BMNBR Stock Heads Under $30 Despite Balance-Sheet Strength as ETH Price Slips Below $3K

Although BitMine's long-term fundamentals are still intact, the cryptocurrency market's recent slump has reduced momentum and forced BMNR...

Quick overview

- BitMine's fundamentals are strong, but recent weakness in the cryptocurrency market has led to a defensive posture for the stock.

- A brief recovery in BitMine shares was halted by resistance at the 100-day moving average, resulting in a sharp decline back toward $30.

- The company's significant exposure to Ethereum magnifies both its potential for recovery and its vulnerability to market downturns.

- Despite strong financials and institutional interest, BitMine's stock performance remains closely tied to the volatility of Bitcoin and Ethereum.

Although BitMine’s long-term fundamentals are still intact, the cryptocurrency market’s recent slump has reduced momentum and forced BMNR to take a defensive stance.

Crypto Selloff Reasserts Control Over BitMine Shares

BitMine (NASDAQ: BMNR) has once again come under pressure as the broader cryptocurrency market slips back into a bearish phase. While the company’s strategic positioning and financial strength remain notable, short-term price action tells a different story. Persistent volatility in Bitcoin and Ethereum continues to dominate sentiment, leaving BMNR vulnerable to downside swings despite periods of sharp recovery.

November’s aggressive selloff across digital assets set the tone. Bitcoin and Ethereum both suffered steep declines, with Bitcoin briefly testing the $80,000 region and Ethereum sliding below critical support levels. BitMine moved in lockstep with the sector, extending a multi-month stretch of instability as investors reduced exposure to crypto-linked equities.

Brief Recovery Fails to Hold as Crypto Momentum Turns Lower

Toward the end of November, a rebound across digital assets sparked a sharp relief rally in BitMine shares. The stock surged more than 60%, climbing from below $25 to above $42 in a matter of weeks. However, that recovery proved fragile.

The rally stalled decisively at the 100-day simple moving average, a technical barrier that rejected further upside. Once momentum faded, sellers quickly regained control. BMNR reversed sharply and fell roughly 25%, sliding back toward the $30 level, where the 200-day moving average now sits.

With cryptocurrencies rolling over again, the stock has lost directional support. A clean break below $30 would expose BMNR to a deeper retracement toward $25, reinforcing the view that recent gains were driven more by short-covering than sustainable demand.

Technical Setup Tilts Bearish Again

From a chart perspective, BitMine’s technical profile has deteriorated. While the 200-day moving average previously acted as a stabilizing force, repeated tests weaken its effectiveness. The failure to reclaim and hold above the 100-day average signals declining upside conviction.

BMNR Chart Daily – The 20 SMA Has Now Turned Into Support

Momentum indicators reflect growing caution. The sharp rejection at resistance suggests that buyers are unwilling to commit aggressively while crypto markets remain under pressure. As long as Bitcoin and Ethereum continue to struggle, BMNR’s price action is likely to remain reactive rather than trend-driven.

Ethereum Weakness Undermines Sector Confidence

Ethereum’s price behavior has been central to BitMine’s recent volatility. After collapsing from above $3,900 to the low-$2,600 range, ETH staged a powerful rebound, gaining roughly 10% in a single session. That move briefly restored optimism across crypto-linked equities.

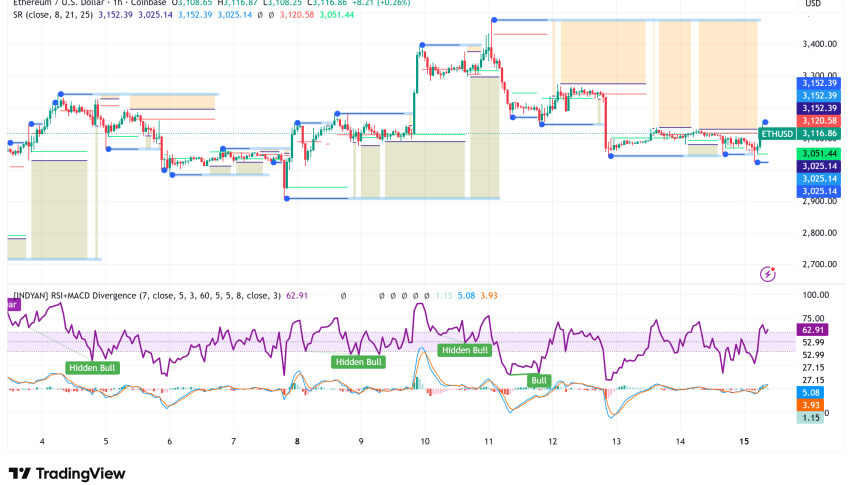

ETH/USD Chart Daily – Starting to Reverse the Trend

However, the recovery has already begun to unravel. Ethereum has slipped back below $3,000, while Bitcoin fell toward $85,000 on Monday. This renewed weakness has reignited fears that the broader crypto market has not yet found a durable bottom, keeping pressure firmly on stocks like BMNR.

Massive ETH Treasury Is a Strength—But Also a Risk

One of BitMine’s defining characteristics is its enormous exposure to Ethereum. Through BitMine Immersion Technology, the company controls the world’s largest corporate ETH treasury. Last week alone, BitMine acquired more than 102,000 ether, worth approximately $320 million, lifting total holdings to nearly 4 million tokens.

As of mid-December, the company reported roughly $1 billion in cash and total digital asset holdings valued at $13.2 billion, including a smaller Bitcoin position and exposure to Worldcoin-focused treasury Eightco. These figures place BitMine among the largest digital asset holders globally.

While this scale provides long-term leverage to a crypto recovery, it also magnifies downside risk. Heavy concentration in Ethereum leaves the stock acutely sensitive to market drawdowns, limiting its ability to decouple from bearish crypto cycles.

Long-Term Vision Clashes With Short-Term Reality

Chairman Tom Lee continues to outline an ambitious roadmap centered on Ethereum’s future role in institutional finance. The planned launch of the Made in America Validator Network in early 2026 is positioned as a cornerstone initiative aimed at large-scale staking and validator infrastructure.

Lee has also cited protocol upgrades, shifting Federal Reserve policy, and post-liquidation market normalization as catalysts for a renewed crypto uptrend. However, markets remain unconvinced in the near term. Promised tailwinds for 2026 offer little protection against current volatility, particularly as risk appetite across digital assets remains fragile.

Strong Financials Struggle to Offset Market Headwinds

Operationally, BitMine stands apart from many crypto-exposed peers. The company recently reported earnings per share of $15.90, return on equity above 16%, and healthy margins. A year-end dividend further underscores balance-sheet strength and disciplined capital management.

Institutional ownership has also increased, with firms such as ARK Investment Management, Vanguard, Pantera Capital, and Sumitomo Mitsui Trust establishing positions. Yet even these positives have failed to shield the stock from broader market forces.

Outlook: Fundamentals Strong, But Cycles Still Rule

BitMine’s long-term strategy and financial footing remain compelling on paper. However, the stock’s near-term trajectory remains tightly bound to crypto price action. As long as Bitcoin and Ethereum remain under pressure, BMNR is likely to face continued volatility and downside risk.

For now, bearish crypto sentiment is outweighing fundamentals, leaving BitMine vulnerable until the broader market delivers a clearer and more sustained recovery.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account