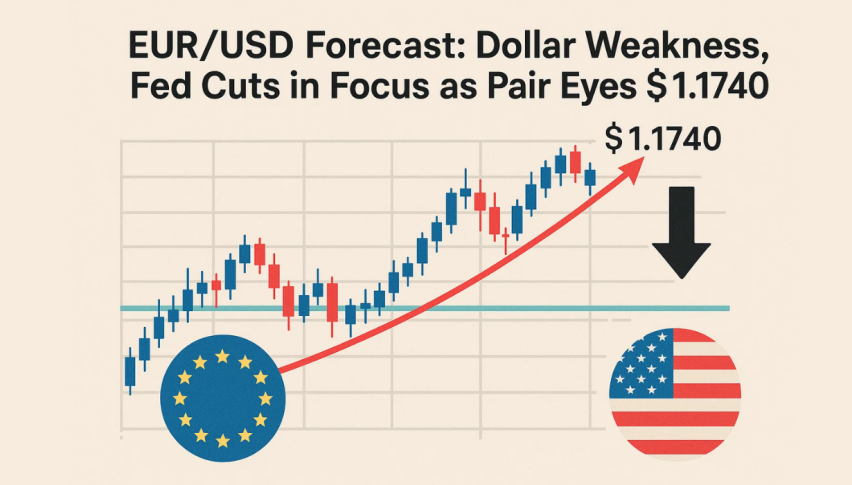

EUR/USD Forecast: Dollar Weakness, Fed Cuts in Focus as Pair Eyes $1.1740

The EUR/USD pair extended gains on Monday, trading around $1.1725 during the European session. The move marks the second...

Quick overview

- The EUR/USD pair gained momentum, trading around $1.1725, driven by a softer U.S. Dollar and steady inflation data.

- August's PCE Price Index showed a year-over-year increase of 2.7%, supporting expectations for continued easing by the Federal Reserve.

- The ECB's decision to keep rates unchanged has stabilized the euro, despite ongoing structural weaknesses in manufacturing.

- Technically, EUR/USD faces resistance at $1.1740, with potential for a breakout towards $1.1780 or a pullback to $1.1690.

The EUR/USD pair extended gains on Monday, trading around $1.1725 during the European session. The move marks the second straight day of upward momentum, largely driven by a softer U.S. Dollar. Markets reacted to August’s Personal Consumption Expenditures (PCE) Price Index, which showed inflation holding steady. Headline PCE rose 2.7% year-over-year, slightly higher than July’s 2.6%, while core PCE held at 2.9%, matching forecasts.

These readings suggest inflation remains elevated but manageable, bolstering expectations that the Federal Reserve will continue easing policy. The Fed cut rates by 25 basis points in September, bringing the federal funds rate to 4.00%–4.25%. According to the CME FedWatch Tool, markets now price in an 88% chance of another cut in October and 65% odds of one in December, signaling broad confidence in a dovish policy path.

ECB Holds Steady as Euro Finds Tailwind

On the European side, the euro has found support as investors anticipate the European Central Bank (ECB) is nearing the end of its easing cycle. At its last meeting, the ECB kept rates unchanged for a second time, signaling a more cautious stance.

While Eurozone services activity remains resilient, manufacturing continues to contract, underscoring structural weakness. Even so, expectations that the ECB will avoid further aggressive easing have helped stabilize the single currency and allowed EUR/USD to hold recent gains.

EUR/USD Technical Outlook: Key Resistance at $1.1740

From a technical standpoint, EUR/USD is facing a decision point. On the 2-hour chart, the pair hovers near $1.1725, just below the 50-SMA ($1.1734) and 100-SMA ($1.1737), which form a strong resistance cluster. A broken rising trendline adds further overhead pressure.

Recent price action shows a rebound from $1.1650, with a sequence resembling a “three white soldiers” pattern—typically a bullish signal. Yet, the latest candles highlight hesitation, with upper wicks suggesting sellers are active near current levels. The RSI sits around 57, showing momentum has improved but isn’t overbought.

- A breakout above $1.1740 could pave the way toward $1.1780–$1.1820.

- A rejection here risks a pullback to $1.1690, and deeper losses toward $1.1650 if selling pressure resumes.

Trade setup: Conservative traders may wait for a daily close above $1.1740 before entering long positions, targeting $1.1780–$1.1820 with stops under $1.1700. Alternatively, a bearish engulfing candle at this resistance zone could justify a short trade, aiming for $1.1690 with stops above $1.1750.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account