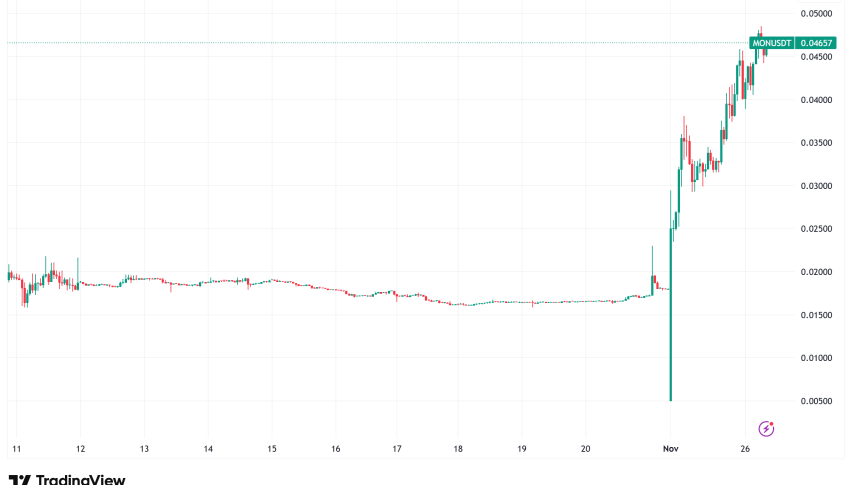

Monad (MON) Surges 52% Post-Launch: Technical Analysis Points to Continued Momentum

The new Monad (MON) token has gotten a lot of attention in the market after its price jumped by an incredible 52% in the first 24 hours of

Quick overview

- The new Monad (MON) token surged by 52% in its first 24 hours, reaching over $0.04 despite a cooling cryptocurrency market.

- After an initial skepticism, MON's price rose from $0.026 to around $0.042 following its airdrop, demonstrating strong demand.

- Technical analysis indicates a bullish breakout for MON, with potential resistance levels suggesting further price increases if momentum continues.

- Analysts predict cautious but positive price growth for MON in the coming years, with long-term forecasts suggesting it could reach up to $2.89 by 2030.

The new Monad (MON) token has gotten a lot of attention in the market after its price jumped by an incredible 52% in the first 24 hours of trade. It is currently worth more than $0.04, even if the rest of the cryptocurrency market is cooling down. Even if Bitcoin and Ethereum fell by 1.8% and 0.6%, respectively, this performance shows that there is considerable independent demand for the high-throughput blockchain’s native asset.

Monad’s Post-Airdrop Rally Defies Initial Skepticism

When Monad’s mainnet went up on November 24, 2025, the crypto community had conflicting feelings about it at first. The coin first went on sale to the public for $0.026 on Coinbase’s marketplace for new tokens. Some speculators were disappointed when early trading prices matched this value. But MON swiftly proved the skeptics wrong by rising to $0.045 on Tuesday and then settling around $0.042, which was a 68% gain from its initial price.

The airdrop gave out over 3.33 billion MON tokens to about 76,000 wallets as a reward for early users, builders, and community members. Some people who got the tokens sold them right away, like one trader who sold 10,600 tokens for $238, but the price has been going up steadily, which means that stronger hands are buying the asset.

MON/USD Technical Analysis Reveals Bullish Breakout Pattern

Chart analysis shows that MON has successfully moved out of its first consolidation phase and broken through established resistance lines, which makes the bullish perspective stronger. The Bull Bear Power (BBP) indicator has gone up, which means that buyers are in charge of the market right now.

If momentum keeps up, the immediate resistance level of $0.050 could be tested before the end of the year. Analysts say that the coin could reach $0.071 in the near future if the market stays very bullish. But the asset is under natural selling pressure from people who got an airdrop and want to lock in their profits, which might momentarily limit upside advances.

Unique Trading Profile Emerges Across Multiple Venues

Monad has set up a strange trading footprint on exchanges all around the world. With $400 million in daily trade, Korean exchange Upbit has the most volume. This is more than 62% of all trading in Korean won pairs. Coinbase comes next with $233 million, and Bybit, which is situated in Dubai, had $160 million in trade volume.

The fact that the token can be used on several chains contributes to its trading profile. MON was released at the same time on Solana and other networks. The Solana version had about 60% of the trading volume compared to native pairings on Uniswap. This method across chains gives you more possibilities for liquidity, but it also makes it harder to get the right price.

Sentiment on the derivatives site Hyperliquid is mostly pessimistic, with nine of the eleven tracked whales holding short positions. Traders are getting ready for a possible drop in the value of the token, even though it has been doing well, because of negative funding rates for long holdings.

Monad Network Fundamentals Show Early Promise

In addition to price action, Monad’s technological features are a basic part of its evolution. The network can handle 10,000 transactions per second, with block times of 400 milliseconds and finality times of about 800 milliseconds. These performance parameters are much better than what Ethereum can currently handle, and the network is fully compatible with the EVM.

Within hours of going live, more than 100 apps were running on the network. There was $115 million in liquidity and $123 million in stablecoin inflows. Uniswap became the most popular protocol on Monad, which shows that DeFi apps are fast to take advantage of the high-throughput environment.

There are both chances and risks with the tokenomics. With only 10.83 billion MON in circulation out of a maximum supply of 100 billion tokens, which is about 10.8% of the total supply, the low float and high fully diluted valuation drew criticism from people like BitMEX co-founder Arthur Hayes, who said he “aped” into the token because of the bull market.

Monad Price Prediction: Conservative Near-Term, Bullish Long-Term

Analysts’ predictions for Monad are cautiously positive. For 2026, the lowest projections are $0.034 in bearish cases and the highest are $0.13 if demand stays strong. The average predicted price is $0.069, which means that the price should go up a little as the product grows and the early launch volatility goes down.

The 2027 view gets more cautious, with predictions ranging from $0.018 to $0.079, taking into consideration the fact that early adopters may want to cash in on their gains. Long-term forecasts, on the other hand, are getting more and more positive. By 2030, MON might hit the $1 threshold, and in the best-case scenarios, prices could go as high as $2.89 if the Layer 1 network gets a lot of market share.

These predictions depend on a few important things: the network’s continued growth, its ability to compete with well-known Layer 1 chains like Solana and Ethereum, and its capacity to draw developers and consumers to its ecosystem.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM