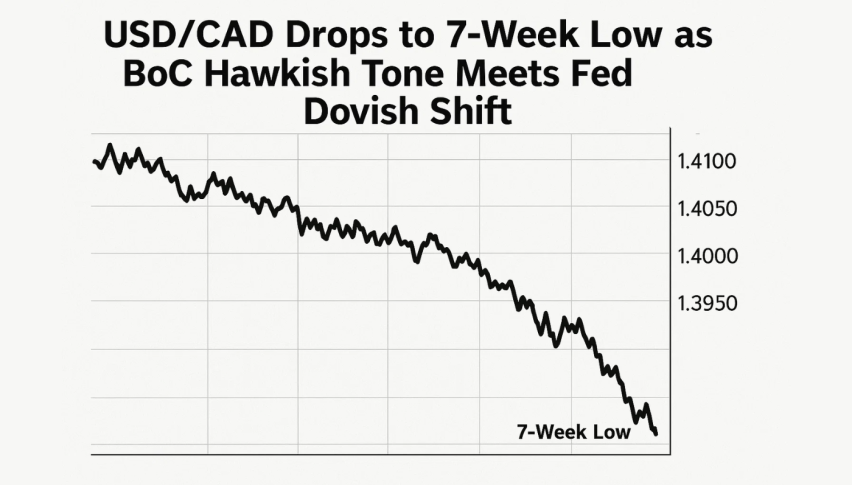

USD/CAD Drops to 7-Week Low as BoC Hawkish Tone Meets Fed Dovish Shift

During early European trading, USD/CAD held just under $1.3800, marking its weakest levels since late October as sellers continued...

Quick overview

- USD/CAD is trading just under $1.3800, marking its weakest levels since late October as sellers dominate the market.

- The Bank of Canada's hawkish stance and unchanged interest rates support the Canadian Dollar amid a favorable economic outlook.

- The US Dollar is under pressure following a recent rate cut by the Federal Reserve, diminishing its safe-haven appeal.

- Traders are now focused on upcoming Trade Balance data from both countries, which could impact USD/CAD volatility.

During early European trading, USD/CAD held just under $1.3800, marking its weakest levels since late October as sellers continued to control momentum. The pair has entered a steady bearish consolidation, with markets increasingly favoring the Canadian Dollar over the softer US Dollar.

BoC Hawkish Tone Supports the Loonie

The Bank of Canada’s decision to keep rates unchanged at 2.25% reinforced support for the Canadian Dollar. Governor Tiff Macklem signaled confidence in maintaining current policy settings, adding that monetary conditions remain appropriate as the economy adjusts to ongoing structural changes.

Markets also interpreted the BoC’s communication as an implicit signal that the rate-cut cycle is effectively over—positioning the central bank ahead of the Federal Reserve’s more cautious outlook.

Additional support for the Loonie came from firmer crude oil prices, which helped offset broader risk-related volatility. Even renewed tariff threats from the US administration failed to disrupt CAD’s momentum meaningfully.

Fed Dovishness Weighs on the US Dollar

The US Dollar continued to drift lower after the Federal Reserve delivered another 25-basis-point rate cut and projected only one additional cut in 2026. Traders increasingly expect the Fed will need to ease further after Chair Jerome Powell highlighted rising labor-market risks and emphasized the need to protect job growth.

This shift has reduced the USD’s safe-haven appeal, especially as equities trade with a constructive tone. With sentiment against the Greenback, USD/CAD remains vulnerable to further downside.

Key Data Ahead for USD/CAD Traders

Market attention now turns to Trade Balance data from both the US and Canada—figures that could influence near-term volatility. Oil prices and broader USD sentiment will also remain central drivers for the pair.

USD/CAD Technical Outlook

USD/CAD trades near $1.3791, firmly within a descending channel that has guided the downtrend since late November. The 20-EMA near $1.3820 continues to act as dynamic resistance, where repeated upper-wick rejections confirm active sellers.

- Immediate support: $1.3783

- Next downside targets: $1.3750 and $1.3708

- Resistance to reclaim: $1.3820, followed by $1.3871

The RSI near 34 signals persistent bearish momentum without entering oversold territory, suggesting further downside remains likely if price stays below the descending trendline.

Overall, USD/CAD maintains a bearish structure, with sellers in control unless a decisive break above $1.3820 shifts momentum.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account