Bitcoin Mining Stocks Surge Over 70% in September, Companies Pivot to AI Data Centers

Bitcoin mining stocks are on a huge rise, with big companies doing far better than Bitcoin itself as investors put a lot of money into AI

Quick overview

- Bitcoin mining stocks have surged between 73% and 124% in September, outperforming Bitcoin itself, which fell over 3%.

- Companies like Bitfarms and Iris Energy are leading the charge, with Bitfarms hitting a new 52-week high and Iris Energy seeing a 268% return this year.

- Investors are increasingly optimistic about miners pivoting towards artificial intelligence and advanced data center infrastructure.

- Despite rising mining difficulties and declining on-chain activity, miners are accumulating Bitcoin, indicating confidence in future price increases.

Bitcoin mining stocks are on a huge rise, with big companies doing far better than Bitcoin BTC/USD itself as investors put a lot of money into AI pivots and changes to data centers. Even though traditional mining economics are under a lot of pressure, companies like Cipher Mining, Terawulf, Iris Energy, Hive Digital Technologies, and Bitfarms have made huge profits that are much bigger than Bitcoin’s recent performance.

Exceptional Stock Performance Amid Industry Headwinds

The latest industry analysis from The Miner Mag says that Bitcoin mining stocks rose between 73% and 124% in September alone, while Bitcoin fell by more than 3% during the same time. Several mining equities are presently at their highest prices in a year or ever, which shows that investors have never been more confident in their strategic changes.

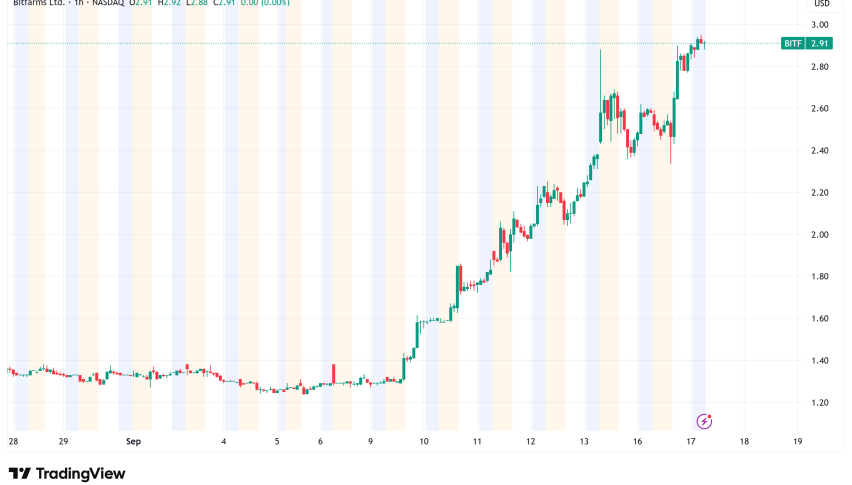

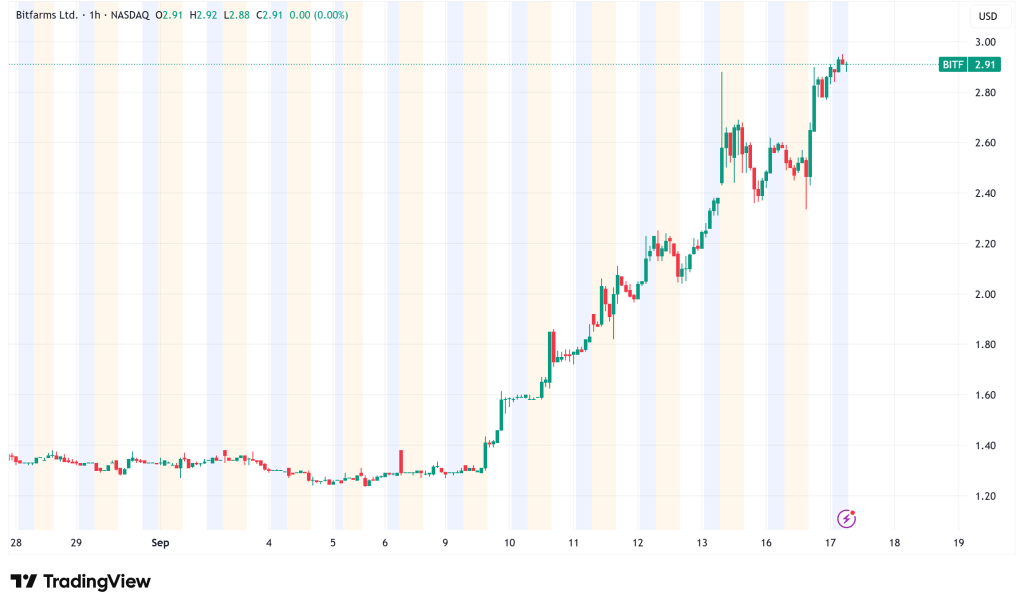

Bitfarms was the leader, with its stock price rising 16.5% in one day to settle at $2.89, a new 52-week high. Trading volume shot up to about 154 million shares, which is a lot more than the three-month average of 32.5 million. This was one of the busiest trading days of the year for the cryptocurrency mining company. In just one week, the stock’s value has more than doubled.

AI Strategy Driving Valuations

The rise shows that more and more investors are excited about miners who are moving toward artificial intelligence and high-performance computer infrastructure. Canaccord Genuity showed how they felt by upping Cipher Mining’s price target from $9 to $13 and keeping a Buy rating based on the company’s AI data center potential at its Barber Lake site.

Iris Energy (IREN), which used to be called Iris Energy, has done quite well, with a return of 268% this year and 368% over the past 12 months. The company is now a preferred partner of Nvidia and can use more than 60,000 Nvidia Blackwell GPUs at its data centers in Canada and more than 19,000 GB300s at its Texas Horizon facility.

Canaccord analysts recently raised IREN’s price target from $37 to $42. They did this because of the growing data center infrastructure, notably the huge 2 GW Sweetwater facility in Texas that was designed exclusively for AI workloads. The company thinks that by December 2025, its AI Cloud business will bring in $200–250 million a year, which is a huge increase from its current $16 million in AI income.

Bitcoin Mining Industry Fundamentals Under Pressure

The stock market is going up even when mining is not going well. The difficulty of the Bitcoin network is expected to go up by another 4.1%, making this the first epoch with an average hashrate above the zetahash milestone. This is a technological win for the network’s security, but also makes it harder for miners to make money.

Hashprice is still locked at $55 per petahash per second, and transaction fees have dropped below 0.8% of monthly rewards, which means that onchain activity is slowing down. These numbers would usually put pressure on mining stock prices, which makes the current surge even more impressive.

Crypto Treasury Strategy and Accumulation Trends

Miners are using treasury methods by keeping more of the Bitcoin they generate instead of selling it right away, in addition to AI pivots. According to Glassnode data, miner wallet balances have been going up for three weeks in a row. On September 9, net inflows reached 573 BTC, the biggest day rise since October 2023.

This approach of accumulating shows that miners are confident that the price of Bitcoin will go up in the future and gives them more financial freedom when they switch to AI-focused business models.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account