Will USAR Stock Reach Record High at $44 on Prospect of Strategic US Backing?

Following news of an upcoming U.S. government investment, shares of USA Rare Earth surged, indicating a renewed focus by investors on...

Quick overview

- USA Rare Earth shares surged by as much as 38% following reports of a significant U.S. government investment.

- The stock remains around 20% higher, marking its strongest level since October and bringing all-time highs back into view.

- Government backing is seen as transformative for small mining companies, potentially accelerating the development of domestic rare earth resources.

- The Trump administration is reportedly set to acquire a 10% stake in USA Rare Earth as part of a $1.6 billion funding package.

Following news of an upcoming U.S. government investment, shares of USA Rare Earth surged, indicating a renewed focus by investors on strategic minerals and domestic supply chains.

Shares Surge on Funding Expectations

USA Rare Earth, Inc. shares jumped sharply on Monday after reports that the U.S. government is preparing to make a significant investment in the company. The stock surged as much as 38% in premarket trading to $34.20 from Friday’s close of $24.77, before paring gains during the U.S. session.

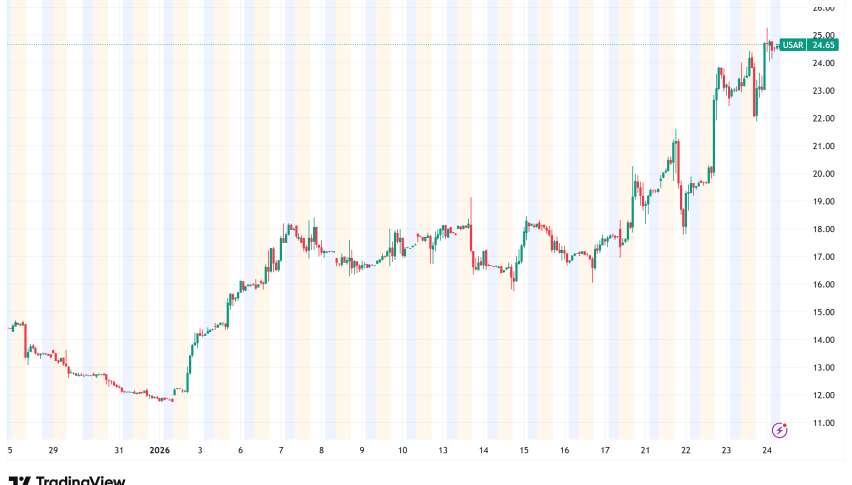

USAR Chart Daily – Gaining 100% Since Last Monday

Even after cooling below $30, the stock remained around 20% higher on the day, marking its strongest level since October and putting all-time highs above $44 back into view.

Why Government Backing Matters

The rally is notable because federal support can be transformative for a small mining company. Government funding can accelerate the development of both a domestic rare earth mine and a magnet manufacturing facility, while also influencing future share issuance and capital structure. For investors, this type of backing often signals long-term strategic importance rather than short-term financial support.

Rare Earths Step Into the Spotlight

Rare earth elements rarely command market attention—until geopolitics and supply chains force them into focus. These materials are essential for high-performance magnets used in electric vehicles, industrial motors, and defence systems. As a result, stocks tied to “onshoring” and domestic production have attracted growing investor interest.

Deal Details and What Comes Next

Reports suggest the Trump administration is set to acquire a 10% stake in USA Rare Earth as part of a $1.6 billion debt-and-equity package, alongside a separate $1 billion private capital raise. An official announcement is expected Monday, with the company planning an investor call. While confirmation is pending, the prospect alone has been enough to reignite momentum in the stock.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM