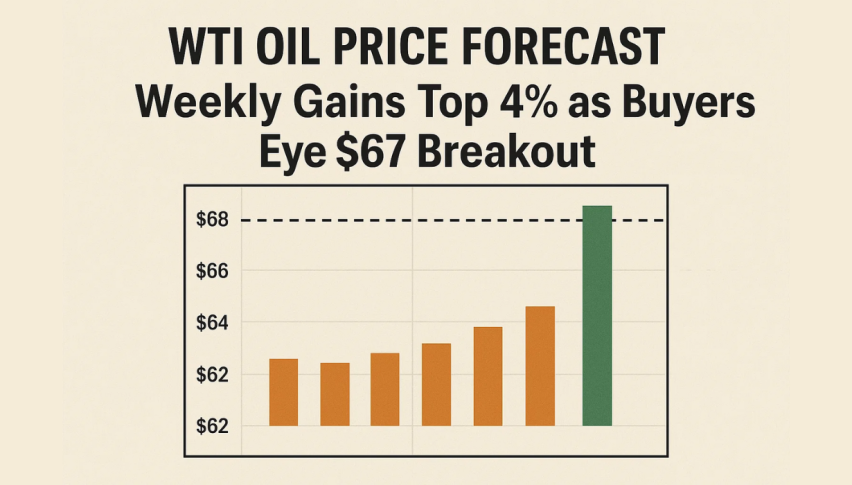

WTI Oil Price Forecast: Weekly Gains Top 4% as Buyers Eye $67 Breakout

WTI crude futures rose above $65 on Friday, near a three-week high and up more than 4% for the week – the biggest gain since June...

Quick overview

- WTI crude futures rose above $65, marking a three-week high and a weekly gain of over 4%.

- Geopolitical tensions, particularly regarding Russian oil exports, are driving the rally despite concerns over demand.

- Technical indicators suggest a bullish trend, with potential targets at $66.00 and beyond if the price maintains above $64.20.

- Traders are advised to consider long positions, with a stop-loss below $63.80 for favorable risk-reward.

WTI crude futures rose above $65 on Friday, near a three-week high and up more than 4% for the week – the biggest gain since June. The rally is driven by supply concerns as geopolitics trumps demand risks.

Pressure on Russian oil exports intensified after US President Donald Trump told Turkish President Recep Tayyip Erdogan to stop buying from Moscow, on top of existing sanctions. Ukraine has also stepped up drone attacks on Russian energy infrastructure, causing fuel shortages and threatening export curbs.

That geopolitical backdrop kept a strong bid under crude even as Kurdish oil exports returned to the market, reviving supply worries. Traders are also pricing in softer US rate cuts, which could slow growth and demand, and renewed global trade tensions added another layer of downside risk.

Key Update

Oil Gains on US Stock Draw, Geopolitical Supply Disruptions

Brent crude rose 1.4% to $68.60/barrel and WTI gained 1.6% to $64.40 after US data showed a decline in crude inventories.

Supply concerns mounted amid export hurdles in Kurdistan, Venezuela, and disruptions…

— File1 Updates (@File1UpdatesIND) September 25, 2025

WTI Crude Oil Technical Outlook: Bulls Test $66

WTI crude is at $65.20 after rebounding from $62.70, in a clear short-term uptrend. The 2-hour chart shows prices moving along an ascending trendline, with higher lows. The 50-period and 100-period SMAs, now at $63.70 and $63.61, are bullish and aligned.

Candlesticks show buying conviction, with big green candles above $65.05. But spinning tops at $65.30 suggest hesitation as bulls hit resistance at $66.00. A bullish engulfing candle or three white soldiers above this level could confirm a breakout to $66.60 and $67.20.

Momentum is supportive but cautious. The RSI is at 65, getting into overbought territory and suggesting a pullback before another leg up. A dip to $64.20-$64.00 would not break the trend and could be a entry point for buyers.

WTI Crude Oil Trade Setup: Higher is the Path of Least Resistance

For traders, it’s simple: as long as WTI is above $64.20, the path of least resistance is up. A long entry at $65.00 with stop below $63.80 is a good risk-reward.

Initial targets are $66.00, with extended gains to $66.60 and $67.20. If it breaks the trendline, then $62.70. For now, with geopolitics and technicals in the bulls’ favour, up next week.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM