GBP/USD Outlook: UK House Prices Edge Up 2.4% in October as Pound Slides Toward $1.31

The UK housing market showed modest strength in October, with annual house price growth rising to 2.4%, up slightly from 2.2%...

Quick overview

- The UK housing market showed modest strength in October, with annual house price growth rising to 2.4%.

- Nationwide's Chief Economist noted that the market remains stable despite higher borrowing costs and slower consumer confidence.

- Home renovations, particularly kitchen and bathroom upgrades, are driving property value increases, with younger homeowners leading in sustainability efforts.

- The British pound is weakening against the dollar, reflecting investor caution as traders anticipate potential policy shifts.

The UK housing market showed modest strength in October, with annual house price growth rising to 2.4%, up slightly from 2.2% in September, according to Nationwide’s House Price Index. On a monthly basis, prices climbed 0.3%, lifting the average home value to £272,226.

Nationwide’s Chief Economist Robert Gardner said the housing market has remained “broadly stable” despite slower consumer confidence and higher borrowing costs. “Prices are close to all-time highs, and mortgage rates are still more than double pre-pandemic levels,” he noted, adding that the market’s resilience reflects strong household balance sheets and limited housing supply.

If income growth continues to outpace house price inflation, Gardner expects affordability to improve modestly into early 2026, especially if the Bank of England resumes rate cuts.

Renovations Remain a Major Value Driver

Nationwide’s survey found kitchen and bathroom upgrades were the most popular home improvements in the past five years, with 71% of homeowners investing in these areas. Meanwhile, green upgrades—especially solar panels—are gaining traction, with 34% of renovators adding eco-friendly features.

Younger homeowners (25–34) led the sustainability charge, with nearly 70% opting for energy-efficient additions. Nationwide’s data also showed that adding a loft conversion or extension with a bedroom and bathroom can lift a property’s value by as much as 24%, while a 10% increase in total floor space typically raises value by 5%.

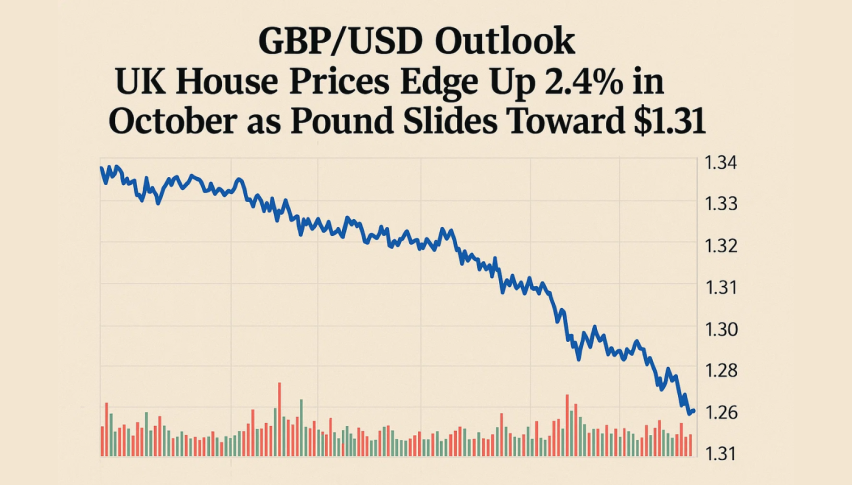

Pound Weakens as GBP/USD Tests $1.31

While housing shows signs of stability, the British pound is losing ground. The GBP/USD pair trades near 1.3105, slipping within a descending channel that’s capped gains since mid-October. The 20-period EMA remains above current price levels, confirming the downtrend’s strength.

A three black crows pattern on the 4-hour chart underscores bearish momentum, with the RSI near 27, suggesting an oversold but still fragile setup. A break below 1.3080 could open the door to 1.3030 and 1.2990, while resistance sits at 1.3160–1.3240.

For short-term traders, the bias remains bearish. Selling rallies below 1.3200 offers the best risk-reward scenario until momentum indicators or bullish candlesticks confirm a reversal.

GBP/USD Outlook: Market Calm, Currency Caution

The UK housing market continues to show quiet strength, but the pound’s technical picture reflects investor caution ahead of potential policy shifts. As traders monitor both BoE decisions and U.S. dollar strength, November could prove pivotal—both for homebuyers watching rates and for traders navigating sterling’s next major move.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM