XRP Price: The Support Holds, ETF Demand and Institutions to Drive Upside Move

XRP’s ability to defend key support above $2 — coupled with ETF momentum and rising institutional demand — is boosting expectations of...

Quick overview

- XRP is showing resilience by holding above the crucial $2 support level, aided by improving market conditions and rising institutional demand.

- The launch of the first spot XRP ETF has generated significant interest, with $245 million in early inflows, signaling strong investor confidence.

- Broader macroeconomic factors, including a recent liquidity injection by the Federal Reserve, are providing a favorable backdrop for digital assets like XRP.

- Ripple's strategic moves in institutional finance and regulatory alignment are enhancing confidence in XRP's long-term utility and potential for recovery.

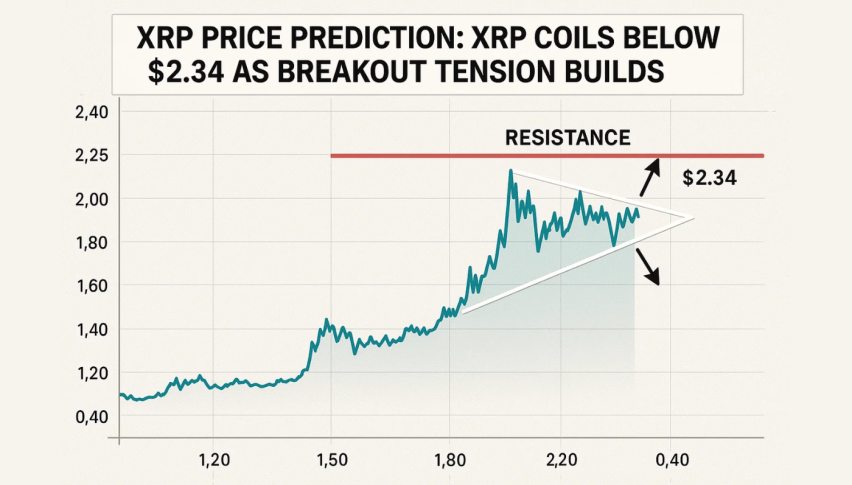

Live XRP/USD Chart

XRP’s ability to defend key support above $2 — coupled with ETF momentum and rising institutional demand — is boosting expectations of a broader crypto recovery.

XRP Steadies as Market Conditions Improve

Ripple’s XRP has emerged from a difficult two-month stretch, during which it shed nearly half its value and fell toward $1.50 in early October. Despite the broader market turbulence, XRP has shown resilience by rebounding off long-term support near its 20-month moving average. As risk sentiment begins to stabilize across global markets, buyers are gradually returning, helping the token hold above the crucial $2 level.

Ripple Chart Monthly – The 20 SMA Is Holding As Support

Long-Term Support Signals Confidence

Even though XRP remains below the important $3 psychological resistance, its ability to respect major technical levels underscores durable investor confidence. Sellers attempted to push the asset lower, but the monthly 20-SMA held firm — a sign that downside pressure may be waning. If sentiment continues to improve, traders will look for a climb back toward $2.70 and $3, which would set the stage for a meaningful trend reversal.

ETF Wave Sparks Renewed Optimism

XRP gained renewed attention on 13 November, when Canary Capital launched the first spot XRP ETF (XRPC) on Nasdaq after securing SEC listing approval. The fund saw $245 million in early inflows, highlighting substantial pent-up demand — even if some of that enthusiasm faded as short-term traders locked in profits.

This debut marks the beginning of a coordinated series of ETF rollouts:

- Franklin Templeton launches November 18

- Bitwise follows November 19–20

- 21Shares & CoinShares between November 20–22

- Grayscale & WisdomTree on the NYSE on November 25

The rapid succession of products signals institutional alignment and creates multiple regulated avenues for traditional investors to gain exposure to XRP. Each issuer brings credibility, liquidity, and deep experience in digital asset management — a rare convergence around a single token.

Liquidity Boost Enhances the Backdrop

Broader macro conditions are also turning more supportive. The Federal Reserve’s latest $29.4 billion liquidity injection lifted risk appetite across financial markets, providing an added tailwind for digital assets. Historically, XRP has performed well during periods of expanded liquidity, and many analysts see this as setting the stage for renewed upside.

Institutional Momentum Strengthens Fundamentals

Ripple continues to make headway on the institutional front:

- CME XRP futures activity is rising, signaling growing professional investor interest.

- The company’s $1 billion acquisition of GTreasury greatly expands its reach in corporate finance, integrating blockchain liquidity with enterprise treasury systems.

- In Europe, Ripple is aligning with the EU’s MiCA regulatory framework, while its subsidiary Standard Custody & Trust secured an SEC no-action letter—enhancing trust among large clients and custodians.

These developments highlight Ripple’s expanding footprint in global finance and reinforce confidence in XRP’s long-term utility.

Technical Outlook: Support Intact, Rebound Likely

From a technical perspective, XRP remains under pressure for now, but sellers are showing signs of exhaustion. The support zone just above $2 and the 20-month SMA continue to act as a strong floor. A break above $3 would signal a clear bullish reversal, while losing the $1.50 region would delay recovery and extend consolidation.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account