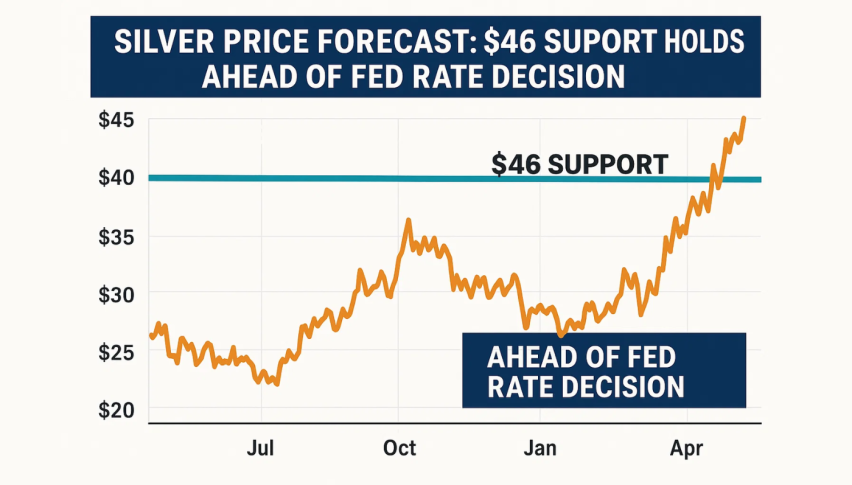

Silver Price Forecast: $46 Support Holds Ahead of Fed Rate Decision

Silver (XAG/USD) hangs tight at $46.70, hovering near its lowest level in 3 weeks as investors get ready for a critical...

Quick overview

- Silver (XAG/USD) is currently trading at $46.70, close to a three-week low as investors await a key Federal Reserve policy decision.

- Recent economic data shows a decline in consumer confidence and a slowdown in pending home sales, which may influence the Fed's decision on interest rates.

- Technically, silver is in a downward trend, with potential support at $46.00 and resistance at $47.95, indicating a volatile market ahead.

- A dovish Fed statement could provide a much-needed boost for silver prices, reversing the current bearish sentiment.

Silver (XAG/USD) hangs tight at $46.70, hovering near its lowest level in 3 weeks as investors get ready for a critical Federal Reserve policy decision later this week. The metal’s been under a tight squeeze thanks to a stronger US dollar and risk-off sentiment, but if the Fed cuts rates by 25 basis points on Wednesday, that might offer some temporary relief.

We’ve got a mixed bag of data coming in on the US economy lately – The CB Consumer Confidence Index slipped a bit to 93.4 from 94.2, which tells us that household sentiment is starting to cool – while Pending Home Sales are looking like they’re going to come in at 1.7%, way down from the previous 4% surge we saw.

A softer economic outlook, combined with falling inflation, might prompt the Fed to do more to ease policy, and that’s usually a good thing for non-interest-bearing assets like silver.

Silver (XAG/USD) Technical Picture: Bears Still Have the Upper Hand Here

Technically, silver is stuck in a downward-trending channel, with price action making lower highs & lower lows since mid-October. We see the metal still trading below its 20-day moving average ($47.95)—a zone that keeps rejecting any attempts at a comeback.

[[XAG/USD-graph]]

Looking at the charts, we see a Doji forming near the channel bottom, which could indicate that the market is really unsure of what’s going to happen next, but the overall momentum still looks bearish. The RSI is looking oversold at 31, suggesting the sellers might start to lose steam soon. We’ve also got some support down at $46.00, but if we see a break below that, it could send prices plummeting down to $44.95 and then $43.78.

On the other hand, if we can get a reversal and break back above $47.95, that might be an early sign that things are starting to turn around, and that could get us headed back towards $49.45 – where the 50-day moving average happens to line up with some prior resistance.

Market Outlook and Trade Setup

Now, with investors waiting to see what the Fed does on Wednesday, the market is going to be pretty volatile —not just in metals but across the whole commodities space — if the Fed decides to lower interest rates. That could make silver look a lot more appealing as the dollar weakens and inflation expectations rise.

Trade Idea:

- Buy Opportunity: Anytime we get a bullish-looking hammer or engulfing candle around the $46.00 level.

- Targets: $47.95 and $49.45.

- Stop loss: If the price falls below $44.80, we can set a stop loss to help manage our risk.

For now, silver is stuck in a holding pattern—but a dovish Fed statement is what we need to get a rally going and reverse all those weeks of bearish sentiment.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM