Tesla Stock Surges 44.6% Amid Market Rebound

Quick overview

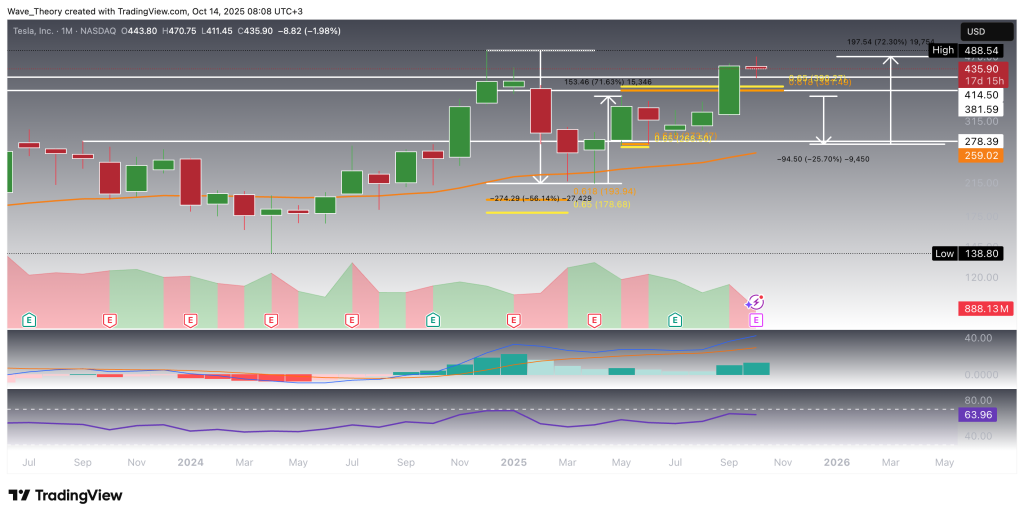

- Tesla Inc. (TSLA) has surged approximately 44.6% since last month, raising questions about its ability to reclaim its all-time high of $488.5.

- The stock has demonstrated a classic Fibonacci support and resistance pattern, with bullish confirmations from multiple technical indicators.

- Currently, TSLA is facing resistance near its all-time high and is consolidating 12% below that level, with critical support zones identified between $382 and $395.

- The overall bullish trend remains intact as long as key support levels hold, with potential for further upside if the stock breaks above its all-time high.

Tesla Inc. (NASDAQ: TSLA) has experienced a powerful rally, climbing approximately 44.6% since last month. With momentum surging, investors are now asking: can Tesla maintain this upward trajectory and reclaim its all-time high of $488.5?

Tesla (TSLA) Stock Follows Classic Fibonacci Playbook

During the transition from 2024 to 2025, Tesla (TSLA) experienced a significant correction, declining approximately 56% from its all-time high of $488.5 down to the golden ratio support at $194. At this level, the stock staged a bullish rebound, climbing roughly 72% before encountering resistance at the golden ratio level of $380, where it faced a temporary bearish rejection.

Subsequently, TSLA retraced about 26% to the next golden ratio support at $270 within a month, before bouncing off bullishly again and embarking on a three-month upward movement.

Most recently, TSLA has surged over 72%, successfully breaking through the key golden ratio resistance at $380, thereby invalidating the previous correction phase and confirming the continuation of the long-term uptrend.

Technical Indicators:

-

MACD histogram has started to tick bullishly higher since last month, signaling renewed buying momentum.

-

MACD lines remain bullishly crossed, reinforcing the uptrend.

-

RSI is in neutral territory, indicating that the stock has room to move higher before overbought conditions emerge.

TSLA’s price action demonstrates textbook Fibonacci-based support and resistance play, with bullish confirmations across multiple technical indicators, suggesting the stock remains in a strong uptrend in both the short- and mid-term.

Tesla Stock Encounters Major Resistance at All-Time High of $488.5

Tesla (TSLA) recently approached its all-time high of $488.5, missing it by roughly 4%. Since then, the stock has undergone a two-week corrective phase, declining toward a support zone between $382.6 and $414.5, currently 12% below the ATH.

Technical Indicators:

-

The MACD histogram has been ticking bearishly lower since last week, signaling short-term consolidation.

-

MACD lines and EMAs remain bullishly crossed, confirming that the mid-term trend remains intact.

-

RSI sits in neutral territory, approaching overbought levels, suggesting momentum is strong but caution is warranted for potential near-term pullbacks.

While TSLA faces resistance near the ATH, the overall bullish structure is maintained, with key mid-term indicators supporting further upside once the short-term consolidation completes.

TSLA

Tesla Stock Approaches Key Support Zones

If Tesla (TSLA) breaches the current support at $414.5, the next significant support zone lies between $381.6 and $395, where multiple Fibonacci levels converge with the 50-day EMA, forming a strong, confluent support area. Should this zone fail to hold, Tesla could retrace further toward the golden ratio support at $345, with the 200-day EMA at $335 providing additional support.

Technical Indicators:

-

EMAs have formed a golden crossover, confirming the trend remains bullish in the short- to medium-term.

-

MACD histogram is ticking bullishly higher, signaling emerging buying momentum.

-

MACD lines remain bearishly crossed, reflecting short-term consolidation.

-

RSI is in neutral territory, suggesting room for either a corrective dip or renewed upward movement.

The confluence of Fibonacci levels and EMAs highlights the $382–$395 zone as critical support. Maintaining these levels would allow Tesla to resume its bullish trend, while a break below could trigger a deeper retracement toward the golden ratio at $345.

Tesla (TSLA) Stock Trades Within a Downward Channel

On the 4-hour chart, Tesla continues to trade within a short-term downward channel:

-

EMAs remain in a golden crossover, confirming the short-term bullish trend.

-

MACD histogram is ticking bullishly higher, signaling underlying buying momentum, while MACD lines are bearishly crossed, reflecting short-term consolidation.

-

RSI remains in neutral territory, suggesting neither overbought nor oversold conditions.

Currently, the downward channel could exert pressure on the stock, potentially pushing it below the 50-4H EMA at $417. Despite short-term channel pressure, the underlying bullish structure remains intact. Traders should monitor $417 as a critical intraday support within the 4H timeframe, with a break signaling potential further short-term consolidation.

Tesla (TSLA) Technical Summary

Trend Overview:

Tesla has experienced significant volatility over the past year:

-

From ATH to correction: Fell 56% from $488.5 to $194 (golden ratio support).

-

Rebound & rally: Surged ~72% to $380, retraced ~26% to $270, then resumed upward movement.

-

Recent price action: Missed ATH by ~4%, now consolidating 12% below ATH.

Key Technical Indicators:

-

EMAs: Golden cross present on monthly, weekly, daily, and 4H charts — confirming bullish trend in short- to long-term.

-

MACD: Lines mostly bullishly crossed; histogram shows short-term fluctuation but strong upward momentum monthly/weekly.

-

RSI: Neutral in most timeframes; approaching overbought near ATH.

Immediate Resistance:

-

$488.5 — all-time high.

-

$414.5–$382.6 — short-term support consolidation zone.

Support / Fibonacci Levels:

-

$414.5 — current support.

-

$382–$395 — key 50-day EMA + Fibonacci confluent support.

-

$345 — golden ratio support.

-

$335 — 200-day EMA support.

Short-Term Outlook:

-

Trading within a downward 4H channel; 50-4H EMA at $417 is critical.

-

Minor consolidation likely; maintaining support zones above $382–$395 will preserve the bullish mid-term trend.

Mid- to Long-Term Outlook:

-

Trend remains bullish as long as key EMAs and golden ratio supports hold.

-

Break above ATH ($488.5) could trigger next major uptrend continuation.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account