Intel Stock INTC Targets $50 After Key Resistance Breaks, Industry Partnerships Grow

As policymakers, investors, and industry titans support Intel's efforts to regain its position as the leading chip manufacturer in the world

Quick overview

- Intel's stock has surged over 55% since early September, reflecting growing confidence in its turnaround strategy.

- The U.S. government's investment in Intel has nearly doubled, reinforcing its strategic importance in domestic chip production.

- Technical performance indicates a potential bullish reversal, with key resistance levels being closely monitored by investors.

- Reports of potential partnerships with major tech players suggest Intel is regaining credibility and positioning itself for future growth.

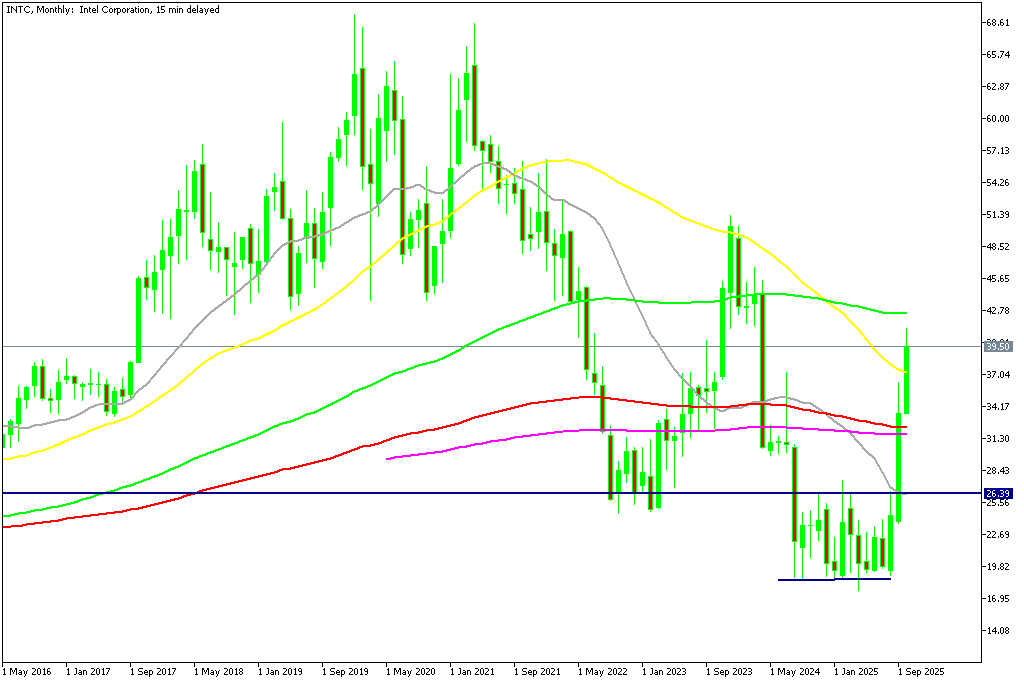

Live INTC Chart

[[INTC-graph]]As policymakers, investors, and industry titans support Intel’s efforts to regain its position as the leading chip manufacturer in the world, the company’s recent ascent reflects a newfound feeling of optimism.

A Rally Fueled by Confidence and Policy Support

Intel’s (NASDAQ: INTC) sharp rebound this week underscores the growing confidence in its turnaround strategy. The stock has surged over 55% since early September, boosted by strong investor sentiment, solid technical performance, and expanding government backing. On Monday, shares climbed another 3.3%, briefly breaking through the key $40 resistance level — a milestone that highlights the market’s conviction in Intel’s ongoing recovery.

The U.S. government’s commitment has played a crucial role in reigniting momentum. Its initial $8.9 billion investment in August has nearly doubled in value to $16 billion, illustrating how quickly sentiment has shifted in Intel’s favor. This public-private partnership has not only strengthened Intel’s balance sheet but also reaffirmed its strategic importance in securing domestic chip production.

Technical Breakouts Reinforce Bullish Outlook

Intel’s technical performance has been equally impressive. After clearing the long-standing ceiling near $37 — its 200-week simple moving average — the stock is now targeting a potential move toward its 2024 highs above $50. On the monthly chart, buyers are eyeing the 100-month SMA at $42.50 as the next key resistance level. A clean breakout above this area could confirm a long-term bullish reversal, suggesting that the worst may be behind the company.

INTC Chart Monthly – The 100 SMA Is the Last Barrier

This steady climb has been supported by sustained buying activity and improving sentiment across the semiconductor sector, where investors are increasingly betting on Intel’s ability to reclaim its edge in manufacturing technology.

Strategic Partnerships and Renewed Industry Ties

Momentum has been further fueled by reports that major tech players like SoftBank, Nvidia, and Apple may explore strategic partnerships or investments with Intel. Such collaborations could open new pathways for innovation and strengthen Intel’s position in a rapidly evolving semiconductor landscape.

After years of losing ground to TSMC and AMD, Intel’s renewed interest from industry peers suggests that the company is regaining credibility. Its expanding focus on advanced fabrication and integrated chip design has reignited discussions about potential cross-industry synergies, reinforcing optimism that Intel’s next growth phase is already taking shape.

Conclusion: Intel’s Revival Has Substance Behind the Hype

Intel’s powerful rally isn’t just about short-term gains — it signals a meaningful shift in perception and performance. With robust government support, growing investor confidence, and the possibility of new strategic partnerships, the company is positioning itself as a renewed force in the global semiconductor race.

While challenges remain, the momentum building around Intel suggests that its transformation story is well underway. If execution continues to align with expectations, Intel’s recent surge may prove to be the start of a lasting resurgence — one driven by innovation, collaboration, and renewed faith in its long-term potential.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM