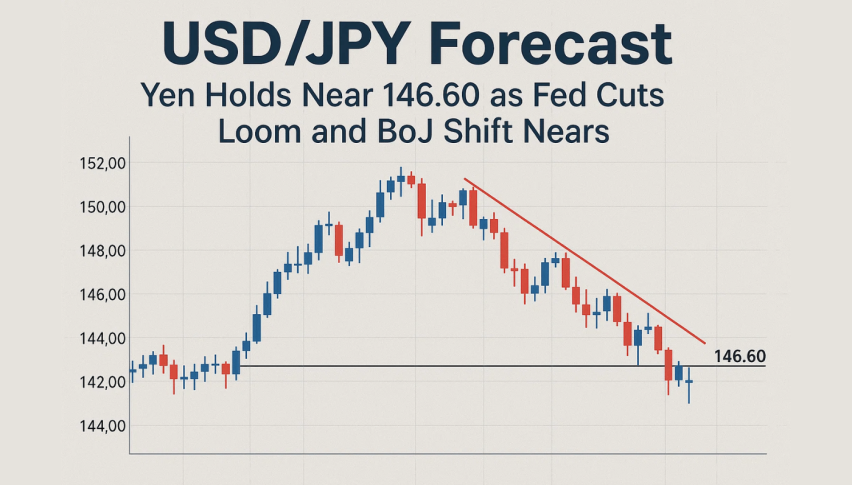

USD/JPY Forecast: Yen Holds Near 146.60 as Fed Cuts Loom and BoJ Shift Nears

The Japanese Yen is struggling to hold ground as markets weigh two opposing forces: the Bank of Japan’s (BoJ) potential rate hike...

Quick overview

- The Japanese Yen is facing pressure from potential Bank of Japan rate hikes and US monetary easing expectations.

- The upcoming Liberal Democratic Party leadership election adds uncertainty to Japan's fiscal and monetary policy.

- The US Dollar is under pressure due to expectations of Fed rate cuts and disappointing labor market data.

- Technically, USD/JPY shows a bearish bias with key support levels at 146.57 and 146.02.

The Japanese Yen is struggling to hold ground as markets weigh two opposing forces: the Bank of Japan’s (BoJ) potential rate hike and ongoing US monetary easing expectations. The latest BoJ meeting summary shows policymakers are discussing a 0.25% hike in October. That would narrow the wide rate gap with the Federal Reserve and provide a floor for the Yen after months of weakness.

Japan’s political calendar adds to the uncertainty. The Liberal Democratic Party leadership election on October 4 will decide the next Prime Minister and could impact fiscal and monetary policy in the months to come. Until then the Yen is sensitive to both political and central bank headlines.

Fed Cuts and US Shutdown Weigh on Dollar

Across the Pacific, the US Dollar is under pressure. The CME FedWatch Tool shows markets fully pricing in a Fed rate cut this month and 90% chance of another in December. That dovish outlook is due to disappointing data: ADP reported a 32,000 drop in private payrolls for September, the biggest decline since March 2023. August numbers were also revised down, showing cracks in the labor market.

The ISM manufacturing index came in at 49.1, seven months of contraction. And the US government has shut down after lawmakers failed to agree on a funding bill. While shutdowns have historically had limited economic impact, this one could delay critical data releases like Nonfarm Payrolls.

Despite all this, US equities are holding up, the S&P 500 is extending its winning streak, reducing safe-haven demand for the Yen.

USD/JPY Technicals Show Bearish Bias

Technically, USD/JPY is weakening, down to 146.60. The pair has broken below both the 50- and 100- period SMAs (148.25 and 147.75) and a sequence of lower highs and lower lows.

Candlestick analysis supports this view: repeated rejections at 148.80 and a series of consecutive red candles looks like a “three black crows” pattern, a bearish continuation signal. The RSI at 31 is oversold, so a short lived bounce isn’t out of the question.

Levels to watch:

- Support: 146.57, 146.02, 145.50

- Resistance: 147.40, 148.20

Trade Idea (Bearish):

- Entry: Short at break below 146.57

- Stop-Loss: Above 147.40

- Target: 146.02, then 145.50

For now the trend is down, bears are in control and buyers are waiting at resistance.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM