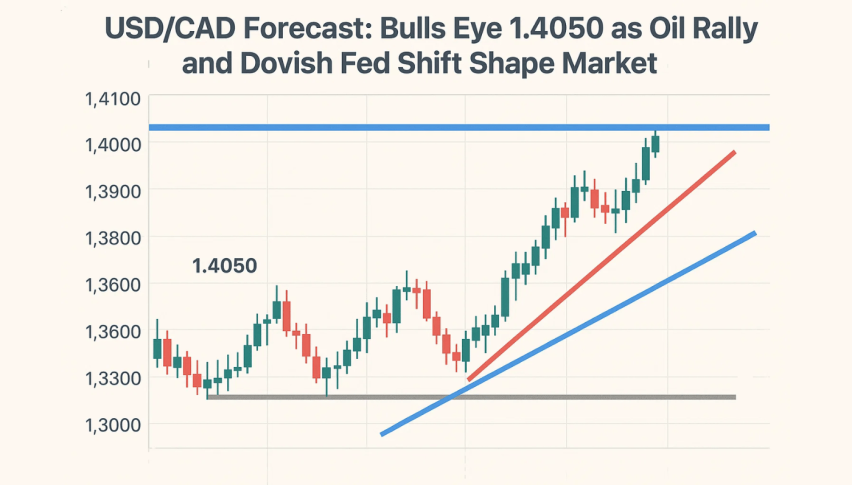

USD/CAD Forecast: Bulls Eye 1.4050 as Oil Rally and Dovish Fed Shift Shape Market

The USD/CAD pair traded at 1.3950 on Monday, flat for the second day as the Canadian Dollar (CAD) rose with oil prices.

Quick overview

- The USD/CAD pair remained flat at 1.3950 as the Canadian Dollar strengthened alongside rising oil prices.

- OPEC+'s limited increase in oil production has supported higher crude prices, benefiting Canada's trade balance.

- The US Dollar is under pressure due to expectations of a dovish Federal Reserve and ongoing government shutdown uncertainties.

- Technically, the USD/CAD is in an uptrend, with potential targets at 1.3985 and 1.4045 if it breaks above 1.3985.

The USD/CAD pair traded at 1.3950 on Monday, flat for the second day as the Canadian Dollar (CAD) rose with oil prices. Canada is a major oil exporter to the US and the Loonie often moves with oil. The latest surge in West Texas Intermediate (WTI) crude to $61.50 per barrel has made the Loonie more attractive.

The price increase followed OPEC+’s decision to increase oil production by 137,000 barrels per day in November, the same as October. This limited supply increase was less than market expectations and eased supply fears and supported oil prices. Higher crude revenues typically boost Canada’s trade balance and the CAD and pressure the USD/CAD lower.

Fed Rate Cut Bets Weigh on Dollar

The US Dollar is under pressure as traders are pricing in a dovish pivot from the Federal Reserve. The CME FedWatch Tool shows 95% chance of a 25-bp cut in October and 84% in December. This has reduced the Dollar’s yield advantage and investors are rotating into higher-yielding and commodity-linked currencies.

Adding to the pressure is the US government shutdown which has now entered a new week. The stalemate has delayed key data releases such as the September Nonfarm Payrolls and heightened uncertainty over fiscal stability. The combination of political gridlock, dovish Fed sentiment and strong commodity momentum is weighing on the Dollar’s short-term outlook.

USD/CAD Technical Forecast and Trade Setup

Technically, the USD/CAD is in an uptrend supported by a rising channel. The pair is above the 50-SMA (1.3930) and 100-SMA (1.3851) which recently had a bullish crossover and is showing higher highs and higher lows, a sign of sustained buying.

Recent spinning top candles indicate short-term indecision but with the RSI at 59, the pair has room to move up before it hits overbought. A break above 1.3985 could open up 1.4013 and 1.4045, where profit taking may occur. Below 1.3900 could invite a deeper pullback to 1.3850.

Trade Idea

- Buy: 1.3930-1.3940 (channel support)

- Stop: Below 1.3870

- Targets: 1.3985 and 1.4045

In short, as long as USD/CAD is above 1.3900, the trend is up. Pullbacks are re-entry opportunities, trail stop below recent swing lows and target 1.4050 area.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account