Pi Coin Eyes $0.65 as ISO 20022 and AI Push Fuel Institutional Demand

Pi Coin has regained bullish momentum after months of consolidation, with prices rebounding from the $0.19 demand zone...

Quick overview

- Pi Coin has regained bullish momentum, rebounding from the $0.19 demand zone and targeting $0.65 after breaking a key descending structure.

- A recent breakout on October 27 indicates a shift in market control, with buyers reclaiming dominance and renewed investor confidence.

- Pi Network's inclusion in the ISO 20022 standard enhances its institutional credibility, while partnerships and upcoming upgrades signal technological growth.

- If momentum persists above $0.50, Pi Coin could advance toward $0.65, marking the start of a potential long-term transformation.

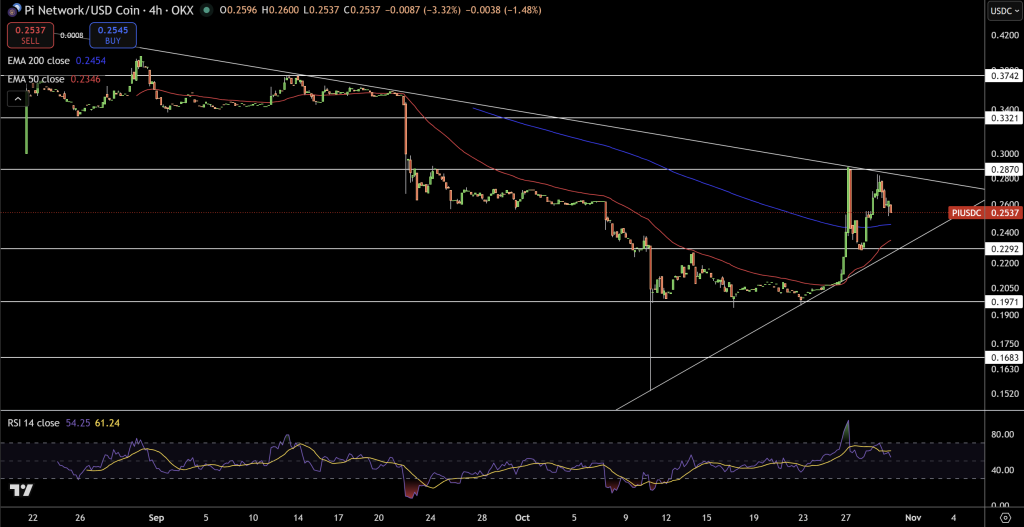

Pi Coin has regained bullish momentum after months of consolidation, with prices rebounding from the $0.19 demand zone and breaking through a key descending structure. The asset now targets $0.65, driven by a confluence of technical and institutional catalysts.

The recent breakout above the descending channel on October 27 reflects a decisive shift in market control. Buyers reclaimed dominance after sustained accumulation, signaling renewed investor confidence in Pi’s long-term trajectory.

- Immediate resistance: $0.287 — where short-term sellers may test momentum.

- Next major zone: $0.40 — historically a consolidation point before continuation.

- Structural confirmation: A breakout above $0.50 could open the path to $0.65.

A bullish MACD crossover supports this momentum, reflecting strengthening sentiment and sustained buying pressure. Exchange outflow data indicates growing on-chain conviction, suggesting that traders expect continued upside as market structure realigns toward a full reversal.

ISO 20022 and AI Partnerships Strengthen Pi Network

Pi Network’s recent inclusion in the ISO 20022 financial messaging standard has significantly strengthened its institutional credibility. This move aligns Pi with global networks like XRP and Stellar, enabling compatibility with established banking and fintech systems.

Beyond compliance, Pi’s technological growth is accelerating. Its partnership with OpenMind showcased an AI proof-of-concept involving 350,000 active Pi Nodes executing decentralized image recognition models. This dual utility — blending blockchain infrastructure with artificial intelligence — is redefining how decentralized computation is monetized.

Additionally, the upcoming Protocol 23 upgrade (Q4 2025) aims to boost scalability and transaction efficiency. With over 3.36 million verified KYC users, Pi’s compliance and infrastructure readiness suggest a maturing ecosystem capable of real-world adoption.

Can Pi Coin Sustain Its Bullish Recovery?

After reclaiming its trend structure, Pi Coin appears positioned for a medium-term rally. The convergence of technical strength, AI-driven use cases, and institutional integration reinforces bullish sentiment across the community.

If market momentum persists above $0.50, Pi Coin could confidently advance toward the $0.65 target, completing its structural reversal. With rising institutional alignment and expanding on-chain participation, Pi’s current phase signals more than a rebound — it marks the beginning of a potential long-term transformation.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM