Decentralized Perps Market Set to End October Above $1.3 Trillion

Decentralized perpetual trading volume is expected to be tremendous in October, having recently crossed a record $1 trillion...

Quick overview

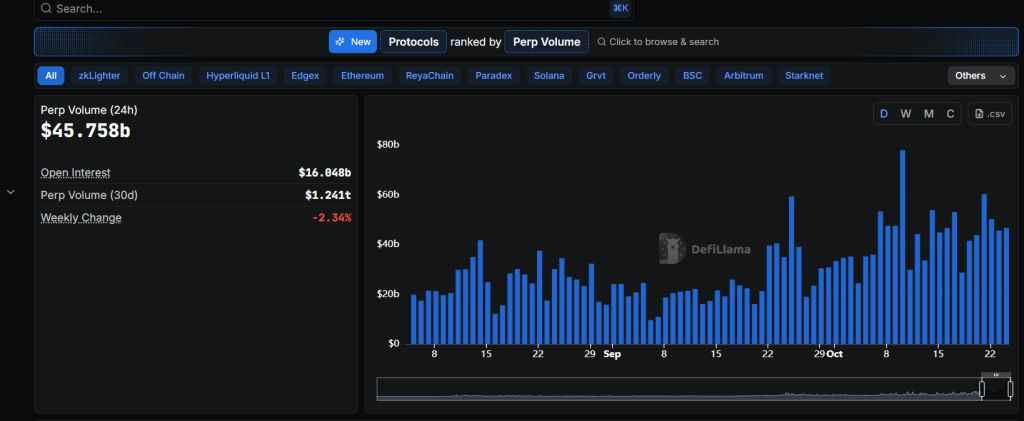

- Decentralized perpetual trading volume is projected to exceed $1.3 trillion in October, significantly higher than August's total.

- Hyperliquid led the trading volume in October with $317.6 billion, followed by Lighter and Aster with $255.4 billion and $177.6 billion, respectively.

- On October 10, decentralized perps volume reached a record $78 billion, with open interest climbing to $16.84 billion.

- Despite centralized exchanges like Binance and Bybit dominating trading volume, decentralized platforms are rapidly closing the gap.

Decentralized perpetual trading volume is expected to be tremendous in October, having recently crossed a record $1 trillion with a week remaining as traders take large bets on the crypto markets.

According to data from DeFiLlama, the top three perps trading platforms this month were Lighter, Aster, and Hyperliquid; smaller decentralized exchanges made up the remaining portion. While Hyperliquid led October in trading volume with $317.6 billion, Lighter, Aster, and edgeX have all performed well, with $255.4 billion, $177.6 billion, and $134.7 billion, respectively, with the remainder made up of smaller decentralized exchanges.

Over the past 24 hours, Lighter’s perps volume has exceeded $10 billion, while Aster and Hyperliquid have recorded $9.78 billion and $8.5 billion, respectively.

On October 10 alone, the platforms helped decentralized perps volume reach a record $78 billion. DeFiLlama data also showed that open interest increased to $16.84 billion, with Hyperliquid accounting for $7.52 billion, next to Aster with $3.317 billion and Lighter with $1.603 billion.

Decentralized perps volume is expected to end October at over $1.3 trillion, substantially twice August’s total, based on the current run rate. Speculative traders looking for greater returns with less holding requirements have been drawn to Perps because of their 24/7 trading, high leverage, no expiration, and capacity to profit from both rising and falling markets.

Centralized Exchanges Still Dominate, but DeFi Perps Rapidly Close the Gap

Centralized exchanges continue to have the highest continual trading volume when compared to decentralized exchanges. On-chain data revealed that Binance led with $70.2 billion in perp volume over the last 24 hours, followed by Bybit with approximately $26 billion in trading volume during the same period.

Open interest perps trading on Binance in the last 24 hours was $30 billion, while Bybit witnessed $17.2 billion. On-chain data also showed that MEXC had the most perpetuals (1,104), followed by Binance, which offers 612 perpetual futures for trading. Gate provides for approximately 741 everlasting trading, whilst Bybit gives approximately 715 perpetual trading.

📈 Decentralized perps just hit $1 TRILLION in volume this month — yes, with a week still to go. Platforms like Hyperliquid, Aster, and Lighter are eating CEX market share as users demand full #DeFi control. Derivatives are going onchain — and fast. 🔥 #Perps #CryptoTrading #DEX… pic.twitter.com/dqXjIPAH43

— ₿itBlitz (@BitBlitz) October 24, 2025

However, the gap is closing as crypto entrepreneurs create more user-friendly interfaces for crypto perp traders to deal with.

Infinex CEO Kain Warwick stated that decentralized everlasting platforms have expanded over the past decade, initially spearheaded by firms like GMX, dYdX, and Synthetic. He also disclosed that Hyperliquid was the first decentralized exchange to successfully scale.

The increase in perps trading volume coincides with the recent 1011 crypto market crisis on October 11, which resulted in a staggering $20 billion in forced liquidations on both decentralized and centralized exchanges. On-chain data suggested that Hyperliquid solely liquidated 1,000 wallets, with 205 of them losing more than $1 million each. On the day before the market bust, on-chain perpetual markets had a record single-day trading volume of $78 billion.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account