USD/CAD Forecast: Fed Rate Cut Expectations Keep Dollar Weak Near 1.4030

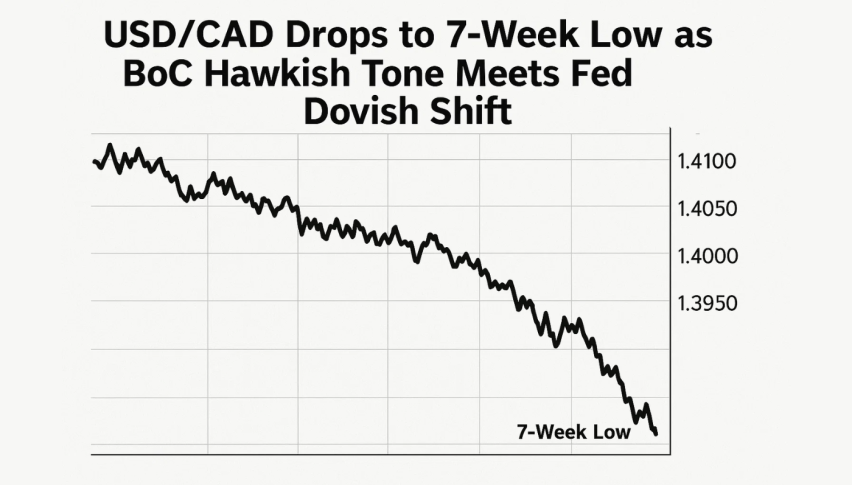

During the European session, the USD/CAD pair failed to stop its bearish bias and remain weaker around the 1.4035 level on Friday.

Quick overview

- The USD/CAD pair remains weak around the 1.4035 level due to pressure from a prolonged US government shutdown and expectations of a Federal Reserve rate cut.

- Concerns over the US economy have intensified as the Senate failed to pass a funding bill, potentially leading to temporary layoffs for federal employees.

- Mixed impacts from declining oil prices and strong Canadian employment data have kept the USD/CAD pair in a narrow trading range.

- Traders are closely monitoring updates on the US government shutdown and comments from Federal Reserve officials for future direction.

During the European session, the USD/CAD pair failed to stop its bearish bias and remain weaker around the 1.4035 level on Friday. However, the US dollar continued to face pressure due to growing concerns over the prolonged US government shutdown, expectations of a Federal Reserve (Fed) rate cut, and renewed trade tensions between the United States and China. Moreover, a drop in Oil prices and stronger Canadian employment data offered a mixed impact on the pair’s overall direction.

US Government Shutdown Adds Pressure on the Dollar

On the US front, the US dollar faced strong selling pressure after the Senate failed for the tenth time to pass the Republican funding bill to reopen the government. The White House warned that around 10,000 federal employees could face temporary layoffs if the shutdown continues, raising concerns about its negative impact on the US economy.

Therefore, the ongoing political deadlock has reduced investor confidence in the Greenback, putting pressure on the USD/CAD pair and keeping it on the weaker side.

Fed Rate Cut Expectations Weigh Further on the Greenback

Moreover, dovish remarks from Federal Reserve officials further weakened the US dollar. Fed Governor Christopher Waller hinted at another rate cut in the upcoming policy meeting, while economist Stephen Miran supported a more aggressive easing approach.

As a result, market expectations for a 25-basis-point rate cut in October have risen to almost 100%, according to the CME FedWatch tool. These growing bets on lower US interest rates have limited the Dollar’s upward momentum.

Escalating US-China Trade Tensions Increase Uncertainty

Apart from this, rising tensions between the United States and China have further hurt market sentiment. US President Donald Trump said that both countries are already in a trade war, while Treasury Secretary Scott Bessent worsened the situation by calling China’s top negotiator an “unhinged” wolf warrior.

As a result, the uncertain trade situation has increased risk aversion, pushing investors away from the US dollar.

Mixed Impact from Oil Prices and Canadian Jobs Data

On the other hand, the decline in crude oil prices has limited the Canadian Dollar’s (Loonie) gains. Oil prices fell to their lowest level since May on Friday, which usually weighs on the Loonie as Canada is a major oil exporter. However, Canada’s strong employment report for September supported the currency by lowering expectations of an immediate rate cut by the Bank of Canada (BoC). Due to these mixed factors, the USD/CAD pair has been moving in a narrow range.

Looking ahead, traders will focus on updates about the US government shutdown and fresh comments from Federal Reserve officials to gauge the next direction. If political uncertainty continues in the US and rate cut expectations grow stronger, the US dollar may stay under pressure.

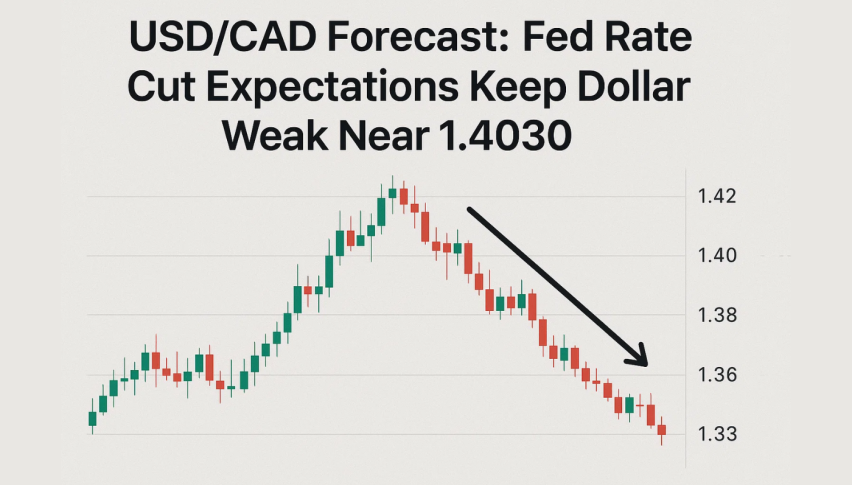

USD/CAD Technical Outlook: Bulls Defend 1.4030 Trendline Support

The USD/CAD pair is holding above its ascending trendline near 1.4030, keeping its short-term bullish structure intact. Price action continues to form higher lows, showing steady buying interest. Both the 20- and 50-period EMAs hover near current levels, signaling short-term balance but hinting at a potential breakout.

Candlestick activity reveals spinning tops and small-bodied candles, marking indecision before momentum builds. The RSI, recovering from 47, suggests upside potential as buyers regain control. If price closes above 1.4078, it could trigger a move toward 1.4112 and 1.4144, key resistance zones aligned with previous swing highs.

A bullish engulfing candle near the trendline would confirm this rebound scenario, while a drop below 1.4020 could shift bias toward 1.3980. For now, traders may eye long setups above 1.4030, targeting gradual gains toward 1.4140 as USD/CAD’s rising channel structure remains intact.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account