CRWV Stock Falls 5%: The CoreWeave Comeback Tested as Investors Question Costly AI Ambitions

After months of steep losses, CoreWeave’s resurgence on the back of a $14 billion partnership with Meta reignited optimism, but CRWV has...

Quick overview

- CoreWeave's stock has rebounded sharply after a $14.2 billion partnership with Meta, despite previous steep losses.

- The company's growth is tempered by high capital expenditures and geopolitical tensions affecting investor sentiment.

- While CoreWeave's revenue surged 105% year-on-year, net losses have widened, raising concerns about profitability.

- Investor sentiment is mixed, with some viewing CoreWeave as a key player in AI infrastructure, while others worry about rising costs and competition.

After months of steep losses, CoreWeave’s resurgence on the back of a $14 billion partnership with Meta has reignited investor optimism—though fresh geopolitical tension and valuation concerns have tempered the excitement.

A Swift Reversal After a Painful Summer

CoreWeave Inc. (NASDAQ: CRWV) has made a dramatic return to investor focus this September after a bruising summer sell-off. Shares that plunged over 55% from their June highs—tumbling from $187 to $84.50—have since rebounded sharply, climbing above $150 before touching $260 following news of a major deal with Meta Platforms (META).

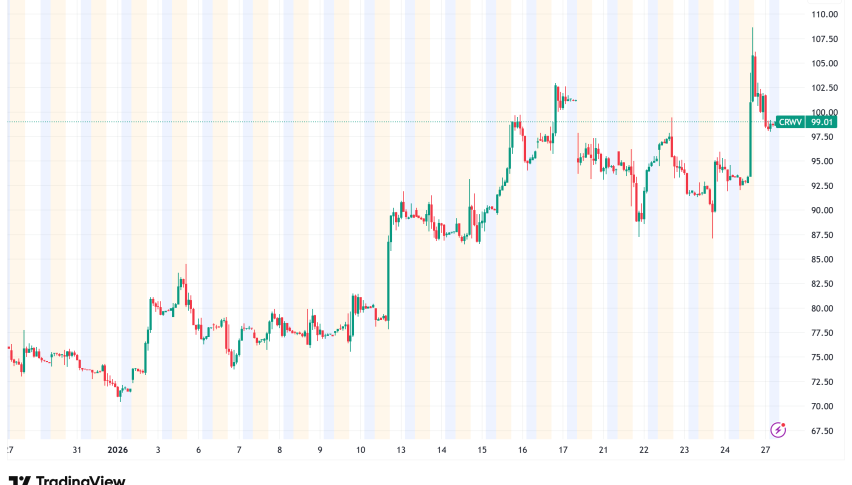

CRWV Chart Weekly – Can MAs Hold As Support or Give Way to Sellers?

However, the rally has been volatile. Since Friday’s high, CoreWeave stock has dropped 13%, including a 5% decline today, suggesting investors remain cautious despite the positive headlines. Technical indicators show the 20-week SMA has turned from resistance into potential support—an encouraging signal, though far from confirming a full recovery.

Meta Alliance Underscores AI Infrastructure’s Soaring Costs

The comeback was fueled by the announcement of a $14.2 billion agreement with Meta to provide long-term AI processing power through 2031, with the option to extend into 2032. CoreWeave will supply Meta with access to Nvidia’s GB300 AI systems, reinforcing its role in powering next-generation AI workloads.

While Meta has not commented publicly, the deal is seen as a validation of CoreWeave’s high-performance cloud infrastructure. Yet it also highlights the capital intensity of AI development—a theme increasingly weighing on valuations across the sector. The partnership positions CoreWeave as a critical infrastructure player, but also binds it to the costly cycle of hardware upgrades and capacity expansion.

Nvidia’s Backstop Strengthens Confidence

Investor sentiment received another boost earlier this year when Nvidia Corp. (NVDA) agreed to purchase up to $6.3 billion in unsold CoreWeave cloud capacity through April 2032. The commitment effectively provides a financial safety net, insulating CoreWeave from demand fluctuations and offering a degree of revenue visibility rarely seen in such a young AI infrastructure firm.

The Nvidia relationship also underscores how intertwined the two companies have become—CoreWeave relies heavily on Nvidia GPUs for its AI clusters, while Nvidia benefits from CoreWeave’s capacity to deploy and manage these systems at hyperscale. Still, the close dependence raises questions about diversification and long-term pricing power.

Geopolitical Headwinds Add to Market Jitters

Beyond company fundamentals, broader macro factors have reintroduced volatility. Renewed anti-China rhetoric from President Donald Trump has weighed on U.S.–China trade sentiment, sparking risk-off moves across tech stocks. Trump’s remarks—accusing China of “economically hostile acts” and threatening to cut trade ties over commodities like cooking oil—have amplified uncertainty, adding another layer of pressure on high-valuation growth names such as CoreWeave.

Adding to the cautious tone, Weiss Ratings reaffirmed a “Sell (D+)” rating on CRWV, citing valuation risks and heavy capital commitments.

Strong Growth, Mounting Costs

CoreWeave’s Q2 results reflected its breakneck expansion. Revenue soared 105% year-on-year to $1.21 billion, supported by major clients such as OpenAI and Microsoft, and the company reported an order backlog exceeding $30 billion.

However, the bottom line remains under strain. Net losses widened to $290.5 million, driven by $2.9 billion in capital expenditures tied to its data center build-out. With plans to invest $20–23 billion annually in infrastructure, analysts warn that maintaining such momentum without a clear path to profitability will be a major challenge.

Balancing Growth Ambition with Investor Discipline

While investors recognize the transformational potential of the Meta and Nvidia deals, sentiment remains split. Bulls see CoreWeave as a future backbone of the AI infrastructure ecosystem—anchored by long-term contracts and hyperscale partnerships. Bears, meanwhile, argue that ballooning costs, rising competition, and the uncertain macro backdrop could delay profitability and limit upside potential.

The stock’s recent pullback may reflect a reality check—a pause as the market reassesses just how much future growth is already priced in.

Outlook: A Pivotal Test Ahead

CoreWeave stands at a crossroads. Its partnerships position it among the elite infrastructure providers of the AI era, but the challenge now lies in proving that scale can translate into sustainable earnings.

If management can demonstrate cost discipline and consistent revenue conversion from its massive backlog, the recent decline may prove a healthy correction rather than a reversal. For now, the stock’s resilience near $130–150 will likely define whether this remains a temporary pullback or the start of a deeper downtrend.

Conclusion: CoreWeave’s resurgence on the back of its Meta and Nvidia alliances shows investor belief in its AI potential—but with rising costs, geopolitical noise, and valuation fatigue setting in, the road to lasting stability may be just as demanding as its climb.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM