Gold Price Prediction: Bulls Defend $3,940 Support as U.S. Data Looms

Gold prices recovered on Wednesday as bargain hunters stepped in after bullion dipped to a near one-week low. The precious metal traded...

Quick overview

- Gold prices rebounded to around $3,974 as bargain hunters entered the market after a recent dip.

- The U.S. dollar index remains near a three-month high, limiting gold's upside but not triggering significant selling pressure.

- The Federal Reserve's recent rate cut has provided temporary support for gold, with market expectations for another cut in December decreasing.

- Gold is currently in a constructive uptrend, with key technical levels indicating potential for further movement depending on upcoming U.S. labor data.

Gold prices recovered on Wednesday as bargain hunters stepped in after bullion dipped to a near one-week low. The precious metal traded around $3,974, buoyed by renewed safe-haven demand amid global market uncertainty and a cautious tone from the Federal Reserve.

The U.S. dollar index (DXY) hovered just below a three-month high, limiting gold’s upside but failing to spark significant selling pressure. According to Jigar Trivedi, senior currency analyst at Reliance Securities, “It’s just bargain buying and broader risk-off sentiment supporting gold.”

Asian equities mirrored Wall Street’s overnight weakness as investors reassessed valuations, further driving funds toward defensive assets like gold.

Fed Pause Keeps Traders Guessing

The Federal Reserve’s rate cut last week provided temporary support for bullion, but Chair Jerome Powell hinted it may be the final reduction this year. Market data from the CME FedWatch Tool shows a 69% chance of another rate cut in December, down from over 90% before Powell’s remarks.

A prolonged U.S. government shutdown has disrupted key data releases, forcing investors to rely on private metrics such as the ADP National Employment Report, due later in the day. Stronger-than-expected payrolls could briefly pressure gold, while a soft reading might reignite rate-cut bets and boost bullion.

Gold, a non-yielding asset, typically benefits from lower interest rates and heightened economic uncertainty, both of which may resurface if labor data weakens.

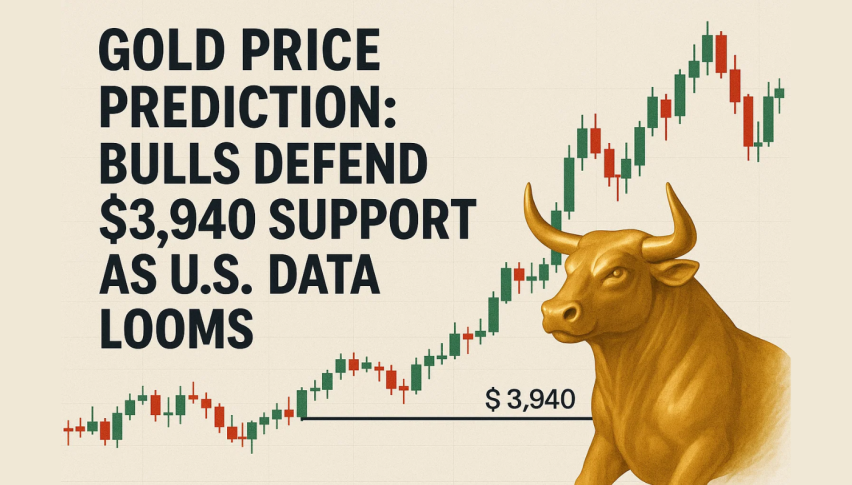

Gold (XAU/USD) Technical View: Bulls Hold the Line

From a technical perspective, gold remains in a constructive uptrend, holding above its ascending trendline support near $3,940. A Doji candle followed by a bullish confirmation bar suggests buyers are regaining control.

The 20-EMA near $4,045 continues to cap upside momentum, but a breakout above this level could trigger a rally toward $4,142. Meanwhile, the RSI at 47 shows improving momentum from oversold levels, hinting at near-term strength.

A break below $3,940, however, may expose support zones at $3,883 and $3,795, inviting renewed dip-buying interest.

Trade Setup: Traders may look for long entries above $3,980, with stops under $3,935 and targets at $4,045–$4,142.

Gold Outlook & Summary:

Gold stands at a pivotal level — steady above $3,940 but capped by $4,045 resistance. With Fed policy uncertainty and U.S. jobs data ahead, volatility could define the next big move in bullion prices.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account