $1.21 billion, more than doubling year-over-year. The company also highlighted a $30.1 billion backlog, reflecting strong forward commitments for AI workloads.

However, scaling has come at a steep cost. Net losses widened to $290.5 million in Q2, driven by $2.9 billion in capital expenditures. Management laid out an ambitious plan to invest $20–23 billion annually in infrastructure to meet demand, but this aggressive spending strategy has amplified fears about profitability and long-term financial sustainability.

Investor Outlook: Balancing Growth and Risk

CoreWeave’s meteoric growth and dominant position in AI workloads highlight its enormous potential. Yet, questions remain over whether the company can manage its expansion without overextending financially. Dependence on a small set of strategic partners, such as Microsoft and OpenAI, could also leave CoreWeave vulnerable if contracts are renegotiated or competition intensifies.

For now, the stock reflects this tension: revenue milestones have been overshadowed by skepticism over funding strategies, dilution risks, and management decisions. Until the company demonstrates a clearer path to sustainable profitability, investors may remain cautious despite the undeniable demand tailwinds powering its business.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM