Hood Stock Hits New Record High as Crypto and Q2 Beat Fuel Rally

The fintech giant's stock has surged to new record highs thanks to Robinhood's impressive quarterly performance, which was driven by growth

Quick overview

- Robinhood's stock surged 13% to a record high of $137.70, driven by strong Q2 results and increased crypto trading activity.

- The company reported Q2 revenue of $989 million, exceeding expectations and marking a 45% year-over-year increase.

- Robinhood's crypto division saw a 98% revenue increase, contributing significantly to its overall growth and user expansion.

- Analyst upgrades and inclusion in the S&P 500 have bolstered investor confidence, highlighting Robinhood's transition to a mature fintech leader.

The fintech giant’s stock has surged to new record highs thanks to Robinhood’s impressive quarterly performance, which was driven by growth in cryptocurrency trading and positive analyst opinion.

A Record-Breaking Climb

With more than 2 billion event contracts exchanged in Q3 alone, Robinhood Prediction Markets recently surpassed 4 billion event contracts traded overall. And we have only just begun. Robinhood Markets Inc. (NASDAQ: HOOD) extended its winning streak this week, jumping 13% in a single session as investor enthusiasm grew around its robust Q2 results. The rally carried the stock to a new all-time high of $137.70, driven by strong revenue growth, a surge in crypto trading activity, and a series of bullish analyst upgrades.

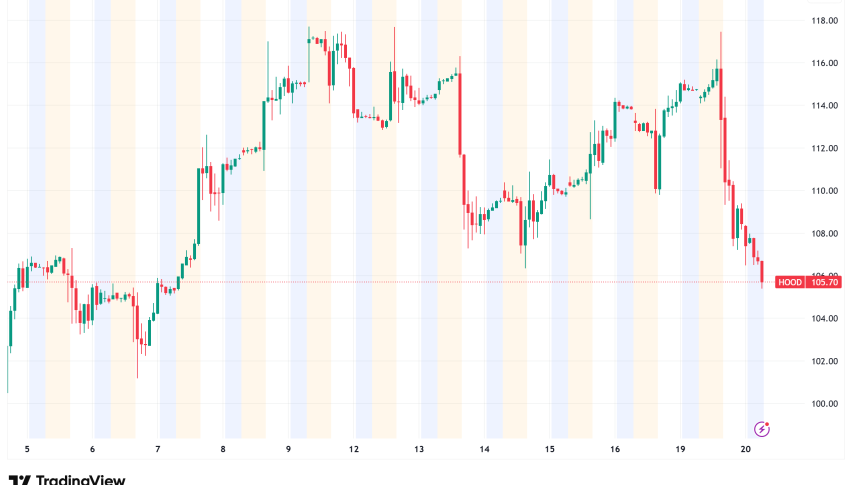

This remarkable momentum follows an already stellar year for the trading platform’s stock. HOOD has gained 246% year-to-date and more than 450% from its April lows near $30, with the stock consistently finding support above key moving averages on daily charts.

HOOD Stock Chart Daily – The 20 SMA Pushing the Price Higher

Earnings Blow Past Expectations

Wall Street’s forecasts were once again outpaced by Robinhood’s Q2 revenue of $989 million, well above the $920 million consensus. The results marked a 45% year-over-year revenue jump and helped deliver GAAP earnings per share of $0.42, beating the average estimate of $0.31 by more than 35%.

Net income climbed 105% year-over-year, while adjusted EBITDA reached $549 million, underscoring a sharp improvement in operational efficiency.

Crypto Division Powers Growth

A standout driver was Robinhood’s crypto trading arm, which posted a 98% revenue increase to $160 million compared with the same period a year earlier. The strong uptake highlights the company’s success in capitalizing on renewed enthusiasm for digital assets.

Robinhood also added 2.3 million new funded accounts during the quarter, signaling sustained user expansion across both its traditional brokerage and crypto offerings.

Index Inclusion and Analyst Upgrades Boost Confidence

Robinhood’s September 22 inclusion in the S&P 500 marked a pivotal milestone, expanding the stock’s visibility to institutional investors and triggering fresh demand. Analysts were quick to respond:

- BofA Securities raised its target to $139

- Mizuho projected $145

- Piper Sandler increased its target to $140

These upgrades reinforced bullish sentiment and provided further tailwinds to the stock’s upward march.

Operational Maturity and Global Ambitions

Beyond headline figures, Robinhood’s Q2 results reflected a broader shift in the company’s business profile. The platform is increasingly seen as transitioning from a fast-growing disruptor to a mature, profitable fintech leader, evidenced by rising margins and better cost discipline alongside impressive user engagement.

Its continued global expansion and deepening digital asset ecosystem suggest a growth story that is extending beyond U.S. retail trading, strengthening its competitive moat in the fintech space.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM