How to trade Binance Options

Learn how to trade Binance Options with this beginner-friendly guide designed to simplify the entire process. We break down key concepts, platform features, and essential strategies, ensuring new traders can confidently navigate Binance’s options interface, manage risk effectively, and begin trading with clarity, structure, and a solid understanding of the fundamentals.

- What are Options Contracts?

- What are Options Contracts used for?

- Key Differences Between Binance Options and Traditional Options

- Types of Binance Options Available

- How to trade Options Contracts on the Binance Web Desktop

- How to trade Options Contracts on the Binance mobile app

- Common Strategies for Beginners

- Common Mistakes Beginners Should Avoid

- What are Binary Trading Options?

Top 10 Forex Brokers (Globally)

What are options contracts?

Options contracts are financial agreements that give a trader the right (but not the obligation) to buy or sell an asset at a specific price (called the strike price) before or on a set expiration date.

Here’s the breakdown:

- Right, not obligation: You can choose whether to exercise the option.

- Underlying asset: Could be crypto (like on Binance), stocks, commodities, or indices.

- Call option: The right to buy at a set price.

- Put option: The right to sell at a set price.

- Premium: The cost you pay to purchase the option.

- Expiration: When the contract ends.

Why Traders Use Options

- Speculation: To profit from price movements.

- Hedging: To protect existing positions from risk.

- Leverage: Options allow significant market exposure with a smaller upfront cost.

Frequently Asked Questions

Are Binance Options suitable for beginners?

Binance Options are not typically suitable for beginners. Options are complex derivatives with risks like leverage and time decay, demanding a strong understanding of concepts like strike prices and the Greeks. It’s recommended that new traders start with spot trading first.

What is the minimum amount needed to trade Binance Options?

The minimum trade order size on Binance for crypto trading pairs is typically 1 USDT. However, the actual price (premium) for a single Options contract will vary based on the asset’s price, volatility, and contract details.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Limited Risk | High Time Decay |

| Short Expiries | Short-Term Focus |

| No Liquidation | Limited Strategies |

| Low Capital Requirement | Requires Market Timing |

Our Insights

Binance Options offer beginners a simple, flexible way to trade short-term market movements with limited risk. While accessible and affordable, they still require timing skill and a solid understanding of options behavior to trade confidently and responsibly.

What are options contracts used for?

Options contracts are used for three main purposes in trading:

| Purpose | Description | Example / Benefit |

| Speculation | Traders buy call or put options to profit from expected price movements. | Profit from rising prices with calls or falling prices with puts, while limiting risk. |

| Hedging | Options act as protection against market volatility or adverse price moves. | Buying a put option protects an existing long position like insurance. |

| Leverage | Options allow control of larger positions using smaller capital. | Gain more exposure with only the premium cost and without the risk of liquidation. |

Frequently Asked Questions

Why do traders use options contracts?

Traders use options contracts primarily for leverage and risk management. They offer a way to control a large position with a small capital outlay (premium) or to hedge existing portfolio risk against adverse price movements, limiting potential losses.

Can options reduce my trading risk?

Yes, options significantly reduce trading risk through hedging. By buying put options, you can effectively insure an existing asset position against a price drop, knowing your maximum possible loss is limited to the option’s premium paid.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Limited Risk (for buyers) | Time Decay |

| Flexible Strategies | Complexity |

| Leverage | Volatility-Driven Premiums |

| Hedging Power | Short Life Span |

| Profit From Multiple Market Conditions | Requires Good Timing |

Our Insights

Options contracts are powerful tools for speculation, hedging, and leveraging market exposure. While they offer flexibility and controlled risk, they also require careful timing and understanding. Used wisely, options can significantly enhance a trader’s overall strategy and protection.

