APLD Stock Down 25% as Insider Selling and AI Hype Burst Reverse the Rally

Following an explosive ascent to all-time highs, Applied Digital's momentum falters as investors begin to doubt the sustainability of...

Quick overview

- Applied Digital's stock has dropped 8% after a period of rapid gains, reflecting waning investor confidence in its AI-driven narrative.

- Despite impressive fiscal Q1 results, insider selling by executives has raised concerns about the company's future performance.

- Increased competition from tech giants and fears of an AI sector pullback are contributing to investor unease regarding Applied Digital's growth prospects.

- The company's high valuation and ambitious projects may pose financial risks if market enthusiasm continues to cool.

Following an explosive ascent to all-time highs, Applied Digital’s momentum falters as investors begin to doubt the sustainability of the AI-driven bubble.

Stock Stumbles After Parabolic Surge

After months of relentless gains, Applied Digital (NASDAQ: APLD) is finally hitting turbulence. Once a darling of the AI infrastructure boom, the stock plunged 8% on Tuesday, erasing nearly all of last week’s sharp gains.

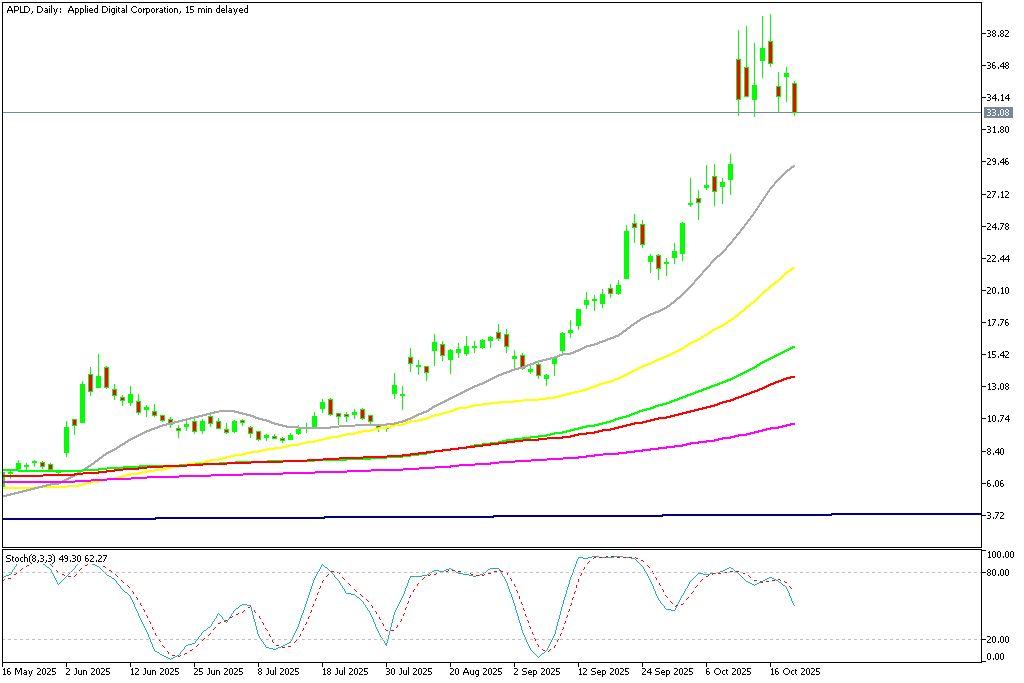

Shares, which soared above $40, now hover around $33—an 18% decline in just days—reflecting a sharp shift in investor mood.

APLD Chart Daily – Sellers Want to Close the Gap

Behind the selloff lies growing skepticism that Applied Digital’s valuation and expansion narrative have run ahead of reality.

From Crypto Host to AI Powerhouse — or Overreach?

Applied Digital’s transformation from a niche crypto-hosting firm into a high-performance computing (HPC) and AI infrastructure provider has been central to its meteoric rise.

Its Polaris Forge campuses in North Dakota, designed for hyperscale AI workloads and powered by renewable hydropower, have been marketed as the company’s competitive edge.

But as Applied Digital leans heavily into the AI narrative, critics argue that the company’s pivot looks increasingly like a high-risk gamble, given its limited track record in large-scale AI computing and the enormous capital costs involved.

Earnings Impress — But Confidence Crumbles

On paper, the company’s fiscal Q1 results were strong:

- Revenue surged 84% year-over-year to $64.2 million

- Adjusted loss narrowed to $0.07 per share, beating expectations

Yet, these upbeat numbers were quickly overshadowed by insider selling.

CEO Wes Cummins sold 400,000 shares worth $6 million, while CFO Muhammad Saidal LaVanway unloaded 75,000 shares for $1.1 million.

The timing — coming at the height of APLD’s rally — sparked speculation that management believes the stock has peaked, triggering renewed selling pressure.

Competitive Threats Cloud the AI Ambition

Adding to investor unease, Alibaba’s new AI processor launch reignited fears of rising competition in the data infrastructure race.

With tech giants like Amazon, Google, and Microsoft accelerating their in-house computing capacity, smaller players such as Applied Digital risk being squeezed out unless they can rapidly scale and innovate.

Despite new leasing contracts and $11 billion in total committed revenue, the competitive moat is thinning, and investors are beginning to question how much room APLD has left to grow.

Lofty Valuations, Thin Margins

Even with strong top-line growth, Applied Digital’s valuation looks stretched.

Trading at a price-to-sales ratio above 13x, the company’s market cap implies near-flawless execution for years to come — a tall order in a cyclical, capital-intensive industry.

Margins remain tight, and debt-linked project funding could weigh on profitability if interest rates stay elevated.

The ambitious $3 billion Polaris Forge 2 project, while impressive in scope, represents a major financial strain at a time when market enthusiasm is cooling.

AI Bubble Fears Add Fuel to the Selloff

Investor jitters are also being amplified by broader fears of an AI sector pullback.

With valuations across AI infrastructure firms skyrocketing in 2025, analysts warn that Applied Digital may be among the first to feel the pain if sentiment shifts or funding tightens.

For now, the market is treating APLD’s slide as a correction — but potentially the start of a larger unwind if insiders continue to sell and execution falters.

Conclusion: Reality Catches Up with the Hype

Applied Digital’s sharp fall serves as a reality check for investors chasing the AI infrastructure boom.

While the company boasts impressive partnerships, strong revenue growth, and ambitious expansion plans, the combination of insider selling, competitive threats, and stretched valuation paints a cautionary picture.

Unless management can restore confidence and deliver sustainable profitability, APLD’s story could shift from breakout success to cautionary tale of overextension in the AI gold rush.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account