CoreWeave’s Comeback? Can the CRWV Stock Rebound Hold or Is Another Slide Coming?

CoreWeave is attempting to stabilize after a punishing downturn, but recent gains have done little to dispel the cloud of skepticism...

Quick overview

- CoreWeave is attempting to recover from a significant 60% decline, with a recent 8% stock increase providing some hope.

- Despite the uptick, investor skepticism remains due to past failures, including a disappointing partnership with Meta.

- The company's aggressive growth strategy and heavy reliance on Nvidia raise concerns about financial stability and profitability.

- CoreWeave's recent financial results show strong revenue growth but also significant losses, leading analysts to question the sustainability of its capital expenditures.

CoreWeave is attempting to stabilize after a punishing downturn, but recent gains have done little to dispel the cloud of skepticism surrounding the company.

CoreWeave’s Attempted Comeback After a Severe Breakdown

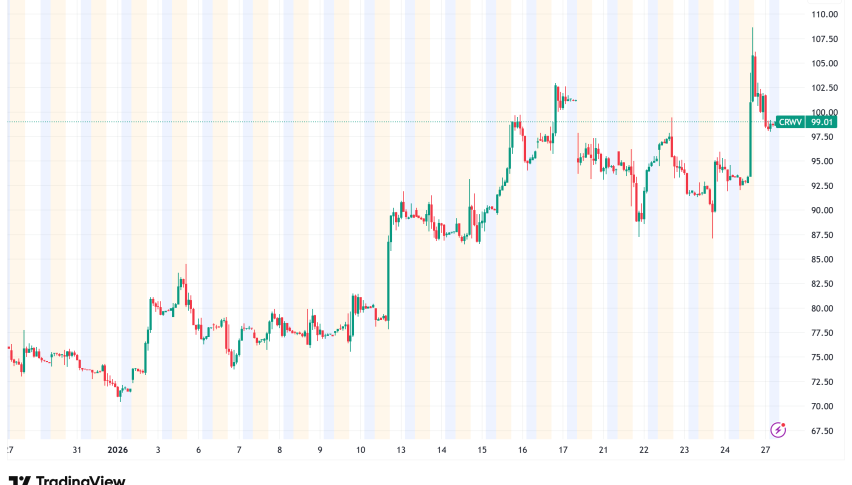

CoreWeave Inc. (NASDAQ: CRWV) is trying to claw back lost ground following a devastating 60% decline from its highs, with the stock finally showing signs of life after weeks of persistent selling pressure. The reversal has been modest but notable: an 8% jump on Thursday lifted the share price above $85 and contributed to a weekly advance of more than 13%.

Yet despite the recent uptick, investors are far from convinced that the worst is over. The market remembers how quickly momentum evaporated after the highly publicized $14 billion partnership with Meta earlier this year — an agreement that initially sparked optimism but failed to generate lasting confidence or meaningful price support.

A Volatile Cycle of Rallies and Reversals

CoreWeave’s recent history reflects a pattern of sharp rebounds followed by equally sharp breakdowns. After a powerful recovery in September that returned the stock to levels above $150, sentiment rapidly deteriorated again. The renewed slump drove shares down to $65 last week before broader market strength finally halted the decline.

CRWV Chart Daily – The 20 SMA Has Been Broken

Technical indicators offer mixed signals: the stock has pushed back above the 20-day moving average, suggesting short-term buyer strength, while the weekly chart reveals that the March highs have transformed into an area of support.

CRWV Chart Weekly – Reversing Higher After the Doji

A doji candlestick at that support zone signals a potential trend reversal, but resistance from August’s lower range continues to cap the advance, leaving a move toward $100 uncertain.

Meta Deal Becomes a Source of Concern, Not Confidence

The long-term agreement with Meta — once viewed as a key stabilizing force — has not restored market trust. Instead, the 2031 contract raised concerns about whether CoreWeave can withstand the relentless capital demands associated with delivering hyperscale AI compute over nearly a decade.

While the Meta deal provided visibility and prestige, many analysts believe it reinforced fears that CoreWeave’s growth comes at the expense of financial balance, liquidity, and long-term profitability. The stock’s inability to maintain gains after the announcement served as confirmation that sentiment remains fragile.

Expansion Costs and Nvidia Dependence Weigh Heavily

CoreWeave’s aggressive growth strategy continues to amplify uncertainty. The pending acquisition of Marimo Inc. introduces additional expenses at a time when the company is already navigating surging infrastructure costs. Meanwhile, its heavy reliance on Nvidia — including an agreement where Nvidia can purchase up to $6.3 billion in unused CoreWeave capacity — underscores the company’s constrained autonomy.

This strategic dependency ties CoreWeave’s financial trajectory directly to Nvidia’s production cycles and pricing decisions, raising questions about how much control management truly has over future margins and scalability.

Profitability Remains a Distant Goal

Financial results have done little to reassure wary investors. Although CoreWeave delivered 105% revenue growth in Q2, reaching $1.21 billion, losses swelled to $290.5 million as the company funneled roughly $3 billion into data-center expansion.

Analysts now expect capital expenditures to reach between $20 billion and $23 billion annually — a figure many believe is unsustainable for a company still far from positive cash flow. With ongoing geopolitical tension and rating agencies such as Weiss assigning a bearish outlook, the recent rebound appears more like a temporary respite than a meaningful shift in market conviction.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM