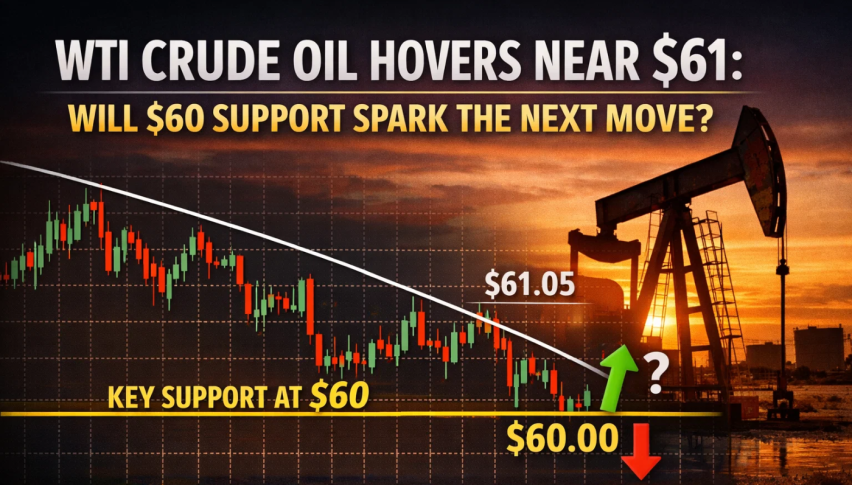

WTI Crude Oil Hovers Near $61: Will $60 Support Spark the Next Move?

WTI Crude oil is trading near $61.10 a barrel and sticking to last week's upward trend as a mix of geopolitical jitters and technical...

Quick overview

- WTI Crude oil is trading around $61.10 a barrel, supported by geopolitical tensions and technical indicators.

- Recent price increases suggest stabilization in the oil market as traders reassess supply risks and macroeconomic factors.

- Geopolitical concerns, particularly in the Middle East, continue to exert upward pressure on oil prices.

- Technical analysis indicates key support at $60.00, with potential bullish momentum if prices remain above $62.40.

WTI Crude oil is trading near $61.10 a barrel and sticking to last week’s upward trend as a mix of geopolitical jitters and technical support keeps prices steady. This comes after a Friday jump of over 2% when markets responded to fresh Middle East tensions, unresolved trade worries, and the growing sense that buyers are really trying to hold the line at key price points rather than just chasing short-term headlines.

The recent price pick-up, however, suggests that oil is finally starting to stabilize and stop falling, rather than continuing its earlier slide, as traders re-evaluate their views on supply risks and the broader macro picture heading into the final week of January.

Geopolitics Keeps The Oil Price at a Premium Risk

And it’s the Middle East that remains right at the centre of things. Reports that a US aircraft carrier group has been sent to the waters off Iran have reignited concerns that a major energy flow disruption could be just around the corner for a region that supplies nearly a third of the world’s oil. The threat, however, isn’t that there will be a direct confrontation. There’s more than enough tension there right now to put a bit of a risk premium back on crude prices.

Elsewhere, the diplomatic situation is still unfolding, weighing on sentiment. The US-brokered talks between Russia and Ukraine broke down without making any progress, but both sides agreed to return to the negotiating table next weekend. The worry now is that any major escalation in the conflict could really start to put a squeeze on energy supplies, particularly for European energy importers.

Trade politics have also managed to stay in the picture. President Trump’s threat to slap a 100% tariff on Canada if it goes ahead with talks with China on a trade deal has once again raised concerns that the global trade system is fragmenting, potentially disrupting energy demand and supply chains.

Supply Pressures Offer a Little Bit of Relief

Despite all this, a bit of a balancing act between rising geopolitical risks and falling supply woes means there’s a buffer against the worst of it. Next week’s should see Kazakhstan’s oil exports return to normal after an offshore mooring facility was brought back online, which might limit some of the upside and suggests that crude prices are finding a way to balance out right now between normalising supply trends and the risk of major disruption.

WTI Technical Outlook: $60 Shows Up as a Key Anchor

And what’s happening with technicals is also starting to be a help. WTI’s chart is looking more positive, having rebounded cleanly off a support zone around $59.00-$59.40 and staying on the right side of a rising trendline drawn from early January’s lows.

WTI has managed to get back above the 50-period EMA and is holding up well against the 200-period EMA, suggesting that buyers are finally starting to get in on the act after the pullback. The candles near $61 are a bit more subdued and show some uncertainty about direction, which points to consolidation rather than outright rejection.

Key levels to watch:

- Support: $60.00 then $59.00

- Resistance: $61.35 and then $62.30-$62.40

- Upside target: $63.40 in the event of a confirmed break.

Momentum is picking up, but it isn’t overstretched right now. The RSI near 61 is starting to show a bit of upside pressure, but not to the point of getting overbought, so it’s keeping the near-term bias looking pretty constructive.

Trade setup: Consider buying dips around $60.00 and targeting $62.30-$63.40; stop-loss below $59.00.

USOIL Outlook

WTI crude, it seems, is starting to shift from being all about volatility to being about the underlying structure right now. As long as the price stays above $60, you’d expect pullbacks to be short-lived and not necessarily trend-changing. A move and stay above $62.40, on the other hand, would start to make things look more decidedly bullish, while a pullback below $59 would be something we should be keeping an eye out for, with the potential for a bit of downside risk.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account