CRWV Stock $10 Down as Nvda Investment Hype Fades – Back Under $100 or Up to $150?

Even if CoreWeave's outstanding start to 2026 has reignited interest in AI infrastructure, Nvidia's long-term investment rationale is still

Quick overview

- CoreWeave has rebounded sharply in 2026, recovering from a significant market value loss in 2025, driven by renewed optimism in AI infrastructure.

- Nvidia's deepened partnership and substantial investment in CoreWeave have bolstered market confidence, despite ongoing concerns about the company's leverage and cash burn.

- While CoreWeave's revenue growth is impressive, its increasing net losses and high capital expenditures raise questions about long-term financial sustainability.

- Investor sentiment remains cautious, as the company's debt structure and operational risks could impact its ability to deliver consistent returns.

Even if CoreWeave’s outstanding start to 2026 has reignited interest in AI infrastructure, Nvidia’s long-term investment rationale is still in jeopardy due to leverage, capital burn, and execution risk.

A Rebound That Few Expected

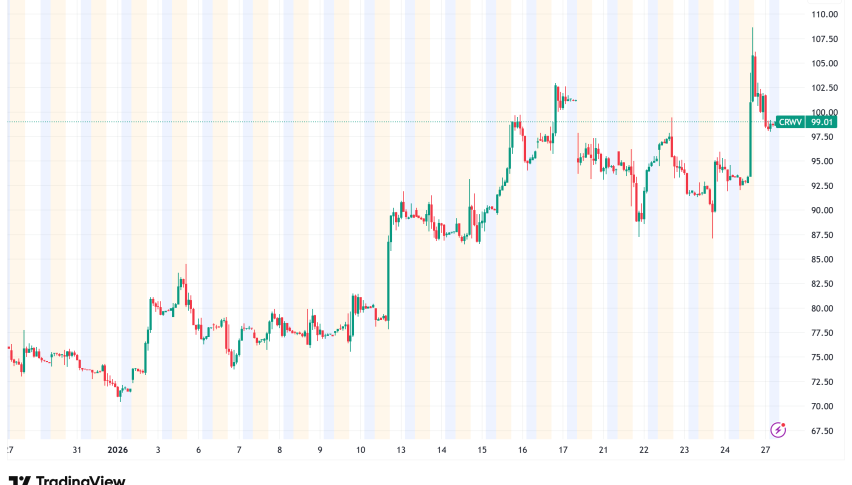

CoreWeave entered 2026 with momentum that sharply contrasted its painful collapse in the prior year. After losing roughly two-thirds of its market value through the second half of 2025, the stock staged an aggressive rebound, climbing above $100 and posting nearly a 30% gain in just one week.

The rally was initially fueled by renewed enthusiasm across the AI complex following a positive earnings surprise from TSMC, which reignited confidence in hardware demand and compute infrastructure. That macro tailwind provided fertile ground for beaten-down AI names—and CoreWeave was among the biggest beneficiaries.

Yet while price action has improved, the fundamental questions that drove last year’s selloff have not disappeared.

Nvidia’s Vote of Confidence Lifts Sentiment

Momentum accelerated further after Nvidia deepened its partnership with CoreWeave, announcing plans to jointly accelerate the rollout of so-called “AI factories”—data centers purpose-built for large-scale AI workloads. Nvidia also disclosed a $2 billion equity investment, purchasing shares at $87.20.

CEO Michael Intrator described the expanded collaboration as validation of surging customer demand. Nvidia’s subsequent regulatory filing revealed ownership of more than 47 million Class A shares, representing 11.5% of that share class—underscoring how closely intertwined the two companies have become.

For the market, Nvidia’s involvement provided credibility and reassurance at a critical moment. Few endorsements carry more weight in AI infrastructure than backing from the dominant GPU supplier.

Messaging Sparks a Rally—but Not a Re-Rating

Year-to-date, CoreWeave is up roughly 32%, though intraday volatility remains elevated. One catalyst behind the recent move was Intrator’s public rejection of claims that CoreWeave’s financing model relies on circular funding tied to Nvidia.

Speaking on a podcast, Intrator dismissed those allegations as “ridiculous,” arguing they ignore the company’s broader capital structure. Management emphasized that Nvidia’s investment—roughly $300 million prior to the latest stake—represents only a small portion of more than $25 billion in total capital supporting a valuation north of $40 billion.

The remarks helped stabilize sentiment, but clarity alone does not guarantee confidence. Investors may accept the explanation, yet still question whether the balance sheet can support the scale of ambition.

Debt Structure: Clever Engineering or Hidden Fragility?

CoreWeave’s management consistently highlights that its debt is largely structured at the project level rather than the corporate level. Borrowing is housed within special purpose vehicles, with long-term contracts—primarily from Microsoft and Meta—directing cash flows first to operating costs and lenders.

This structure mirrors project finance models used in traditional infrastructure sectors such as energy and transportation, theoretically limiting risk to individual assets rather than the parent company.

However, AI infrastructure differs from pipelines or power plants. Hardware cycles are shorter, technology evolves rapidly, and resale values are uncertain. While project finance may reduce isolated failures, it does not eliminate systemic risk if assumptions around utilization, pricing, or asset longevity prove optimistic.

The Ghost of 2025 Still Looms Large

Despite the strong start to 2026, last year’s collapse continues to shape investor psychology. CoreWeave’s selloff coincided with tighter financial conditions and a growing realization that AI infrastructure providers may not enjoy the same margin profiles as software or chip designers.

As rates rose and liquidity tightened, markets began to penalize capital-intensive business models. By the end of 2025, CoreWeave was no longer priced for perfection—it was priced for caution.

That context matters. Today’s rebound may reflect relief and positioning rather than a definitive shift in long-term expectations.

Strategic Validation Without Financial Relief

CoreWeave recently received further validation through its participation in the U.S. Department of Energy’s Genesis mission, a high-profile initiative combining AI, advanced computing, and scientific research to support national energy and security goals.

The involvement enhances CoreWeave’s credibility and positions it as a strategically important infrastructure provider. It also reinforces the narrative that AI compute is becoming critical national infrastructure.

Still, reputation does not pay down debt. Government affiliations may strengthen long-term positioning, but they do little to reduce leverage, capital intensity, or near-term cash burn.

Management Optimism vs. Investor Arithmetic

Executives have also pushed back against concerns around GPU depreciation and obsolescence. Intrator and Chief Strategy Officer Brian Venturo argue that GPUs retain value longer than critics assume and can be redeployed across evolving workloads.

The explanation has merit—but investors remain focused on returns, not narratives. The core issue is whether returns on tens of billions of dollars in infrastructure investment can consistently exceed the cost of capital.

Until that equation is proven with numbers, reassurance alone is unlikely to shift skepticism.

Wall Street’s Guarded View

Goldman Sachs added to the debate by initiating coverage with a Neutral rating and an $86 price target—below recent trading levels. While acknowledging CoreWeave’s purpose-built architecture and strong position in high-end AI compute, Goldman flagged execution risk and what it described as outsized leverage.

Net debt is estimated at roughly six times trailing EBITDA, leaving minimal room for error. At that level, even modest disruptions—pricing pressure, contract delays, or higher financing costs—could force difficult strategic trade-offs.

The stock trading above Goldman’s target reflects optimism, but it also raises downside risk if expectations falter.

Technical Picture Reinforces Uncertainty

Technically, CoreWeave remains in a fragile position. The 20-week moving average has repeatedly acted as resistance, both during last year’s failed rally and again in recent weeks. Until the stock can reclaim and hold above that level, upside moves are likely to be treated as tactical rather than structural.

CRWV Stock Daily – The 20 SMA Rejected the Price Again

Above that, the $150 zone—last tested in October—remains a major hurdle. On the downside, a break below $100 would expose the $90 support area and potentially reopen a path toward the late-2025 lows near $65.

For now, volatility—not confirmation—defines the chart.

Growth Is Explosive, Costs Are Relentless

Operationally, CoreWeave continues to deliver staggering top-line growth. Third-quarter revenue more than doubled year-over-year to $1.21 billion, reflecting relentless demand for AI compute.

But that growth comes at a steep price. Net losses widened to nearly $291 million, while quarterly capital expenditures approached $3 billion. Forward estimates suggest annual capex could reach $20–$23 billion—an extraordinary burden unless margins expand materially.

Planned financing, including $2 billion in convertible senior notes, adds further concerns around dilution and fixed obligations.

Between Strategic Importance and Financial Strain

CoreWeave sits at the heart of the AI infrastructure boom, supplying the computational backbone of the next technological cycle. That strategic relevance explains why positive headlines continue to spark sharp rallies.

Yet the balance sheet tells a tougher story. Until leverage moderates, cash flow improves, and returns on capital become more transparent, investor confidence is likely to remain fragile.

For now, CoreWeave represents less a clean AI growth story and more a high-stakes test of how much financial strain the market is willing to tolerate in pursuit of long-term technological dominance.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM