CRWV Stock Jumps Above $80 After Hours, but CoreWeave’s Structural Risks Persist

After shattering important support, CoreWeave shares saw a dramatic comeback, but the outlook is still clouded by growing debt, significant

Quick overview

- CoreWeave's stock experienced a brief rebound after a significant decline, but ongoing concerns about debt and sector sentiment continue to impact its outlook.

- Despite securing high-profile partnerships, investors remain wary due to fears about the company's financial capacity and the sustainability of its growth.

- CoreWeave's recent plans to raise $2 billion through convertible notes have heightened investor anxiety regarding its capital needs and potential dilution.

- While the company reported strong revenue growth, its mounting losses and dependence on Nvidia add complexity to its financial situation.

After shattering important support, CoreWeave shares saw a dramatic comeback, but the outlook is still clouded by growing debt, significant capital requirements, and shaky sentiment in the AI field.

A Comeback Attempt Meets Renewed Volatility

CoreWeave’s latest attempt at a sustained recovery once again highlighted the stock’s extreme sensitivity to sentiment across the AI infrastructure space. After weeks of heavy selling pressure, shares briefly found their footing early this month, only for renewed concerns around debt, earnings quality, and sector-wide risks to drag the stock below key support levels. That breakdown revived fears that the worst of the correction was not yet over.

However, Thursday delivered a notable shift in tone. Buyers stepped back in aggressively, pushing CoreWeave shares up roughly 5% during regular trading hours, followed by another 3.5% gain in after-hours action. The rebound lifted the stock back toward the $70 level, effectively erasing Wednesday’s losses and offering investors a glimmer of short-term relief after a punishing stretch of declines.

CoreWeave Joins U.S. Department of Energy’s Genesis Mission

The Essential Cloud for AI™ today announced that it has joined the Genesis Mission, a U.S. Department of Energy initiative that unites leading scientific institutions, supercomputing centers, AI platforms, and technology providers. The mission is focused on accelerating discovery science, strengthening national security, and advancing innovation across the U.S. energy sector.

Genesis is designed to link advanced computing infrastructure with experimental research facilities and large-scale datasets spanning key scientific disciplines. By creating a more connected research ecosystem, the initiative aims to significantly enhance the productivity and real-world impact of American science and engineering.

Through this collaboration, researchers will gain improved access to the tools needed to build, train, and deploy next-generation AI systems with greater speed, efficiency, and reliability. The initiative underscores the growing role of AI-enabled cloud infrastructure in supporting breakthrough research and maintaining U.S. leadership in science and technology.

A Fragile Recovery Gives Way to Selling — Then a Bounce

CoreWeave Inc. (NASDAQ: CRWV) has struggled to regain stability since suffering one of the steepest drawdowns among AI-linked stocks this year. After plunging more than 60% in November on the back of disappointing earnings and rising skepticism around its expansion strategy, the stock managed a brief rebound above $90 last week, recovering roughly $25 from its lows.

That recovery quickly unraveled. Weak earnings from Oracle reignited doubts about the broader AI infrastructure trade, sparking concerns that demand growth may not be strong enough to justify the enormous capital commitments being made across the sector. Selling pressure returned with force, dragging CoreWeave below $64 on Wednesday and briefly pushing it beneath the November low near $65.

Thursday’s rebound, which carried shares back to $70 by the close of after-hours trading, marked a welcome reversal. Still, investors remain cautious, viewing the move as a tactical bounce rather than confirmation of a durable trend change.

Technical Damage Still Weighs on Sentiment

Despite the bounce, the technical picture remains fragile. CoreWeave’s earlier failure to hold above short-term moving averages continues to undermine confidence. The break below the 20-day simple moving average signaled that buyers lacked conviction during the prior rebound, reinforcing the idea that the rally was corrective rather than the start of a sustained advance.

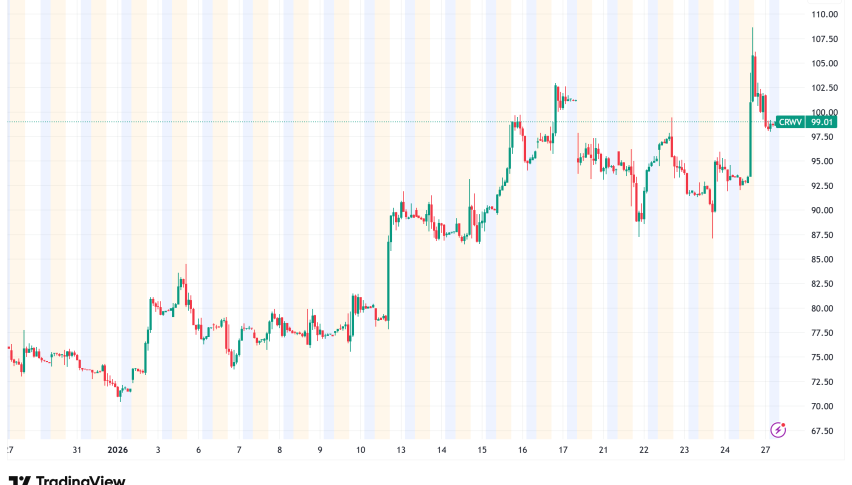

CRWV Chart Daily – The 20 SMA Has Been Broken

This technical weakness resonates strongly with investors who remember earlier failed recoveries. Earlier in the year, the stock surged toward $150 before reversing sharply, trapping late buyers and reinforcing skepticism toward rallies that are not supported by improving fundamentals. While Thursday’s move has stabilized near-term momentum, the stock remains vulnerable unless it can reclaim and hold above key resistance levels.

High-Profile Deals Can’t Fully Calm Balance-Sheet Fears

CoreWeave continues to secure attention-grabbing partnerships that underscore its importance in the AI ecosystem. Its $14 billion agreement with Meta initially fueled optimism, highlighting long-term demand for high-performance AI infrastructure. Yet the scale of the deal also intensified scrutiny of CoreWeave’s financial capacity to deliver on such commitments without further stretching its balance sheet.

More recently, the company announced a partnership to support Runway’s next-generation AI video models using NVIDIA’s GB300 NVL72 systems. This deal emphasizes CoreWeave’s growing role in compute-heavy workloads beyond text-based AI, reinforcing its relevance as generative AI applications become more complex.

Still, these contracts have not been enough to offset near-term worries about funding, execution risk, and profitability. Investors appear increasingly focused on how these deals will be financed, rather than the headline growth they represent.

A Pattern of Extreme Swings

CoreWeave’s stock history over the past year reads like a case study in AI-era volatility. A powerful rally in June carried shares as high as $187 before profit-taking and broader risk aversion triggered a sharp reversal. A subsequent rebound in September briefly lifted the stock above $150 once again, only for momentum to fade and prices to slide steadily lower.

The recent drop toward the mid-$60s revived memories of those earlier collapses. Although the latest rebound has stabilized the stock for now, the inability to string together higher highs continues to fuel skepticism. In a market increasingly intolerant of uncertainty, repeated failures to hold gains have made investors wary of committing fresh capital.

Debt Offering Rekindles Investor Anxiety

Adding to the pressure, CoreWeave recently announced plans to raise $2 billion through a convertible senior notes offering, with an additional $337.5 million available through an over-allotment option. The notes, set to mature in December 2031, will pay semiannual interest in cash, though final terms have yet to be finalized.

The timing of the announcement unsettled markets. With the stock already under pressure, the prospect of additional leverage and potential dilution amplified fears that capital needs are accelerating faster than expected. For many investors, the move reinforced the view that CoreWeave’s growth trajectory is heavily dependent on continuous access to external financing.

Strong Revenue Growth, Mounting Losses

Operationally, CoreWeave’s growth story remains compelling. Third-quarter revenue surged 105% year over year to $1.21 billion, reflecting intense demand for AI compute resources. Yet profitability remains elusive. Net losses widened to $290.5 million as the company invested nearly $3 billion into expanding its data-center footprint.

Looking forward, analysts estimate annual capital expenditures could reach $20–$23 billion, a level that has raised concerns among ratings agencies and institutional investors. Some have warned that the mismatch between explosive growth and limited cash-flow resilience could become increasingly problematic if market conditions tighten.

Dependence on Nvidia Adds Strategic Complexity

CoreWeave’s close relationship with Nvidia remains both a strength and a risk. Agreements allowing Nvidia to purchase up to $6.3 billion of unused capacity provide validation and utilization support, but they also limit CoreWeave’s strategic flexibility. Pricing power, margins, and capacity planning are closely tied to Nvidia’s own cycles.

Plans to acquire Marimo Inc. further complicate the financial picture, potentially adding integration risk and additional strain to an already leveraged balance sheet. Even as AI demand expands, investors are questioning whether CoreWeave can scale profitably without assuming escalating levels of risk.

An Uncertain Road Ahead

Thursday’s rebound offers a measure of relief after a bruising selloff, but it does not erase the structural challenges facing CoreWeave. The company sits at the intersection of surging AI demand and enormous capital intensity, a combination that promises opportunity but also magnifies risk. Until financial pressures ease and confidence improves, CoreWeave’s rallies are likely to remain vulnerable to sharp reversals in sentiment.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM