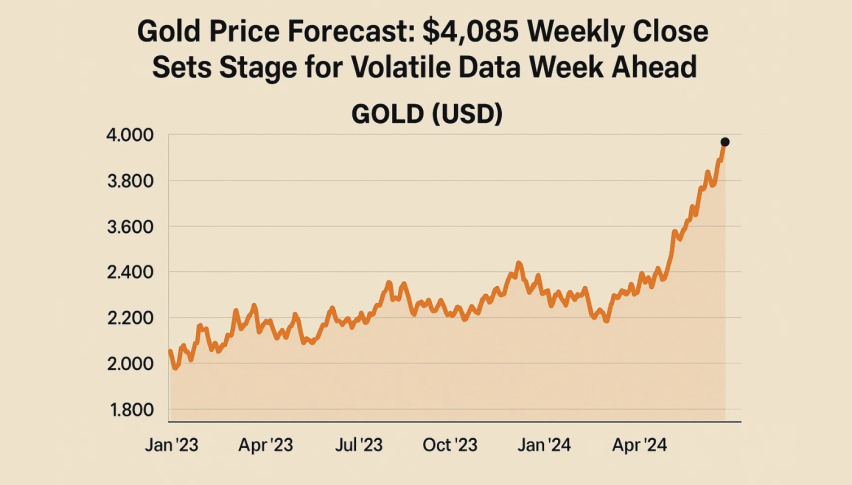

Weekly Gold Price Prediction: XAU Upside Intact as A Go-To Asset, Amid Global Volatility

Gold remains the top choice for stability seekers, holding firm despite shifting Fed expectations, global trade tensions, and ongoing...

Quick overview

- Gold remains a preferred investment for those seeking stability amid economic uncertainty and market volatility.

- Despite a brief pullback, gold prices have rebounded, supported by favorable Fed policies and institutional buying.

- Major investment banks project continued growth for gold, with UBS forecasting $4,200 and Goldman Sachs predicting $4,900 by late 2026.

- Central banks are increasingly accumulating gold, now holding more than U.S. Treasuries for the first time since 1996.

Live GOLD Chart

Gold remains the top choice for stability seekers, holding firm despite shifting Fed expectations, global trade tensions, and ongoing market volatility.

Gold Holds Its Ground as Uncertainty Lingers

Gold continues to attract investors seeking safety in a period marked by uneven economic signals, shifting Federal Reserve expectations, and geopolitical tension. After soaring to a record $4,381 per ounce in late October, the metal eased below $4,000 as market nerves briefly calmed. The initial surge was driven by anxiety over U.S.–China trade tensions, though a temporary thaw — including paused tariffs and renewed talks on rare earth exports — helped cool the immediate demand for safe havens.

Technical Picture: Support Holds Firm

Despite that pullback, gold’s weakness was short-lived. Following the U.S. government reopening and the Fed’s 25 bps rate cut, buyers returned quickly, pushing prices back toward $4,245. Even Friday’s broad selloff across global assets saw gold stabilize at its 20-day SMA, reinforcing its reputation as a defensive asset even in rapid market swings.

XAU Chart Daily – The 20 SMA Acting As Support Now

Fed Policy Encourages Long-Term Bullish Momentum

The Federal Reserve’s pivot toward more accommodative policy has been a powerful driver behind gold’s broader uptrend. Since late August — when prices hovered closer to $3,300 — expectations for softer monetary conditions have breathed new life into the rally. While Fed Chair Jerome Powell continues to repeat a cautious, data-driven stance, analysts note that even a gradual easing cycle tends to favor gold in an environment of sticky inflation and high debt burdens.

Short-term volatility remains: traders have reduced expectations for a December rate cut to around 40%, and hawkish commentary from several Fed officials trimmed some of gold’s recent gains. Still, the structural trend remains supportive.

Major investment banks echo that outlook:

- UBS expects gold to reach $4,200 over the next year.

- Goldman Sachs projects $4,900 by late 2026, pointing to persistent institutional buying and broader diversification by global wealth funds.

With a dense calendar of U.S. economic releases ahead — including the jobs report, Fed minutes, and remarks from Powell — gold may see choppy trading in the near term.

Central Banks and Institutions Keep the Market Well Supported

Institutional and sovereign appetite continues to underpin the market. Gold-backed ETFs drew $26 billion in inflows during Q3, lifting total ETF holdings to a new high of $472 billion. In a notable milestone, global central banks now hold more gold than U.S. Treasuries for the first time since 1996, underscoring a significant shift in reserve strategies.

China’s decision to remove VAT rebates on domestic gold purchases could soften retail demand temporarily, but this is expected to be easily absorbed by ongoing accumulation from central banks, sovereign wealth funds, and institutional investors worldwide.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account