Super Micro Computer Surges 8% as $40B Revenue Outlook and Analyst Upgrades Reignite AI Enthusiasm

Supermicro's impressive quarterly earnings report earlier this month, which showed $12.68 billion in net revenue and $400.56 million in net

Quick overview

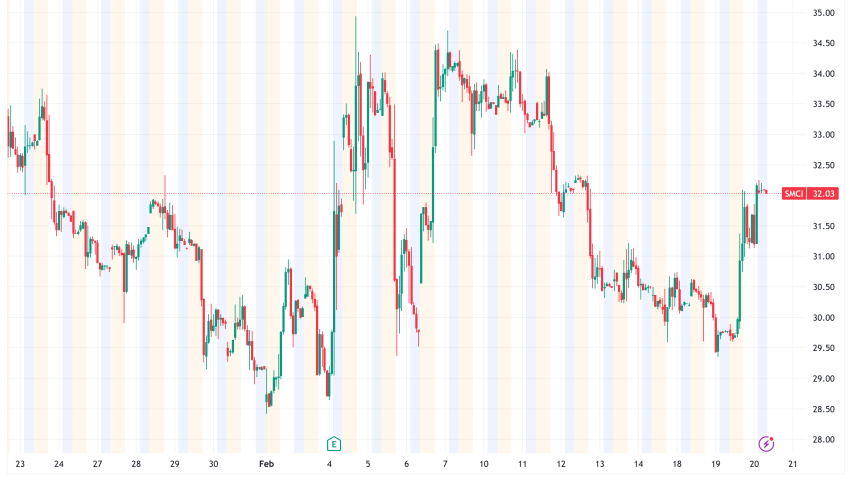

- Super Micro Computer Inc. (SMCI) saw an 8.25% increase in stock price, closing at $32.16, driven by analyst upgrades and strong insider purchases.

- The company reported impressive quarterly earnings of $12.68 billion in net revenue, with AI platforms contributing over 90% of that total, prompting an increase in full-year guidance to at least $40 billion.

- Analysts have upgraded SMCI to a 'strong buy', highlighting the potential for margin improvement in its Data Center Building Block Solutions platform.

- Despite being down nearly 45% from its October highs, the stock's current price-to-earnings multiple is considered low for a company with a strong foundation in AI infrastructure.

A combination of positive factors, including analyst upgrades, insider purchases, and a bold revenue estimate, offered investors new reasons to revisit one of the most volatile plays in the AI infrastructure industry, and Super Micro Computer Inc. (NASDAQ: SMCI) finished Thursday at $32.16, up 8.25%.

As options traders flooded the market with call orders and the stock recovered above its 50-day moving average, a technical milestone that momentum investors closely monitor, trading volume for the San Jose-based provider of server and storage solutions reached 42.1 million shares, approximately 47% above its three-month average of 28.6 million.

SMCI’s Record Revenue and the $40 Billion Milestone

Supermicro’s impressive quarterly earnings report earlier this month, which showed $12.68 billion in net revenue and $400.56 million in net profitability, preceded the rally. The fact that AI platforms accounted for over 90% of that revenue shows how fully the company has established itself as the hub of the worldwide rollout of AI infrastructure. In response to the findings, management increased full-year guidance to at least $40 billion, which was a staggering $2.13 billion more than Wall Street had anticipated.

Analysts have raised the stock to a “strong buy” following the results, citing Supermicro’s Data Center Building Block Solutions platform’s potential for margin improvement as the main justification for owning shares. For investors who have seen the stock return substantial returns in spite of the company’s underlying business progress, the upgrade changed the focus from pure sales growth to operating leverage.

The fact that the SMCI is still down almost 45% from its October highs, even after Thursday’s spike, serves as a reminder of the volatility the stock has experienced. But more and more people are seeing that discount as a chance rather than a red flag. Analysts characterize the stock’s current projected price-to-earnings multiple of less than 17 times as abnormally low for a business with such a strong foundation in AI infrastructure.

A noteworthy surge in insider purchases supports the bullish argument. In early February, CFO David Weigand and CEO Charles Liang both bought company stock at an average price of about $33.33, indicating that the people who know the company the best think it is undervalued at its current level.

Supermicro appears to have a solid strategic position outside of the financial sheet. The business has privileged early access to state-of-the-art GPUs thanks to its close relationships with Nvidia and other top chipmakers, solidifying its position as the preferred provider for hyperscale AI deployments. Investor interest has also been piqued by reports of a possible expansion of “Make in India” AI servers, which suggests longer-term geographic diversity.

SMCI Stock Outlook

The consensus rating on Wall Street for SMCI is currently “Moderate Buy,” with a mean price target of about $43, which indicates a 35% increase from current levels.

The S&P 500 fell 0.28% and the Nasdaq fell 0.31% on Thursday, indicating that the overall market provided little assistance. Dell Technologies saw a 1.95% increase while Hewlett Packard Enterprise saw a 0.74% decline among hardware peers.

if Supermicro can turn its dominant position in the demand for AI servers into long-term profit growth and if the $40 billion revenue forecast turns out to be a ceiling or a floor are the main questions facing investors moving ahead.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM