Coinbase (COIN) Tumbles 4.3% Toward Support as Nevada Lawsuit and Insider Breach Rock Investor Confidence

Coinbase Global Inc. (COIN) extended its losing run to eleven straight sessions on Tuesday, with shares sliding 4.36% to close at $179.66.

Quick overview

- Coinbase's stock has fallen for eleven consecutive sessions, closing at $179.66, the lowest since April.

- The Nevada Gaming Control Board has initiated legal action against Coinbase for offering unlicensed prediction markets.

- An insider breach has compromised sensitive client information, affecting about thirty users and adding to Coinbase's challenges.

- Analysts predict a significant drop in earnings for the upcoming fourth-quarter report, despite a forecasted revenue increase.

Coinbase Global Inc. (COIN) extended its losing run to eleven straight sessions on Tuesday, with shares sliding 4.36% to close at $179.66. The stock has dropped to depths not seen since April, trading considerably below both its 50-day and 200-day moving averages as the company faced various problems leading into its February 12 earnings announcement.

Regulatory Crossroads: Nevada Challenges Prediction Markets

The crypto exchange now risks legal action from Nevada gaming authorities over its recently opened prediction markets. The Nevada Gaming Control Board filed a civil enforcement action Monday against Coinbase Financial Markets, charging the company offered unlicensed wagers on athletic events. The board has requested a temporary restraining order and preliminary injunction to suspend Coinbase’s derivatives exchange and prediction market operations linked to sports betting.

“The Board takes seriously its obligation to operate a thriving gaming industry and to protect Nevada citizens,” said Mike Dreitzer, head of the Nevada Gaming Control Board. The complaint arrives less than a week after Coinbase announced the launch of prediction markets across all 50 U.S. states through a collaboration with Kalshi.

Similar action was taken against Polymarket in Nevada, where a court last week issued a temporary restraining order preventing the platform from providing event-based contracts to citizens of the state. These state-level actions could question the federal Commodity Futures Trading Commission’s power to regulate prediction platforms without clear federal legislation.

Security Alert: Insider Breach Exposes Sensitive Tools

Coinbase confirmed an insider security compromise that affected about thirty clients, adding to the company’s problems. A contractor unlawfully accessed client information in December, including email addresses, names, birth dates, phone numbers, and bitcoin wallet balances. The individual no longer works for Coinbase, and affected users received identity theft protection services. This marks the second such incident in recent months, following a previous hack linked to outsourcing business TaskUs in January 2025.

Coinbase (COIN) Technical Analysis: The “Death Cross” Weighs Heavy

The stock’s technical indicators paint a dismal picture. Coinbase’s Relative Strength Rating has fallen to just 10 out of 99, indicating substantial underperformance relative to other equities. The creation of a “death cross,” where the 50-day moving average falls below the 200-day moving average, signals sustained bearish sentiment. The company holds a Composite Rating of only 28 out of 99.

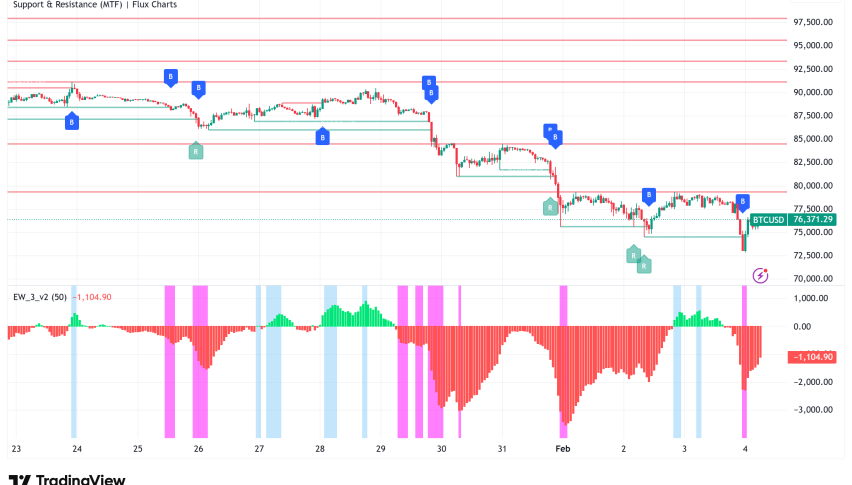

Bitcoin’s recent decline is reflected in Coinbase’s difficulties; on Tuesday, the cryptocurrency was trading at $80,000, well below its October top of $125,000. The exchange’s performance is tightly related to crypto asset prices, which have stagnated in early 2025.

What’s Next for Coinbase Stock?

Looking ahead, analysts predict fourth-quarter earnings of $1.06 per share on revenue of $1.8 billion when the company reports February 12. While sales is forecast to climb 55% year-over-year, earnings are expected to collapse 77% from the preceding year.

One potential catalyst for recovery might be movement on crypto regulation. President Donald Trump recently organized discussions between crypto leaders and banks regarding the Clarity bill for market restructuring, however the legislation has yet to pass the Senate Banking Committee.

Despite joining the S&P 500 benchmark index in May 2024, Coinbase has seen institutional investors retreat. The stock has an Accumulation/Distribution Rating of E, the lowest possible grade, since mutual funds, which own 37% of outstanding shares, have been net sellers over the last 13 weeks.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM