Palantir Valuation Reality Check: PLTR Stock Heads to $150 as Market Grows Impatient

Palantir enters the new year under pressure as valuation concerns, technical weakness, and rising investor caution overshadow solid...

Quick overview

- Palantir's stock has dropped approximately 12.5% in the new year, raising concerns about its valuation despite solid fundamentals.

- Recent insider selling and technical weaknesses have contributed to a deteriorating market sentiment around the stock.

- While Palantir's government contracts provide stability, they also create concentration risks and limit growth flexibility.

- The upcoming earnings report will be crucial for assessing whether Palantir can maintain momentum amid rising investor caution.

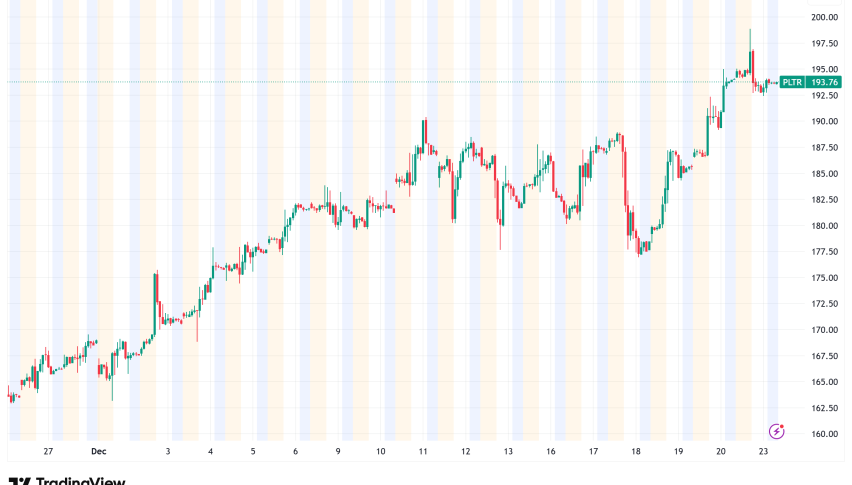

Live PLTR Chart

[[PLTR-graph]]Palantir enters the new year under pressure as valuation concerns, technical weakness, and rising investor caution overshadow solid fundamentals and long-term ambition.

A Fragile Start to the New Year

After an impressive rebound through December, Palantir Technologies has stumbled out of the gate in the new year. Shares are down roughly 12.5% in just one week, marking a sharp reversal that has unsettled investors who had grown comfortable with the stock’s relentless climb. The decline comes despite ongoing contract wins, improving profitability, and a bullish long-term narrative tied to artificial intelligence and government software.

Instead, the market appears to be refocusing on a familiar concern: whether Palantir’s valuation has simply run too far ahead of reality.

This shift in tone suggests the rally may have reached a point where optimism alone is no longer sufficient to sustain upside.

December’s Bounce Gives Way to Renewed Selling

Palantir’s late-2024 rebound was powerful, erasing a significant portion of November’s selloff and restoring bullish momentum. That recovery, however, now looks increasingly fragile. Shares slipped late last week, falling about 4% on Friday, before extending losses into the current session with another near-2% decline.

The inability to sustain buying pressure above the psychologically important $200 level has become a focal point. For many traders, that failure signals exhaustion rather than consolidation. Instead of forming a new base, price action now resembles a rollover, with sellers growing more confident as support levels are tested.

With PLTR trading near $170 after a sharp daily drop of roughly 4.5%, short-term sentiment has clearly deteriorated.

November’s Selloff Still Haunts Positioning

The memory of November’s abrupt correction remains fresh. That drawdown was sparked by renewed scrutiny of Palantir’s valuation and its dependence on U.S. government revenue. While the stock recovered impressively, it never fully repaired the technical damage left behind.

Investors who endured that volatility appear quicker to reduce exposure this time. Rather than buying dips aggressively, many are choosing to lock in gains or step aside entirely. This behavior suggests confidence is thinning, particularly among momentum-driven holders who are sensitive to technical breaks.

The recent move has erased much of December’s upside and now threatens to open the door to a deeper retracement.

Technical Signals Turn Less Forgiving

From a chart perspective, Palantir’s structure has weakened noticeably. Shares have slipped below the 20-week simple moving average, which had provided reliable support throughout the rally from late summer. This breakdown raises the risk that the pullback is not merely a pause, but the early phase of a broader reversal.

PLTR Chart Weekly – Can Sellers Push Below the 50 SMA This Time?

Attention is now shifting to the 50-week moving average as the next major line of defense. A decisive break below that level would likely reinforce bearish narratives and encourage further de-risking.

Some technicians have also pointed to a potential head-and-shoulders formation developing on the weekly chart—a pattern often associated with trend reversals rather than healthy consolidation.

Valuation: The Market’s Persistent Objection

At the center of the debate remains Palantir’s valuation. Even after the recent pullback, the stock trades at levels that place it among the most expensive names in the S&P 500. Such pricing leaves little margin for error, particularly in a market that has grown less forgiving toward richly valued growth stocks.

According to widely cited estimates, Palantir has been trading at more than 400 times trailing earnings and close to 190 times forward earnings. At those multiples, strong execution is not enough—exceptional execution is required just to justify the status quo.

This dynamic amplifies every headline, earnings report, and insider disclosure, turning routine developments into potential catalysts for outsized moves.

Insider Selling Adds to Near-Term Unease

Recent insider activity has added another layer of caution. Chief Financial Officer David Alan Glazer disclosed the sale of just over $1.6 million worth of shares, a transaction that quickly drew market attention given Palantir’s valuation-sensitive profile.

While such sales are typically pre-planned and represent a small fraction of executive holdings, the timing has not helped sentiment. In an environment already primed for skepticism, even modest insider selling can reinforce fears that upside is becoming limited.

Rather than signaling panic, the sale appears to have validated existing concerns among nervous investors.

Government Contracts Remain a Strength—but Also a Constraint

Palantir’s government business continues to anchor its revenue base, providing stability but also reinforcing concentration risk. A notable win in December was the U.S. Navy’s ShipOS initiative, authorizing up to $448 million for software deployment across the Maritime Industrial Base.

Early pilot programs have demonstrated meaningful efficiency improvements, reducing planning timelines at submarine shipyards. These results highlight Palantir’s strength in complex, high-stakes environments where switching costs are high.

However, reliance on government contracts also limits flexibility. Budget cycles, political scrutiny, and contract timing can introduce lumpiness, making it harder to sustain the kind of smooth growth trajectory that premium valuations demand.

International Growth Meets Geopolitical Friction

Palantir’s international ambitions remain intact, but progress has been uneven. A three-year contract renewal with France’s domestic intelligence agency underscores the stickiness of its platforms once embedded in critical workflows.

By contrast, Swiss defense authorities recently opted against adopting Palantir software following a risk assessment focused on data sovereignty. The decision serves as a reminder that geopolitical and regulatory concerns can override technical merit—particularly for U.S.-based defense technology firms operating abroad.

These mixed outcomes highlight both opportunity and limitation in Palantir’s global expansion strategy.

New Frontiers, Uncertain Timelines

Beyond traditional markets, Palantir is positioning itself for future growth in highly specialized domains. Partnerships with Voyager Space and Starlab Space aim to deploy Foundry as a data backbone for commercial space stations.

While strategically intriguing, these initiatives remain early-stage and speculative. Revenue contributions are likely years away, making them insufficient to offset near-term valuation concerns or technical weakness in the stock.

For now, they add narrative depth but little immediate financial relief.

Earnings Loom as the Next Test

The next major catalyst is Palantir’s upcoming earnings report, tentatively expected in early February. Investors will be watching closely to see whether U.S. commercial demand can sustain its recent momentum and whether AIP deployments are translating into repeatable, scalable revenue.

Palantir’s most recent results were undeniably strong. Revenue surged 63% year over year to $1.18 billion, while net income more than tripled. Management raised full-year guidance and projected robust free cash flow.

Yet even these numbers have struggled to silence valuation critics.

Confidence Meets Caution

Palantir now finds itself in an uncomfortable middle ground. Execution remains solid, contracts continue to expand, and long-term positioning in AI-driven decision software is compelling. At the same time, expectations are sky-high, technical momentum is fading, and tolerance for missteps is shrinking.

The recent selloff may not represent a collapse in conviction—but it does reflect a market increasingly unwilling to pay any price for growth.

For Palantir, the challenge ahead is no longer proving that the business works, but proving that it can grow fast enough to justify the premium investors have already assigned.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account