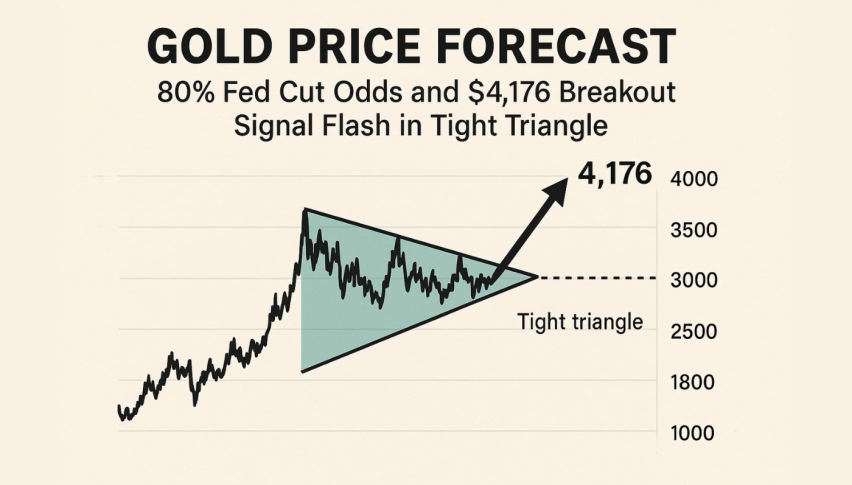

Gold Price Forecast: 80% Fed Cut Odds and $4,176 Breakout Signal Flash in Tight Triangle

Gold (XAU/USD) softened during early European trade, easing away from its two-week high and settling near the $4,150 region.

Quick overview

- Gold (XAU/USD) has softened from its two-week high, settling near the $4,150 region due to improved market sentiment and expectations of lower US interest rates.

- The CME FedWatch Tool indicates an 80% probability of a 25-basis-point rate cut in December, reflecting investor confidence in the Fed's dovish stance.

- Geopolitical tensions have eased, leading to improved global risk appetite and reduced safe-haven demand for gold.

- Gold is currently trading within a tightening symmetrical triangle, with potential breakout levels at $4,242 and $4,313.

Gold (XAU/USD) softened during early European trade, easing away from its two-week high and settling near the $4,150 region. The pullback wasn’t driven by panic selling but rather a mild improvement in broader market sentiment as traders leaned into expectations of lower US interest rates over the next few weeks. With US Thanksgiving keeping volumes light, even small sentiment shifts were enough to nudge gold off its recent peak.

Expectations for a December rate cut remain firmly in place. The CME FedWatch Tool shows markets pricing an 80% probability of a 25-basis-point cut, reflecting how quickly investors have embraced the Fed’s dovish tone. Normally, a weaker dollar would give gold more room to run, but risk appetite improved just enough to keep gains limited.

Dovish Fed Tone Keeps Dollar Soft

Recent commentary from senior Fed officials continued to lean toward easing.

- New York Fed President John Williams said rates could be lowered without threatening inflation progress.

- Governor Christopher Waller noted that labor conditions look weak enough to justify another cut.

- Governor Stephen Miran stressed that economic softness may call for larger adjustments to return policy to neutral.

Despite mixed US data — stronger jobless claims but weaker business surveys — markets focused almost entirely on the Fed’s next move. As a result, the dollar struggled to build momentum even though the data wasn’t uniformly negative.

Geopolitical Calm Reduces Safe-Haven Demand

Geopolitical tensions eased modestly across several regions, improving global risk appetite. Equity markets responded positively, and that shift naturally reduced safe-haven flows into gold. With risk assets finding temporary support, bullion’s upside cooled despite supportive macro conditions.

Gold (XAU/USD) Technical Outlook: Breakout Nearing as Triangle Tightens

Gold continues to trade inside a tightening symmetrical triangle, with price pressing against the upper trendline around $4,176. A steady series of higher lows from the $4,041 zone shows that buyers haven’t stepped aside, even as rallies stall near $4,242.

The metal remains above the 20-EMA, confirming underlying momentum, while RSI near 59 signals firm—but not overheated—strength. A clean breakout above the triangle’s top would expose $4,242, followed by an extension toward $4,313. Failure to clear resistance leaves room for a pullback toward $4,113, where the rising trendline and EMA converge.

With volatility compressing, traders won’t have to wait long before gold picks a direction.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM