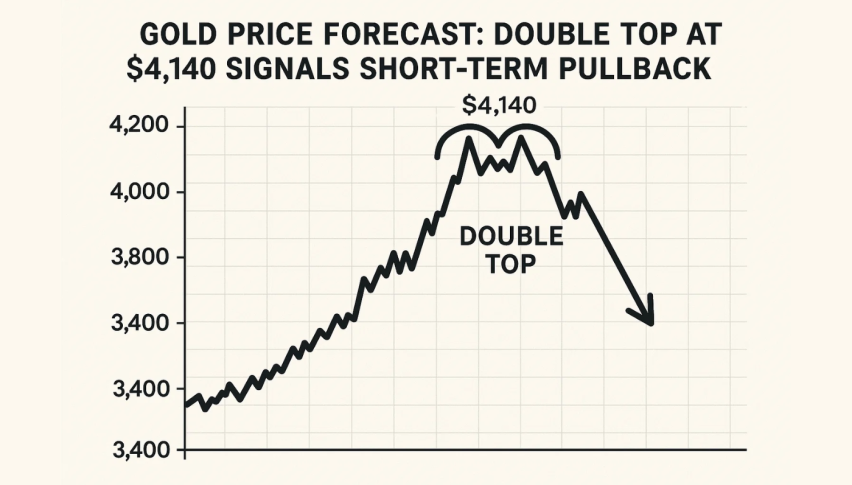

Gold Price Forecast: Double Top at $4,140 Signals Short-Term Pullback

Gold (XAU/USD) slipped back on Wednesday, with the price hovering around $4,107 - having failed for the second time this week...

Quick overview

- Gold (XAU/USD) has struggled to break the $4,140 resistance level, forming a double top that signals waning bullish momentum.

- The recent pullback follows a slight rebound in the US dollar index, which has put pressure on gold prices.

- Traders are anticipating a 68% chance of a Federal Reserve rate cut in December, leading to profit-taking after a recent surge in gold prices.

- Current trading strategies suggest shorting any rallies that fail to surpass $4,140, with potential targets set at $4,047 and $3,964.

Gold (XAU/USD) slipped back on Wednesday, with the price hovering around $4,107 – having failed for the second time this week to break past the $4,140 barrier. A double top has formed at this level – a bearish signal that’s starting to come across loud and clear that bull momentum is starting to wane – at least in the short-term. This pullback comes after the US dollar index (DXY) bounced back by a tiny 0.1%, ending a five-day losing streak and putting some pressure on precious metals priced in dollars.

Gold had been on a tear lately amid expectations that the Federal Reserve will start cutting interest rates in December. A look at CME Group’s FedWatch Tool shows that traders are betting on a 68% chance of a 25-basis-point rate cut, up from 64% just 24 hours earlier. But after that three-week surge in the price of gold, you’re starting to see some profit-taking – investors are just waiting for some new economic data to come in and take a better look at what the Fed might do next.

Gold (XAU/USD) Technical Outlook: Will this Double Top be the Start of a Correction?

Take a look at that 4-hour chart and you’ll see a double top forming at $4,141, a price that just happens to be the 61.8% Fibonacci retracement from last month’s fall. This rejection has triggered a bit of a sell-off, and now gold is heading towards the $4,085-$4,047 range—a break below this level could signal the start of a deeper correction towards $3,964, a level where support comes from that ascending trendline from late October.

The RSI has slipped below 60, which suggests momentum is starting to cool, while the bearish engulfing candle on the 4-hour timeframe reinforces the idea that things are looking a bit grim for gold at the moment. And yet the 20 EMA is still above the 50 EMA, which suggests the bigger picture is still looking pretty positive – even if the next few weeks might be a bumpy ride.

Trade Set Up: Sell Any Rallies that Fail to Break Past $4,140

For anyone looking to trade gold now, the focus is going to be on shorting any rallies that fail to get past $4,140—the initial targets are $4,047 and $3,964. Stop losses can be set just above $4,160 to protect you against any false breakouts—and if gold manages to close decisively below $4,047, then it’s likely we’re going to see a bearish reversal pattern and another leg south in the coming days.

The overall trend of gold remains intact, but the chart is definitely more bearish at the moment. Unless gold closes decisively above $4,142, the pressure will remain on the price as traders reposition ahead of key US inflation and employment data.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM