Dogecoin Price Consolidation Intensifies Amid Whale Accumulation and Tesla Integration Hints

Dogecoin (DOGE) is turning 12 years old, and the first meme cryptocurrency is reaching a very important point in its history. At the time of

Quick overview

- Dogecoin is celebrating its 12th anniversary, currently trading above $0.14 amidst a struggle between positive fundamentals and technical resistance.

- Tesla's website has integrated Dogecoin as a payment option, coinciding with a spike in network activity and an increase in active addresses.

- Large holders, or whales, have accumulated significant amounts of DOGE, but this has not yet translated into higher prices due to strong resistance levels.

- The price prediction for DOGE suggests a range-bound movement, with potential upside if it breaks above $0.1409 and downside risks if it falls below $0.1393.

Dogecoin DOGE/USD is turning 12 years old, and the first meme cryptocurrency is reaching a very important point in its history. At the time of writing, DOGE was trading steadily above $0.14. It is in an interesting tug-of-war between positive fundamentals and strong technical resistance that has repeatedly turned down attempts to raise prices.

Tesla’s Payment Update Coincides with Network Activity Spike

There were some interesting changes that happened around the time of Dogecoin’s anniversary festivities. Tesla’s website has been changed to include better ways to pay for electric cars with Dogecoin. This could be connected to the XMoney payment mechanism on Elon Musk’s X platform. This integration might make DOGE useful for more than just buying things, like the Model 3 and Cybertruck, which are worth a lot of money.

On the other hand, on-chain measurements show a hopeful picture. There are now 71,589 active addresses on the network, which is the most since September. Even though prices have stayed in a restricted range, this three-month surge in activity shows that chain engagement is getting better.

DOGE Whale Accumulation Creates Fundamental-Technical Divergence

The most interesting thing about Dogecoin’s current situation is how different the way people are buying it and the way the price is moving are. Large holders have rapidly boosted their shares, buying 480 million DOGE between December 2 and 4. This buying frenzy raised the total whale holdings from 28.0 billion to 28.48 billion tokens, which shows that institutions have a lot of faith in the asset.

But this buildup hasn’t led to higher prices yet. DOGE is still having trouble getting over the $0.1409 resistance level. When trading volume hit 333 million, which is 79% higher than typical, there was a clear rejection. This big increase in volume caused instant selling pressure, which shows that there is a lot of distribution at this psychological barrier.

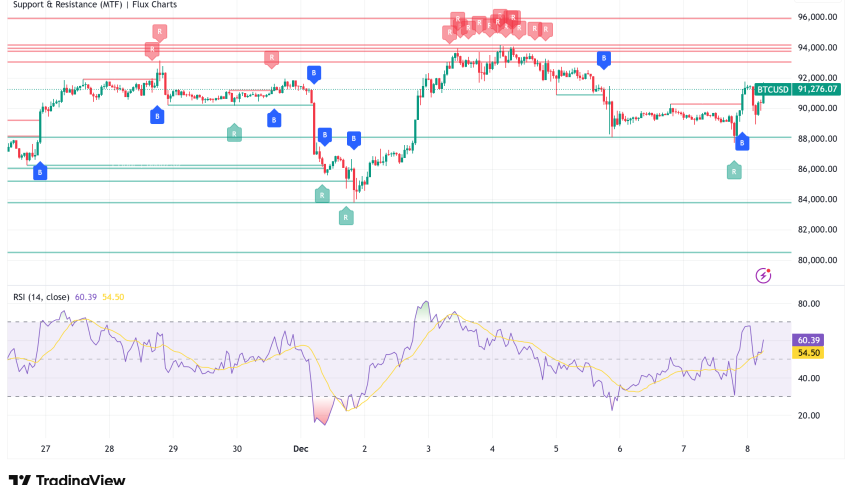

DOGE/USD Technical Outlook: Range-Bound with Clear Battle Lines

The technical structure shows that a coin is in consolidation mode. DOGE has set a narrow range between $0.1393 and $0.1400. Recently, there was a small breakdown that pushed the token down to $0.1392 on volume exceeding 15 million.

DOGE has down 1.2% from recent highs of $0.1522 to its current low of about $0.1395. Several tries to go back to $0.1409 have failed, and the fact that volume has dropped after these breakout fails shows that the market is still unsure. There is no verified trend reversal on lower timeframe charts, and momentum indicators are still weak even though the fundamentals are good.

The most important intraday event was around 07:00 UTC, when the volume explosion happened at the same time as the severe rejection from resistance. After that, the price fell, setting new support at $0.1393, with the price staying around the $0.1395 midway.

Dogecoin Price Prediction: Consolidation Before Catalyst-Driven Movement

The difference between optimistic on-chain indicators and mediocre technical performance suggests that DOGE will probably stay in a range for the time being. Traders should keep an eye on two important levels:

- Upside scenario: If the price breaks above $0.1409 with steady volume, it might go up to $0.142, and if momentum builds, it could even go up to the $0.15-$0.16 zone.

- Downside risk: If the $0.1393 support level doesn’t hold, the price might go back down to $0.1380, and if it keeps going down, it could go down to $0.13.

Long-Term Perspective on Dogecoin’s 13th Year

Dogecoin is now in its 13th year, which is impressive because most cryptocurrency projects don’t last that long. DOGE has shown that it can last, going from a joke by Billy Markus and Jackson Palmer in 2013 to a market cap of $22.5 billion and a spot in the top 10.

The launch of a Spot Dogecoin ETF, which has only seen a small amount of early participation, is a symbolic change for the meme coin. It means that big financial companies now see DOGE as a good investment opportunity that is structured and regulated. This is a big change from its original joke-based origins.

Analysts have many different ideas on what the price will be. Some say it could be as low as $0.75, while others say it might go as high as $1.30 or even $10. These longer-term estimates, on the other hand, depend on catalysts appearing to terminate the current period of consolidation.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account