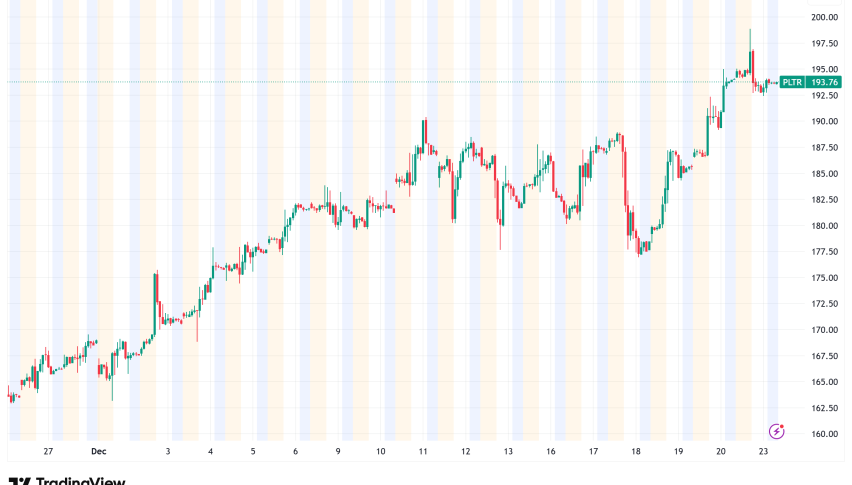

Palantir Breaks Out Above $190: Historic 2025 Momentum Meets High-Stakes 2026 Valuation

Palantir Technologies (NASDAQ: PLTR) rose even higher this week, breaking through its cup-with-handle entry target of $190.39 on Friday

Quick overview

- Palantir Technologies' stock surged past the $190 mark, closing at $193.98, marking a 150% gain in 2025.

- The company secured significant contracts with the U.S. Navy and Army, boosting its revenue growth by over 50% in both commercial and government sectors.

- Despite strong fundamentals, concerns about Palantir's high valuation persist, with a price-to-sales ratio of 117, far exceeding industry norms.

- CEO Alex Karp launched The Neurodivergent Fellowship to attract talent with unique cognitive abilities, enhancing the company's focus on AI-driven innovation.

Palantir Technologies (NASDAQ: PLTR) rose even higher this week, breaking through its cup-with-handle entry target of $190.39 on Friday, to close at $193.98 on Monday. The data analytics business has had an amazing 2025, with a 150% gain so far this year.

Palantir is the eighth-best stock in the S&P 500 and the third-best in the Nasdaq-100 for 2025, so this technical breakthrough is a big deal. Technical traders like the cup-with-handle pattern, which is a bullish continuation formation. It signals that the stock could go up even more as it finds new support levels above the breakout point.

Historic Contracts Drive Momentum

A number of major agreements and significant alliances have helped Palantir do so well this year. The U.S. Navy gave the firm a contract worth up to $448 million to use its Foundry platform and Artificial Intelligence Platform (AIP) to improve shipbuilding and supply chain processes. A summer deal with the U.S. Army worth up to $10 billion over the next ten years was even more important.

The company’s new cooperation with Nvidia is another important step forward. It combines Palantir’s data mining tools with Nvidia’s GPU technology and CUDA architecture to make what analysts call a full-stack operating system for faster computing.

The growth in revenue has been very impressive. The commercial and government divisions both grew by over 50% in the first nine months of 2025. Palantir has changed a lot since the AI revolution opened up new business opportunities. Before before, the company relied mainly on contracts with the government.

Palantir’s Valuation Reaches Extreme Levels

Market watchers are worried about Palantir’s valuation even though the company’s fundamentals are excellent. The stock’s price-to-sales ratio is 117, which is more than three times more than the next closest software-as-a-service company. This is more than what internet pioneers like Cisco, Microsoft, and Amazon were worth at their highest points during the dot-com boom, when they were worth between 30 and 50 times their revenues.

Analysts point out that even companies that have made big contributions to disruptive technology have had trouble keeping such high multiples in the past. Investors need to decide if Palantir’s AI leadership is worth the extra cost or if the stock has gone too far.

CEO Makes Headlines with Neurodivergent Fellowship

CEO Alex Karp recently started The Neurodivergent Fellowship after a New York Times interview that went viral. This has helped the company get more attention. The program is looking for people with cognitive qualities that Palantir thinks will be helpful in AI-driven settings. It offers jobs with salaries between $110,000 and $200,000 a year, as well as stock options and sign-on incentives.

The corporation made it clear that the fellowship is not a “diversity initiative” but rather a strategic way to hire people who can recognize patterns and think outside the box. It’s important to note that candidates don’t need formal diagnoses to be eligible.

Palantir (PLTR) Stock Outlook for 2026

Analysts are mostly hesitant, even though Palantir has shown that it can compete with established corporate software companies like Salesforce and SAP. The company’s long-term prospects look good because it is in a good position between software and AI. However, the stock’s rise due to momentum has made it quite risky.

Market experts say that investors should look for better times to buy in 2026, especially if the AI sector as a whole sees corrections or expectations reset that cause prices to drop from where they are now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM