Chris Larsen Moves 50M XRP to Evernorth as Profits Hit $764M

Ripple co-founder and executive Chairman Chris Larsen has banked a whopping $764.2 million in realised XRP profits since 2018...

Quick overview

- Ripple co-founder Chris Larsen has realized $764.2 million in XRP profits since 2018, with a significant increase in 2025.

- Larsen recently transferred 50 million XRP to the Evernorth treasury, a new venture fund aimed at investing in the XRP ecosystem.

- Evernorth is backed by major players in the industry, including SBI Holdings and Pantera Capital, with a goal to raise $1 billion for XRP projects.

- Currently, XRP is trading around $2.34, facing market volatility and technical challenges, but there are signs of renewed interest from institutional investors.

Ripple co-founder and executive Chairman Chris Larsen has banked a whopping $764.2 million in realised XRP profits since 2018 – and these figures have just been splashed across on-chain data courtesy of analyst Maartunn on Oct 23. CryptoQuant had a look at the numbers and found that Larsens profits shot up sharply in 2025, from a pretty low $200 million to a cool $750 million in the space of a few months – and all this was triggered by some pretty key XRP market events.

This week, Larsen moved a whoppng 50 million XRP into the Evernorth treasury, a brand new XRP-focused venture fund. This move sent shockwaves through the market – were we seeing another massive sell-off on the cards? Not according to Larsen, who quickly clarified that it was all part of the plan to invest in the ecosystem, rather than to liquidate his holdings.

Larsens past sales near the high point of the market have always been a bit of a target for traders to keep an eye on, but it looks like his recent actions might be marking a new direction for him – rather than cashing in on profits, he’s possibly shifting towards helping to develop and support the network.

Key Insights:

- Total realized XRP profit: $764 million

- 2025 profit jump: from <$200M to >$750M

- Latest 50M XRP transfer tied to Evernorth investment

Evernorth Raises $1B With Major Backers

This newly launched Evernorth treasury has the backing of industry big-hitters, including Larsen and some major players in the XRP space – they’re aiming to raise close to $1 billion to help grow the XRP ecosystem. SBI holdings are putting in $200 million and there are commitments from a bunch of other big players – including Pantera Capital, Kraken, and GSR. The idea here is that Evernorth becomes a key hub for XRP-based projects – stablecoins, DeFi protocols and developer grants – Larsen is clearly feeling pretty confident about XRP’s long term prospects here.

Analysts reckon that Larsens involvement in this project marks a bit of a shift in perception – from ‘whale seller’ to strategic investor, focused on building resilience into Ripple’s ecosystem.

XRP Holds Above $2.30 Amid Market Volatility

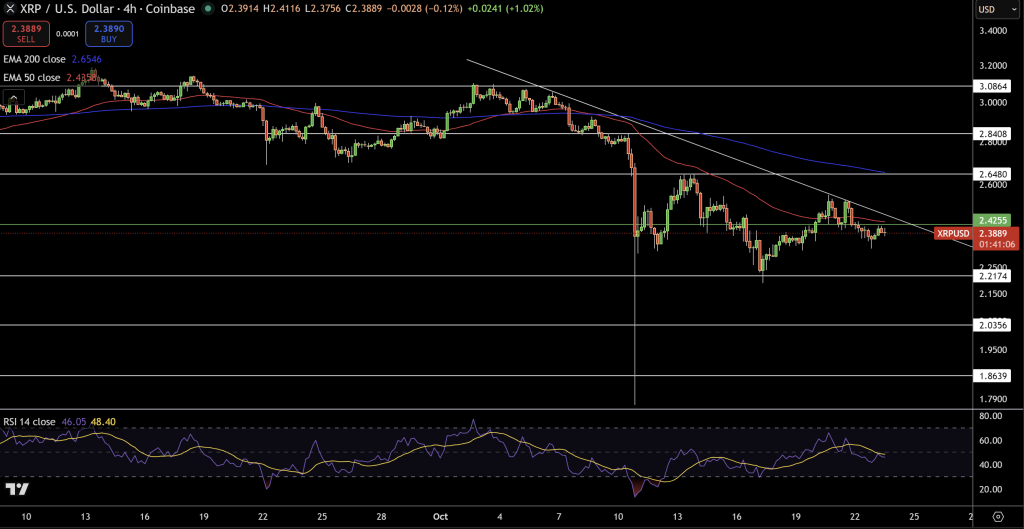

Right now XRP is trading at around $2.34, down 1.5% in the past 24 hours – still clinging on to that support level at $2.30 though. Volume has been going down, down 12% to be exact, which suggests that retail traders might be getting a bit less enthusiastic about this particular token.

In technical terms, XRP is at a bit of a crossroads – trading below all three of its 50-, 100- and 200-day SMAs and with the RSI at a pretty low 40, things don’t look too rosy at the moment. Analyst Ali Martinez has warned that if XRP can’t get above the 200-DMA at $2.59, we could see a retest of the $2 mark.

Open interest in XRP futures has dipped a bit, but there are signs that institutional investors are starting to get a bit more interested. If Evernorth manages to get their fundraising up to speed, some analysts reckon XRP could start to stabilise above $2.30 and start to attract some renewed investor interest.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM