USAR Stock Heads Under $20 as Questions Emerge on U.S. Backing of Rare Earth

USA Rare Earth’s explosive rally on government investment speculation is now being reassessed, as evolving policy details and execution risk

Quick overview

- USA Rare Earth Inc. shares surged on speculation of a substantial U.S. government investment, briefly trading above $32.

- The proposed funding package from the U.S. Department of Commerce includes a $1.6 billion deal aimed at supporting the company's strategic role in national security.

- Investor confidence has waned due to the non-binding nature of the government letter and concerns over execution risks, as the company is still pre-revenue.

- Technical indicators show a bearish trend, with the stock threatening to break below the $20 level, raising concerns about further downside risk.

USA Rare Earth’s explosive rally on government investment speculation is now being reassessed, as evolving policy details and execution risks temper initial optimism.

Speculation Ignites a Sharp Rally

Shares of USA Rare Earth Inc. (USAR) surged on Monday, briefly trading above $32 after reports suggested a substantial U.S. government investment was imminent. The move reignited investor focus on strategic minerals and domestic supply chains, particularly as Washington continues to emphasize reducing reliance on foreign sources for critical materials.

The stock climbed as much as 38% in premarket trading to $34.20 before giving back part of those gains during the regular session, signaling that enthusiasm was already being met with early profit-taking.

Government Backing Provides Strategic Validation

Underlying the rally was a letter of intent from the U.S. Department of Commerce outlining a potential funding package of approximately $1.6 billion. The proposal includes a roughly $1.3 billion senior secured loan, around $277 million in federal grants, and an equity stake estimated at about 10%.

If finalized, the deal would represent a strong endorsement of USA Rare Earth as a national-security supplier of heavy rare earth elements. In parallel, the company announced a private PIPE transaction of roughly $1.5 billion, anchored by Inflection Point, bringing total committed capital above $3.1 billion.

The combined funding is intended to advance the Round Top project—targeting commercial production around late 2028—and accelerate commissioning at the Stillwater magnet plant, with Line 1a expected to ramp up in the first quarter of 2026.

Investor Skepticism Quickly Emerges

Despite the scale of the proposed funding, investor confidence proved fragile. Markets quickly focused on the non-binding nature of the government letter of intent, as well as the dilutive impact of equity and warrants embedded in the structure.

Execution risk remains elevated, as USA Rare Earth is still pre-revenue and several key operational milestones remain years away. Concerns were further amplified after a Reuters report suggested the U.S. government may move forward without previously discussed minimum price guarantees for critical mineral projects—raising uncertainty around long-term project economics.

Following the report, shares of multiple critical mineral companies weakened in after-hours trading, underscoring broader sector sensitivity to policy clarity.

Technical Picture Deteriorates

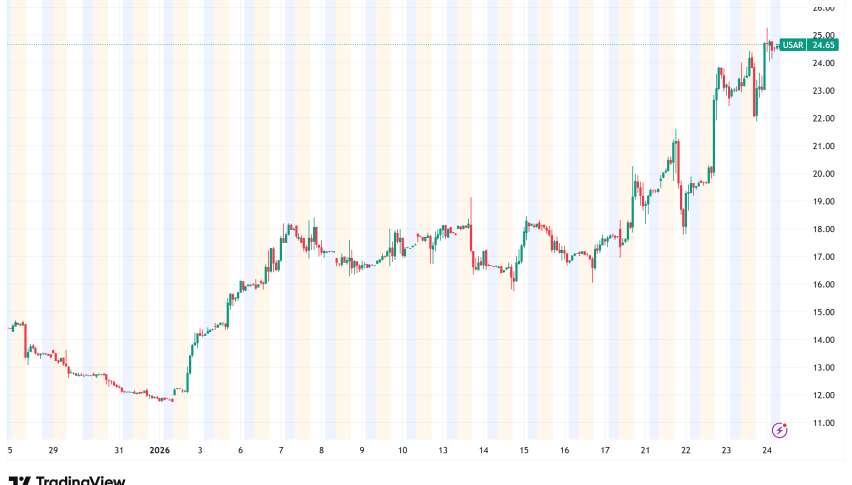

From a technical standpoint, momentum has shifted decisively. After doubling in value since last Monday, USAR has recorded three consecutive bearish sessions. The stock is now threatening to break below the $20 level, where the 20-day simple moving average currently sits.

USAR Chart Weekly – Sellers Test the 20 SMA

A confirmed break below this zone would expose downside risk toward the $12 area, corresponding to the late-2025 lows. Until policy details and funding terms gain clarity, volatility is likely to remain elevated.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM