Daily Crypto Signals: Bitcoin Faces $65K Critical Test, Monero Surges Past $500 Milestone

Bitcoin confronts a pivotal "do-or-die" price level at $65,000 as power law analysis suggests the market may enter a consolidation phase

Quick overview

- Bitcoin faces a critical price level at $65,000, which may determine its market trajectory as it approaches a potential consolidation phase in 2026.

- Monero has surged past $500 for the first time since 2021, driven by increased institutional interest in privacy coins amid Zcash's governance issues.

- BitMine has staked over 1 million ETH, marking a significant milestone in the cryptocurrency market.

- Concerns about social media censorship of crypto information have been raised, highlighting the impact of bot activity on platforms like X.

Bitcoin BTC/USD confronts a pivotal “do-or-die” price level at $65,000 as power law analysis suggests the market may enter a consolidation phase in 2026, while privacy coin Monero XMR/USD has broken above $500 for the first time since 2021 amid rival Zcash’s governance crisis. The contrasting trajectories highlight growing institutional interest in privacy-focused cryptocurrencies even as Bitcoin investors debate whether traditional four-year cycle patterns still apply to the maturing asset.

Crypto Market Developments

Over the weekend, the cryptocurrency market saw a lot of action, with big changes in institutional posture, platform controversies, and the way the market works. BitMine, the biggest Ether ETH/USD treasury firm, reached a big milestone by staking more than 1 million ETH after making four distinct deposits of 86,400 ETH worth over $268.7 million. The company now has 1,080,512 staked ETH, which at current staking rates should bring in an extra $94.4 million worth of ETH each year.

At the same time, Ki Young Ju, the creator of CryptoQuant, publicly chastised social media site X for censoring real crypto-related information while ignoring the huge amount of bot activity. Data showed that automated accounts made more than 7.7 million posts on bitcoin in just one day. This was more than 1,200% more than regular levels. Ju said that X’s algorithmic crackdowns are hurting real users instead of separating real accounts from bots. He also said that the platform’s paid verification method doesn’t work as a way to screen out fake accounts.

Samson Mow, the founder of Jan3, predicted that Tesla CEO Elon Musk would “go hard into BTC” this year, even though Musk has said in the past that he is worried about how Bitcoin affects the environment. In May 2021, Tesla stopped accepting Bitcoin payments because of concerns about the environment. Then, in July 2022, the company sold 75% of its Bitcoin assets.

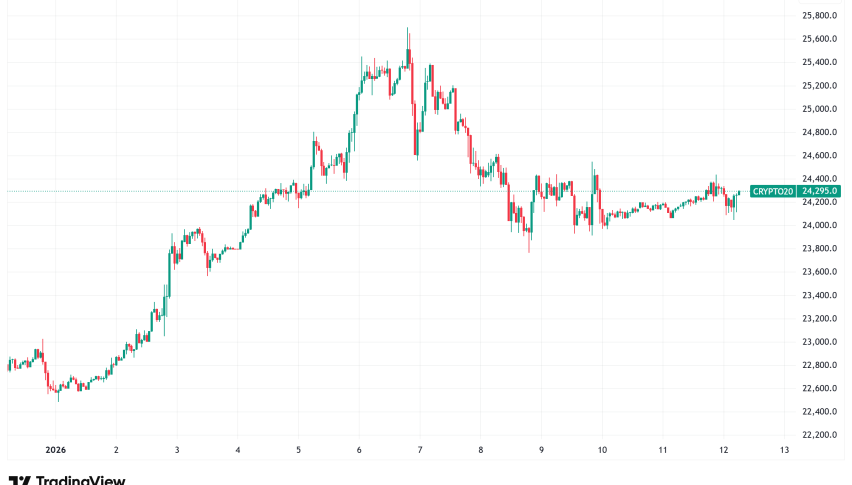

Bitcoin Power LawTrendline Suggests $65K Test

Bitcoin is at a very important point right now. Power law study shows that $65,000 might be a “do-or-die” price level if 2026 is a year of consolidation instead of ongoing bull market momentum. Jurrien Timmer, who is in charge of global macro at Fidelity Investments, said that Bitcoin has closely followed its power law trendline for most of the current bull cycle, but it may now need to test lower support again. The study shows that if Bitcoin stays stable for the next year, the power law trendline, which is presently at $45,000, might move closer to the $65,000 level, which was the previous cycle high. This would provide a clear battleground for price activity.

After 2025 concluded in the red, the first time a post-halving year ended lower than it started, the discussion about Bitcoin’s four-year halving cycles has gotten even more heated. Some people in the market have completely given up on cycle theory, but executive David Eng says that bear markets will always be a part of Bitcoin as it grows, but the price cycles will be longer and the volatility will be lower. Eng says that Bitcoin is “a scarce fixed asset inside the financial system, not a standalone S-curve like the internet.” This means that the current “compressed” power law readings need an upward relief rally, with prices needing to catch up to long-term growth models instead of the models adjusting downward.

Monero Crosses $500 After Weekend Rally

Monero broke beyond the $500 barrier for the first time since May 2021, temporarily reaching $500.66 after gaining more than 6% on Sunday and 20% over the past week. The privacy-focused cryptocurrency’s rise moved it close to its all-time high of about $517.50 set in April 2021, putting XMR on the verge of price discovery territory. The rally happened at the same time as a governance crisis at Zcash, a competing privacy coin. The Electric Coin Company crew all quit at once because of bad working conditions and board disagreements, which caused ZEC to drop more than 20% to about $360.

But based on past patterns, it could be best to be careful even when Monero is doing well. Technical research shows that XMR has tried to break above its record high seven times before, but each time it failed and then dropped sharply, by 40% to 95%. If this fractal pattern keeps happening, Monero might go through a long corrective phase that targets the $200-$270 range. This range is where the ascending trendline support and important Fibonacci retracement levels are.

On the other hand, if XMR breaks out and stays above the $500–$520 resistance zone, it would break the negative historical pattern and could push the price up to $775, following the route of cryptocurrencies that broke out after years of consolidation in 2025. There has been more interest from institutions in privacy coins. Companies like Grayscale and Coinbase have pointed out privacy-focused cryptocurrencies as a key growth trend as demand for financial privacy rises in a world that is becoming more regulated.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM