Gold Price Forecast: $4,510 Target as Dollar Strength Tests Key $4,430 Support

Gold prices remained under pressure in the latest session, with XAU/USD trading near $4,470 after failing to extend its prior rebound.

Quick overview

- Gold prices are under pressure, trading near $4,470 after a failed rebound, influenced by a modest recovery in the US dollar.

- Initial Jobless Claims rose to 208,000, slightly below expectations, indicating labor market stability and limiting gold's appeal.

- The US dollar index is near a one-month high, with markets anticipating the upcoming Nonfarm Payrolls report to shape Fed policy expectations.

- Geopolitical tensions continue to support gold as a safe-haven asset, despite recent price weakness.

Gold prices remained under pressure in the latest session, with XAU/USD trading near $4,470 after failing to extend its prior rebound. The pullback followed a modest recovery in the US dollar, which gained traction after fresh US labor market data reinforced the view that the economy remains resilient.

According to the US Department of Labor, Initial Jobless Claims rose to 208,000 for the week ending January 3, slightly below market expectations of 210,000 but above the prior week’s revised 200,000. While not a game-changer, the data supported the dollar by signaling continued labor market stability, limiting demand for non-yielding assets such as gold.

Silver followed a similar path, with XAG/USD slipping to $76.55, down around 0.6% on the day, as traders remained cautious ahead of key US employment data.

Fed Rate Expectations Keep Markets Cautious

The US dollar index is hovering near a one-month high, supported by data resilience but capped by expectations that the Federal Reserve will begin cutting rates later this year. Markets are now focused on the upcoming US Nonfarm Payrolls report, with economists expecting roughly 60,000 new jobs in December and the unemployment rate easing toward 4.5%.

These figures will be critical for shaping near-term Fed policy expectations. A softer labor print could revive rate-cut bets and weaken the dollar, while stronger data may extend pressure on gold.

Geopolitics Still Underpin Safe-Haven Demand

Despite near-term weakness, gold continues to find structural support from global uncertainty. Ongoing tensions involving Russia and Ukraine, renewed frictions between China and Japan, and political developments in Venezuela have kept investors cautious.

Comments from US President Donald Trump suggesting prolonged US involvement in Venezuela to secure energy resources, alongside China’s tighter export controls on rare earth materials to Japan, have reinforced gold’s role as a long-term hedge against geopolitical risk.

Gold Technical Outlook: Triangle Signals Break Ahead

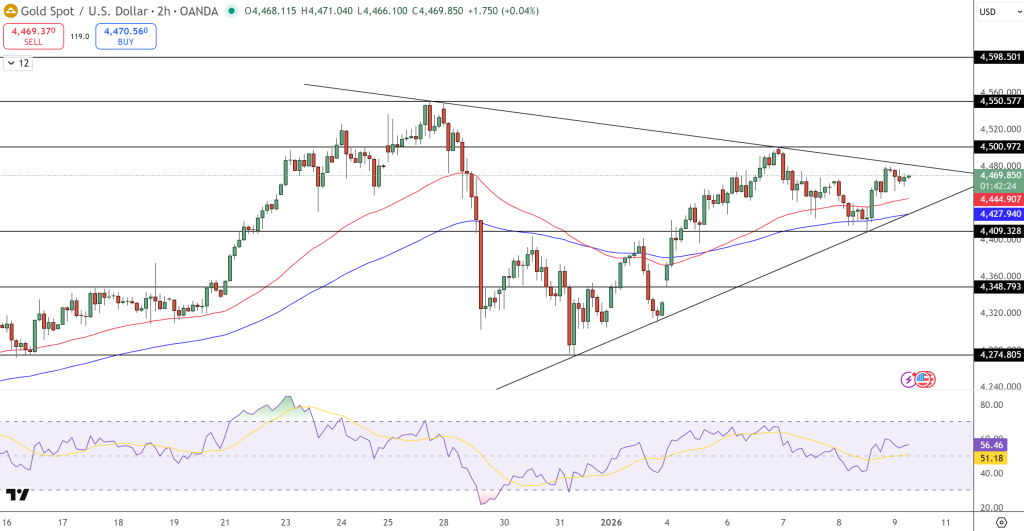

From a technical perspective, gold is consolidating within a rising channel on the 2-hour chart after rebounding from the $4,275 late-December low. Price action is now compressing into a symmetrical triangle, with descending resistance from the $4,550 high and rising support near $4,430.

Recent candlesticks show smaller bodies and mixed wicks between $4,460 and $4,480, signaling balance rather than aggressive selling. The 50-period moving average is flattening just below price, while the 200-period average near $4,410 continues to act as dynamic support. RSI near 55 points to mild bullish momentum without overbought conditions.

Key levels to watch:

- Resistance: $4,500–$4,510

- Support: $4,430, then $4,350

Trade idea: Buy on a pullback near $4,430, target $4,510, stop below $4,395.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account