Forex Signals Brief Sept 9: Oracle, GameStop Earnings and Apple’s iPhone Launch

Oracle and GameStop are the focus of today's earnings calendar, and investors are intently observing both companies for clues about retail..

Quick overview

- Oracle and GameStop are in focus today as investors look for insights into retail momentum and tech strength.

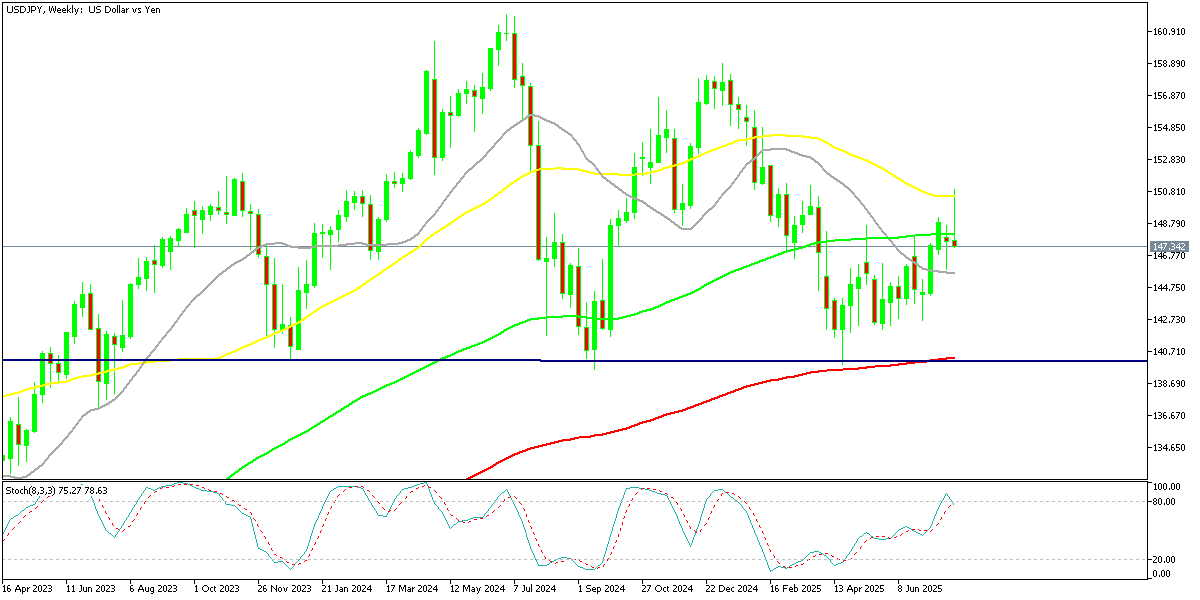

- Political events have caused market volatility, with the Japanese yen weakening and the euro briefly shaken by leadership changes in France.

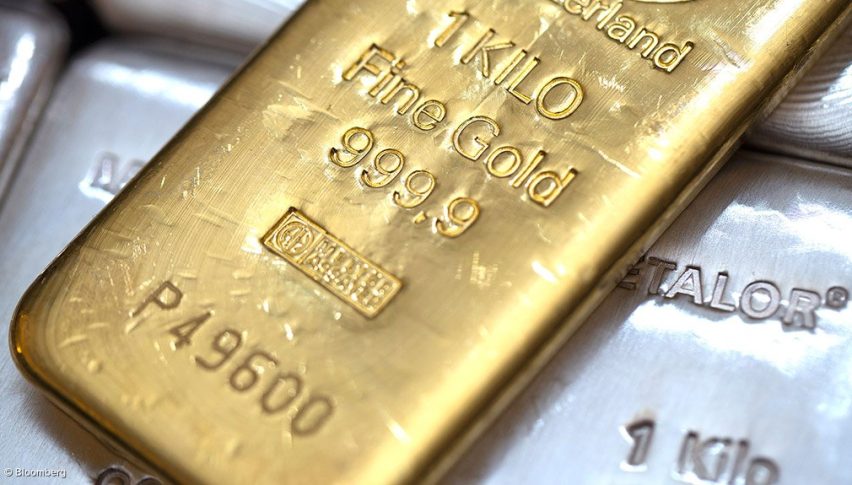

- Gold has surged to a record high of $3,646 per ounce, reflecting its appeal as a safe haven amid uncertainty.

- US equity markets saw gains led by technology, with the NASDAQ reaching a new record high despite mixed global signals.

Live BTC/USD Chart

Oracle and GameStop are the focus of today’s earnings calendar, and investors are intently observing both companies for clues about retail momentum and tech strength. The corporate update cycle is made more comprehensive by the reporting of several more well-known names.

Political Shifts and Currency Volatility

Markets struggled to find a clear driver on the day, as political events dominated early headlines. The Japanese yen weakened initially after the weekend resignation of the prime minister, slipping around 120 pips before reversing the move and leaving USD/JPY flat by the close. Later in Europe, political turbulence flared up when France’s prime minister was ousted, briefly shaking the euro before it rebounded. These developments highlight the challenge for investors trying to avoid political unrest, as shocks appear to be emerging on multiple fronts.

Dollar Weakness and Policy Expectations

The overriding theme in the broader market was a weakening US dollar, pressured by falling yields and shifting interest-rate bets. Traders are now pricing in a 10% chance of a 50 basis point rate cut at the September 17 Fed meeting, alongside expectations of further easing in 2025. Lower rates continue to weigh on the greenback, reinforcing a softening trend across currency markets.

Gold Shines as a Safe Haven

Amid political and monetary uncertainty, gold surged to another record, touching $3,646 per ounce. This marks the metal’s fifth gain in the past six sessions, underlining its safe-haven appeal as investors hedge against volatility and potential policy missteps.

US Equity Markets: Tech-Led Gains

On Wall Street, equity indices pushed higher despite mixed global signals. The NASDAQ reached a new record high, driven by renewed strength in technology. Broader participation across sectors was modest, but sentiment remained cautiously constructive as markets prepare for upcoming economic data.

Key Market Events to Watch Today

Spotlight on Apple’s iPhone Launch

Looking ahead, attention turns to Apple’s September 9 iPhone launch event. Historically, JPMorgan notes, these fall presentations have rarely produced major surprises. Expectations this year are particularly muted, as Apple struggles to demonstrate momentum in artificial intelligence compared to rivals like Meta, which continues to poach top AI talent. Apple’s stock is down 4.3% year-to-date, making it one of the weakest performers among the “Magnificent 7” tech giants—surpassed only by Tesla’s decline. This muted outlook underscores why investors are entering the event with tempered expectations.

Corporations Reporting Q2 Earnings

Oracle Corporation (ORCL)

- Q1 2026 Earnings Release – After Market Close (AMC)

- Expected EPS: $1.48

- Focus: Cloud growth, AI integration progress, and enterprise demand trends.

GameStop Corp. (GME)

- Q2 2025 Earnings Release – After Market Close (AMC)

- Expected EPS: -0.08

- Focus: New game releases, digital asset strategy, and cost-control efforts.

Synopsys, Inc. (SNPS)

- Q3 2025 Earnings Release – After Market Close (AMC)

- Expected EPS: $3.75

- Focus: Semiconductor demand, AI-driven design software, and backlog updates.

SailPoint, Inc. (SAIL)

- Q2 2026 Earnings Release – Before Market Open (BMO)

- Expected EPS: $0.04

- Focus: Cybersecurity adoption, identity management growth, and margin improvements.

Last week, markets were quite volatile again, with gold soaring to $3,600. EUR/USD continued the upward move toward 1.17, while main indices closed higher. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

Gold Kisses $3,600 on the Way to $4,000

Meanwhile, gold continues to attract strong safe-haven flows. Prices surged above $3,660 early yesterday, hitting a new record high, so buyers are in total control, while China has resumed buying bullion. Technical charts now highlight the $3,700 level as the next major resistance, which will be broken soon as the upside accelerates.

USD/JPY Continues Trading in the Range

Foreign exchange markets saw sharp swings. Early in the week, U.S. yield differentials and Japanese capital outflows pushed the dollar above ¥150, but disappointing U.S. jobs data triggered profit-taking, causing the USD/JPY to slide by four yen from its peak. The move underscored persistent volatility as traders weighed Japan’s intervention risks against evolving Fed expectations.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin Climbs Above the $110K Level Again

Cryptocurrencies remained highly active over the summer. Bitcoin (BTC) climbed to fresh highs of $123,000 and $124,000 in July and August, supported by institutional inflows and technical strength. However, remarks from Treasury Secretary Scott Bessent ruling out U.S. increases to BTC reserves triggered a steep pullback, sending the coin down to $113,000 before recovering above $116,000 last week, however sellers returned and sent BTC below $110,000, however we saw a rebound off the 20 weekly SMA (gray) yesterday.

BTC/USD – Weekly chart

Ethereum Heads to $4,500

Ethereum (ETH) has been similarly strong, surging toward $4,800, its highest since 2021 and near its all-time peak of $4,860. Despite a dip last week, ETH found support at the 20-day SMA, with retail enthusiasm and renewed institutional participation driving fresh upside momentum. However buying resumed and on Sunday ETH/USD printed another record at $4,941. However we saw a retreat to $,000 lows over the weekend, but yesterday buyers returned.

ETH/USD – Daily Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM