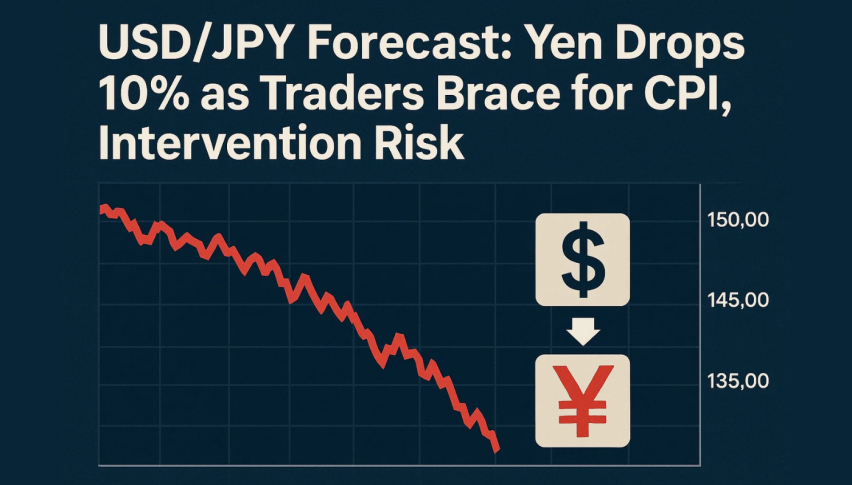

USDJPY Forecast: Yen Drops 10% as Traders Brace for CPI, Intervention Risk

During Wednesday’s European session, USDJPY recovered earlier losses and traded back toward 156.60, extending a trend that’s seen...

Quick overview

- USDJPY has recovered to around 156.60, despite the Yen being the weakest G8 currency.

- The Bank of Japan is hinting at a possible interest rate hike, but the Yen continues to decline.

- The Yen has dropped nearly 5% since early October and over 10% since US tariff announcements.

- US economic data remains mixed, yet the Dollar is supported by the Yen's weakness.

During Wednesday’s European session, USDJPY recovered earlier losses and traded back toward 156.60, extending a trend that’s seen the Yen post the weakest performance among G8 currencies. Even with the Bank of Japan hinting at a possible rate hike, the currency continues to slide, keeping the Dollar supported despite softer US economic signals.

BoJ Signals a Hike, But Yen Doesn’t Respond

A Reuters report this week suggested the BoJ is preparing markets for a potential interest-rate increase as early as next month. Yet the Yen hasn’t strengthened. Policymakers remain concerned that a fragile Yen could add stress to households and businesses, limiting the BoJ’s ability to tighten policy aggressively.

The decline has been steep: the Yen has dropped nearly 5% since Prime Minister Sanae Takaichi took office in early October, and more than 10% since US tariff announcements earlier this year.

Officials have openly warned that currency intervention is “on the table,” and with US markets thinned by the Thanksgiving holiday, traders see this week as a window where authorities could step in. Japan’s Tokyo CPI report, due Thursday, will also shape expectations for the BoJ’s December stance, with forecasts pointing to cooling inflation.

US Data Keeps the Dollar Supported

Across the Pacific, US economic data has been mixed. Retail Sales softened, producer prices steadied, and consumer confidence fell. Meanwhile, dovish comments from Federal Reserve officials Christopher Waller and John Williams fueled expectations of a December rate cut. Yet even with rate-cut bets rising, the Yen’s weakness has helped the Dollar maintain an upward bias.

USD/JPY Technical Outlook

USDJPY is attempting to build momentum after finding support near 155.68, a level that aligns with the rising November trendline. Price has climbed back above the 20-EMA, showing early signs of stabilization, though the pair remains capped below 157.19, a level that sellers defended earlier this week.

The RSI has pushed above 50, pointing to improving sentiment while avoiding any overbought signals. A decisive break above 157.19 would clear the way toward 157.88, followed by a retest of 158.56, a key resistance zone.

If price slips back under 156.00, downside pressure may re-emerge, exposing 155.68 and potentially 154.79 as the next support areas.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM