USD/CHF Rejects The 0.8850 Psyche Barrier

For the USD/CHF, rates are on the march north. Considering this morning’s dismal Jobless Claims numbers, the bullish action is a surprise.

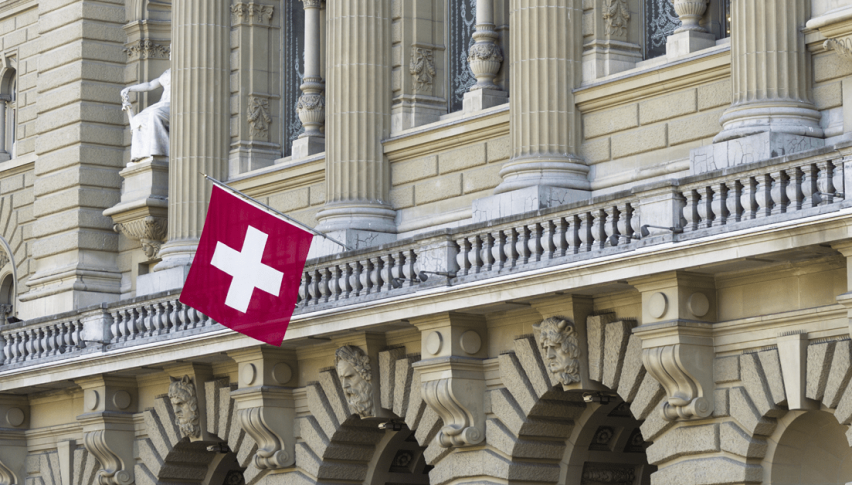

The USD/CHF has continued its month-long down trend today, falling beneath the 0.8900 handle. However, rates did bounce hard from 0.8850 as bidders stepped up in mass. Although this psychological barrier isn’t likely the bottom for the Swissy, the bullish action is picking up.

This morning’s economic calendar brought mixed news to the Greenback. Here’s a quick look at the highlights:

Event Actual Projected Previous

CPI (MoM, Nov.) 0.2% 0.2% 0.0%

Core CPI (MoM, Nov.) 0.2% 0.1% 0.0%

Continuing Jobless Claims (Nov. 27) 5.757M 5.335M 5.527M

Initial Jobless Claims (Dec. 4) 853K 725K 716K

The big takeaway from this group of numbers is the uptick in CPI. Lagging inflation has been a concern of the Fed for years. Now, it appears that QE unlimited is finally sending prices higher. This is good for USD bulls as it suggests that 0% interest rates may come off the table earlier than expected.

On the labor front, today brought another sub-par collection of numbers. Unemployment claims are up once again, in direct relation to newly imposed regional COVID-19 lockdowns. Until states like California and New York re-open for business, these weekly jobless claims numbers will struggle.

For the USD/CHF, rates are on the march toward 0.8900. Considering this morning’s dismal Jobless Claims numbers, the bullish action is somewhat surprising.

USD/CHF Rallies From 0.8850 Psyche Level

In a Live Market Update from last week, I pointed out the presence of psyche barriers at 0.8850 and 0.8800. Thus far, it looks like 0.8850 may prove valid short-term support.

+2020_12_10+(10_56_34+AM).png)

Here are two key levels to watch for the USD/CHF:

- Resistance(1): 38% Fibonacci Retracement, 0.8944

- Support(1): Psyche Barrier, 0.8850

Bottom Line: The trend for the USD/CHF is down and a bearish bias remains warranted. If we see rates extend toward the 38% Retracement, a selling opportunity may come into play.

As long as the Psyche Level (0.8850) is an active bottom, I’ll have sell orders queued up from 0.8934. With an initial stop loss at 0.8964, this trade produces 60 ticks on a 1:2 risk vs reward ratio.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account