USD/CAD Price Forecast: Dollar Strengthens as Oil Falls and Trade Tensions Fuel Bullish Breakout

On Wednesday, during the European session, the USD/CAD pair floated around 1.4042 - and stuck to its bullish course...

Quick overview

- The USD/CAD pair is currently trading around 1.4042, maintaining a bullish trend since mid-September.

- The Canadian dollar is under pressure due to escalating trade tensions and declining oil prices, which are affecting investor sentiment.

- Despite a recent pause in upward movement, technical indicators suggest that the bullish momentum for USD/CAD remains strong.

- Traders are considering long positions around 1.4030-1.4040, targeting levels of 1.4110 and 1.4145.

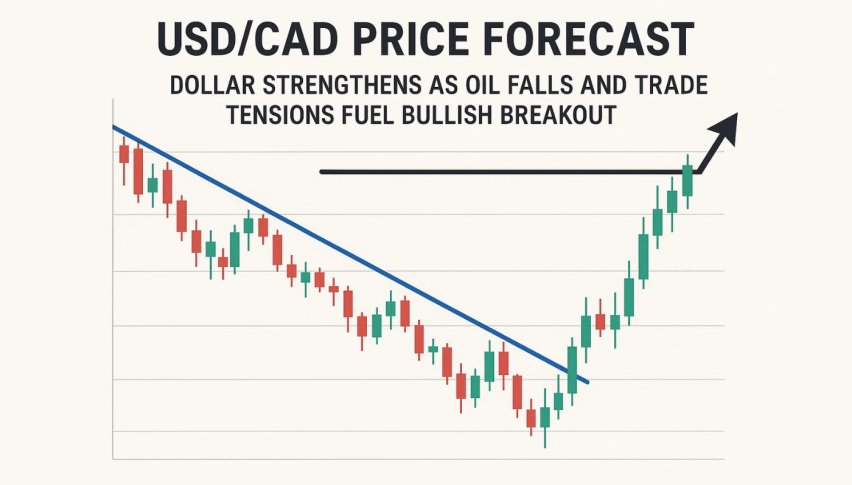

On Wednesday, during the European session, the USD/CAD pair floated around 1.4042 – and stuck to its bullish course within a very clear uptrend line that’s been shaping price action since mid-september

That latest move upwards is down to investors still favouring the US dollar right now, given all the heightened trade tensions and falling oil prices, which are both putting more pressure on the Canadian dollar.

Canadian Dollar Feeling the Heat from Trade & Oil Slump

The Loonie’s struggling still as the threat of trade war escalates – all these recent tariffs being dished out between the US and China is getting investors worried again about global growth.

Even though Trump and Xi are due to meet up later this month, no one’s holding out much hope at all that they’ll sort out the tensions. WTI oil has also taken a tumble to around $58.50 a barrel – the lowest in weeks – and that’s as a result of output growth and forecasts of slower demand causing uncertainty. Given Canada’s reliance on oil exports, this decline is making life tough for their currency.

Taking a Look at the Charts : Bulls Still in the Driver’s Seat

From a technical standpoint, USD/CAD is hovering below its resistance level at 1.4078 – and that spinning top candle is signifying a bit of a pause for breath.

But the overall picture remains bullish because the pair’s forming higher lows along that trendline support in the region of 1.3980-1.4020. The RSI level of 59 says the pair’s nowhere near being overbought, and that bullish EMA crossover tells us the upside momentum is still strong.

The USD/CAD Trade Opportunity

Traders might be thinking of going long around 1.4030-1.4040 , with a target in sight of 1.4110 and 1.4145, with a stop-loss below 1.3980. As long as the pair’s got the trendline to cling to, the technical outlook stays firmly bullish for now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM