SOL Tests Critical $210 Resistance as Bitwise Solana ETF Records $55M First-Day Volume

Solana is currently trading above $194, down more than 3% in the last 24 hours. This is happening despite though institutional interest in

Quick overview

- Solana is currently trading above $194, down over 3% in the last 24 hours, despite high institutional interest following the launch of several ETFs.

- Bitwise's Solana Staking ETF had a record debut with $55.4 million in trading volume, indicating strong institutional confidence in staking-based products.

- Technical analysts are closely monitoring the $210 resistance level, which could lead to significant price movements for Solana.

- If Solana breaks through $210, it may target the $240-$250 range, while failure to do so could see it drop back to the $176 support level.

Solana SOL/USD is currently trading above $194, down more than 3% in the last 24 hours. This is happening despite though institutional interest in the cryptocurrency is at an all-time high after the launch of several exchange-traded funds that specialize on Solana. The cryptocurrency is at a very important moment right now, with technical analysts watching the $210 level as the point when the commodity will make its next big move.

Record-Breaking Solana Staking ETF Launch Signals Growing Institutional Appetite

Bitwise’s Solana Staking ETF (BSOL) had an amazing first day on the market on Tuesday, with $55.4 million in trading volume. This is the biggest debut volume of any crypto ETF issued in 2025. This performance above Bloomberg ETF analyst Eric Balchunas’ pre-launch prediction of $52 million and was much better than Canary Capital’s competing launches, which saw $8 million in trading for the Hedera ETF (HBR) and only $1 million for the Litecoin ETF (LTCC) on its first day.

Before it even launched, the fund gathered almost $223 million in assets. This shows that institutions are quite confident in staking-based bitcoin products. BSOL gives investors access to Solana and an estimated 7% yield from staking rewards. This makes it a good choice for institutions that want to grow their wealth and make money without doing anything.

The SEC’s Division of Corporation Finance made things clearer in May when it said that some proof-of-stake operations are not considered securities offerings under federal law. This led to the establishment of the ETF. This regulatory approval has opened the floodgates for staking-focused products. BSOL is now the second US Solana ETF, following REX-Osprey’s SSK, which saw $12 million in trading on its debut day in June.

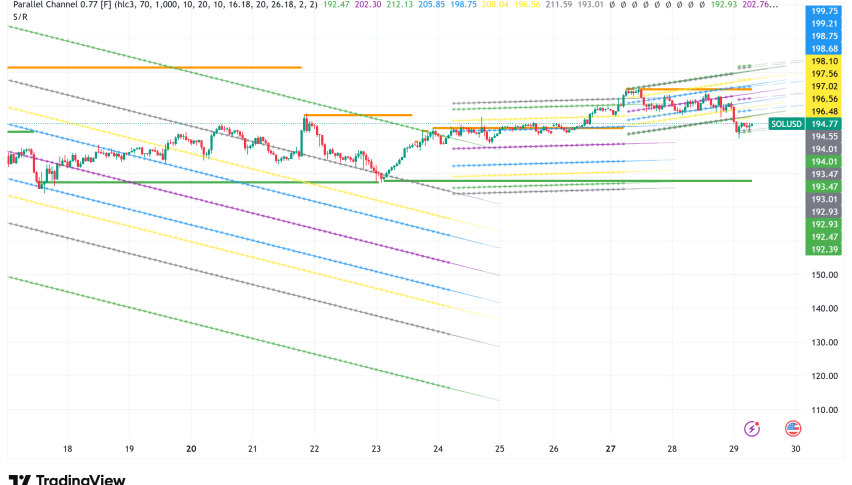

SOL/USD Technical Analysis: Parallel Channel Pattern Suggests Impending Volatility

Solana is currently trading in a Parallel Channel pattern on the 4-hour chart. This pattern has held the price movement for the previous two weeks. SOL has been rising toward the higher resistance level at $210 since it successfully tested the channel’s lower support level around $176 last week.

Ali Martinez, an expert, says that the Bitcoin looks ready to test the $210 resistance level before deciding what its next big move will be. The Parallel Channel pattern shows two possible outcomes: Solana might be turned down around $210 and fall back to the $176 support level, or it could burst past resistance and start a long-term bullish rise.

The market is currently in a consolidation phase because traders are weighing the good news about institutional ETF adoption against the bad news that has caused the price to drop 3% in the last 24 hours.

Solana Price Prediction: $210 Breakout Could Target $240, Rejection Eyes $176

Technical analysts think that if Solana breaks through the $210 resistance level with a lot of volume, it will move toward the $240-$250 zone in the near future. A confirmed breakout would probably draw in momentum traders, and it might happen at the same time as more institutional purchasing through the new ETFs.

But if SOL doesn’t break beyond $210, it could go back down to test the $176 support level again. If this support level breaks down, it would be bad news and might lead to deeper drops toward the $160–$165 zone.

The medium-term picture is still cautiously hopeful, especially as JPMorgan thinks the Solana ETFs might bring in between $3 billion and $6 billion in new money in their first six months of trading. If institutional capital flows like these happen, they could really help prices go up, and SOL may reach the $250-$300 range by mid-2026.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account