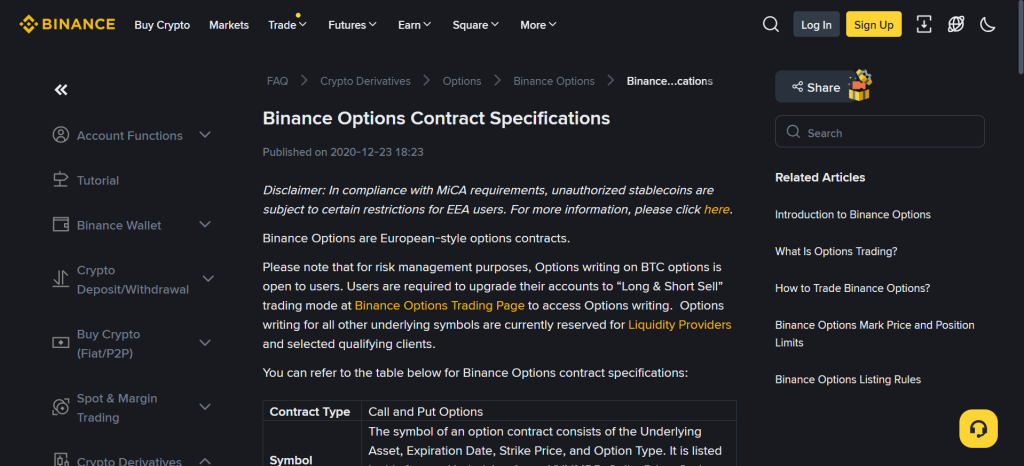

Key Differences Between Binance Options and Traditional Options

| Feature | Binance Options | Traditional Options |

| Expiry Timeframes | Very short-term (5 mins to 1 day) | Longer-term (weeks, months, years) |

| Exercise Style | European-only (exercise at expiry) | American or European (exercise anytime or at expiry) |

| Trading Complexity | Simple: buy Calls or Puts | Complex strategies: spreads, straddles, condors, etc. |

| Margin Requirement | None | Margin required for selling/writing options |

| Liquidation Risk | None | Possible margin calls or liquidation |

| Underlying Assets | Mostly cryptocurrencies (BTC, ETH) | Stocks, ETFs, indices, commodities, FX |

| Settlement | Cash-settled automatically at expiry | Both physical and cash settlement available |

| Pricing Behavior | Volatile, influenced by short expiries | Based on option pricing models (e.g., Black-Scholes) |

| Platform Interface | Simplified, mobile friendly | Advanced trading interfaces with analytics tools |

| Target Users | Beginners & short term crypto traders | Retail traders, institutions, long-term investors |

| Regulation | Varies by region, less regulated | Strongly regulated on financial exchanges |

| Strategy Variety | Limited | Extensive strategy flexibility |

| Risk Level | Limited risk for buyers | Risk varies widely (especially for sellers) |

Frequently Asked Questions

Why are Binance Options seen as more beginner-friendly?

Binance Options are seen as more beginner-friendly because they are European-style (exercised only at expiry) and cash-settled, simplifying the process. Furthermore, their short expiration times limit the complexity of long-term risk management.

Do Binance Options follow the same pricing models as stock options?

No, not exactly. While both use the Black-Scholes framework as a starting point, Binance Options pricing must be adapted for the unique characteristics of crypto, namely high volatility, the 24/7 market, and the lack of dividends. More advanced models (like Heston or jump-diffusion) are often layered on top.

Our Insights

Binance Options offer a fast, simplified way to trade short-term crypto movements, while traditional options provide deeper strategy and longer expiries. Understanding their differences helps beginners choose the approach that best matches their trading goals, risk tolerance, and experience.

Types of Binance Options Available

Here are the types of Binance Options available, explained clearly for beginners:

| Type | Best For | Expiry | Risk Level | Ease for Beginners |

| Call Options | Bullish trades | 5 mins – 1 day | Limited | Very easy |

| Put Options | Bearish trades | 5 mins – 1 day | Limited | Very easy |

| Ultra Short-Term (5–30 mins) | Quick speculation | Very short | High (time decay) | Moderate |

| Short-Term (1h–1d) | Slower, controlled trades | Short | Moderate | Easy |

| BTC/ETH Options | Crypto-focused traders | Varies | Depends on volatility | Easy |

Frequently Asked Questions

Which Binance Option type is best for beginners?

The best option for beginners is buying either a Call or Put option. This strategy limits your maximum potential loss to the small premium you pay upfront. Avoid selling (writing) options, as it exposes you to unlimited loss potential and requires complex margin management.

Are call and put options the only strategies on Binance?

No, call and put options are the basic instruments used to construct more complex positions. Binance supports multi-leg strategies like Spreads (e.g., Bull Call, Bear Put), Straddles, and Strangles, which are created by combining multiple calls and puts.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Simple structure | Fast time decay |

| Short expiries | Limited strategies |

| Limited risk | High volatility |

| No liquidation risk | Short-term focus |

| Low capital requirement | Requires precise timing |

Our Insights

Binance Options offer simple, fast-expiry call and put contracts ideal for beginners. With limited risk and easy execution, they’re accessible, but traders must manage time decay and volatility to use these short-term options effectively.

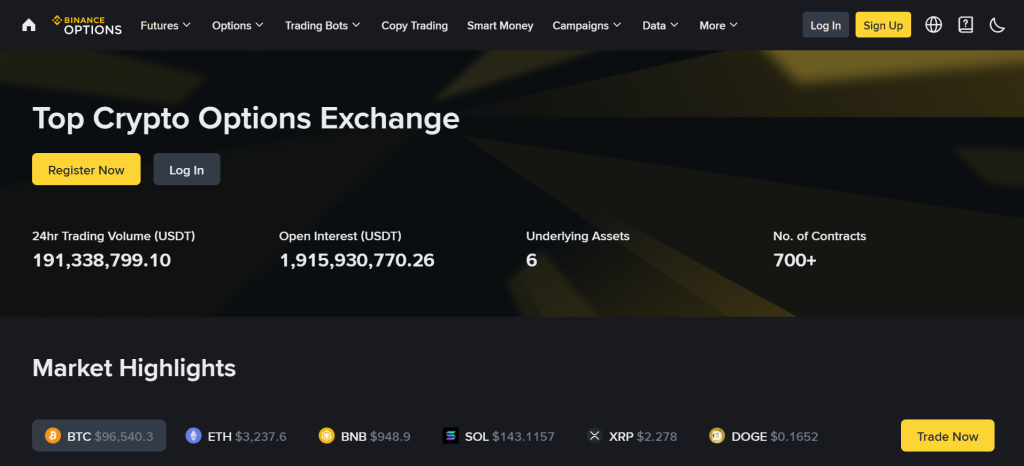

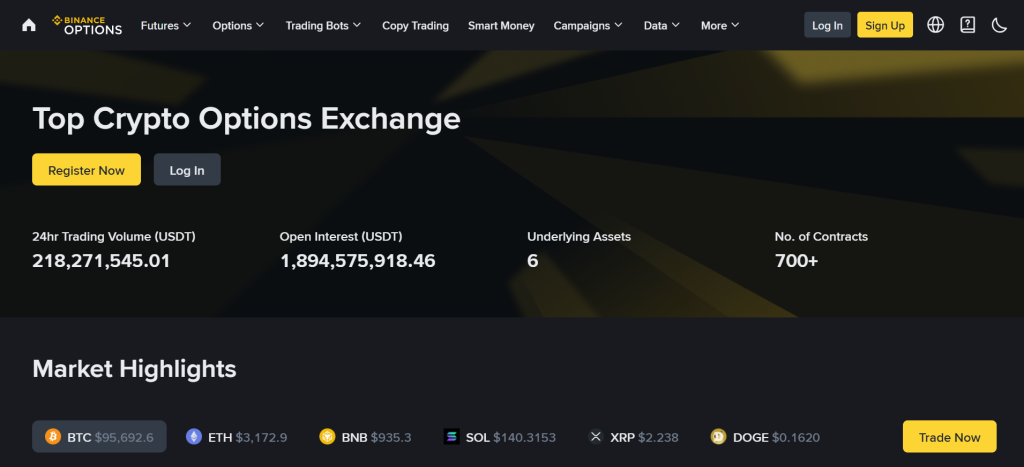

How to trade options contracts on the Binance Web Desktop

Trading Binance Options

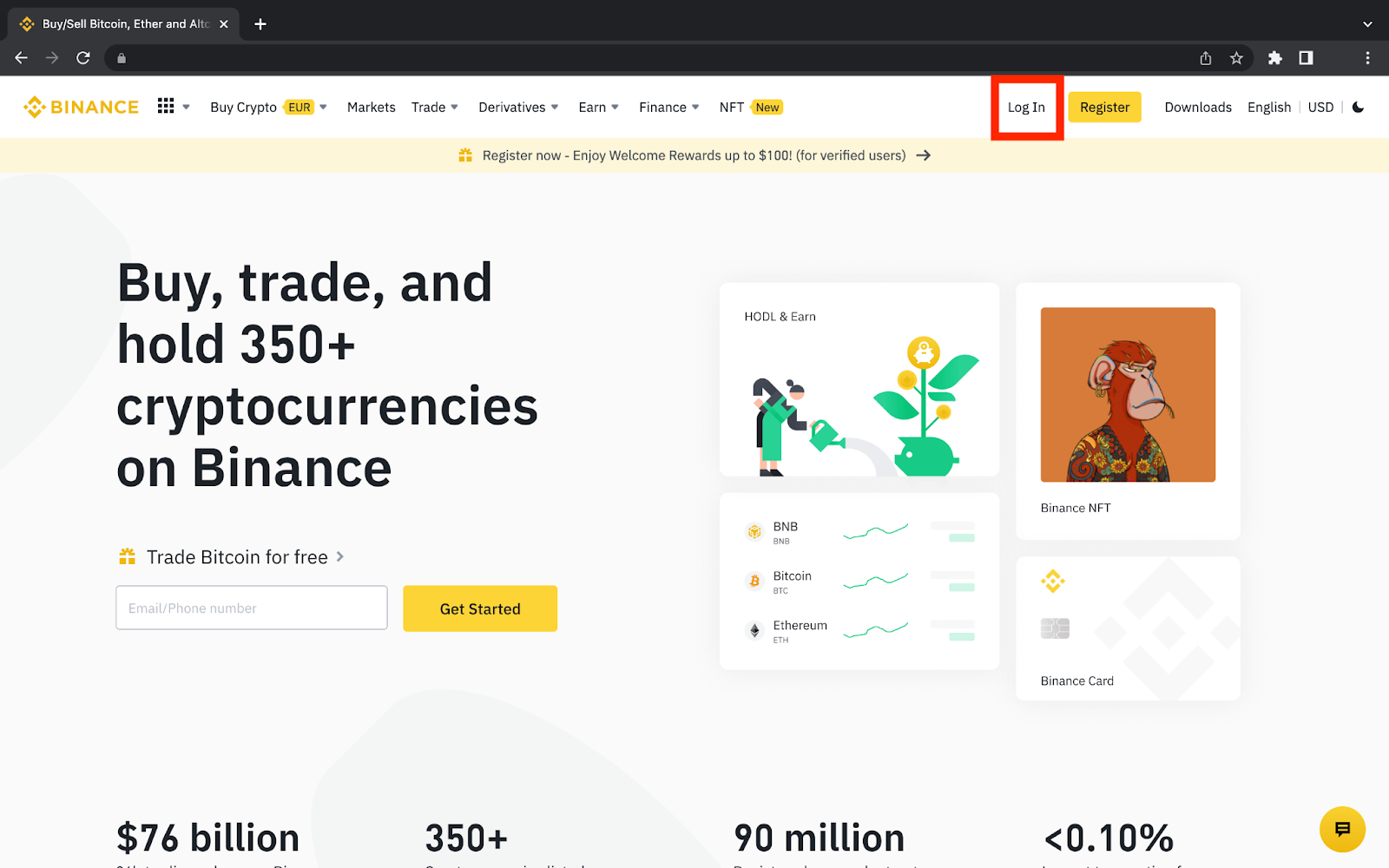

Step 1 – Go to Binance and click [Login], or [Register] if you don’t have an account yet.

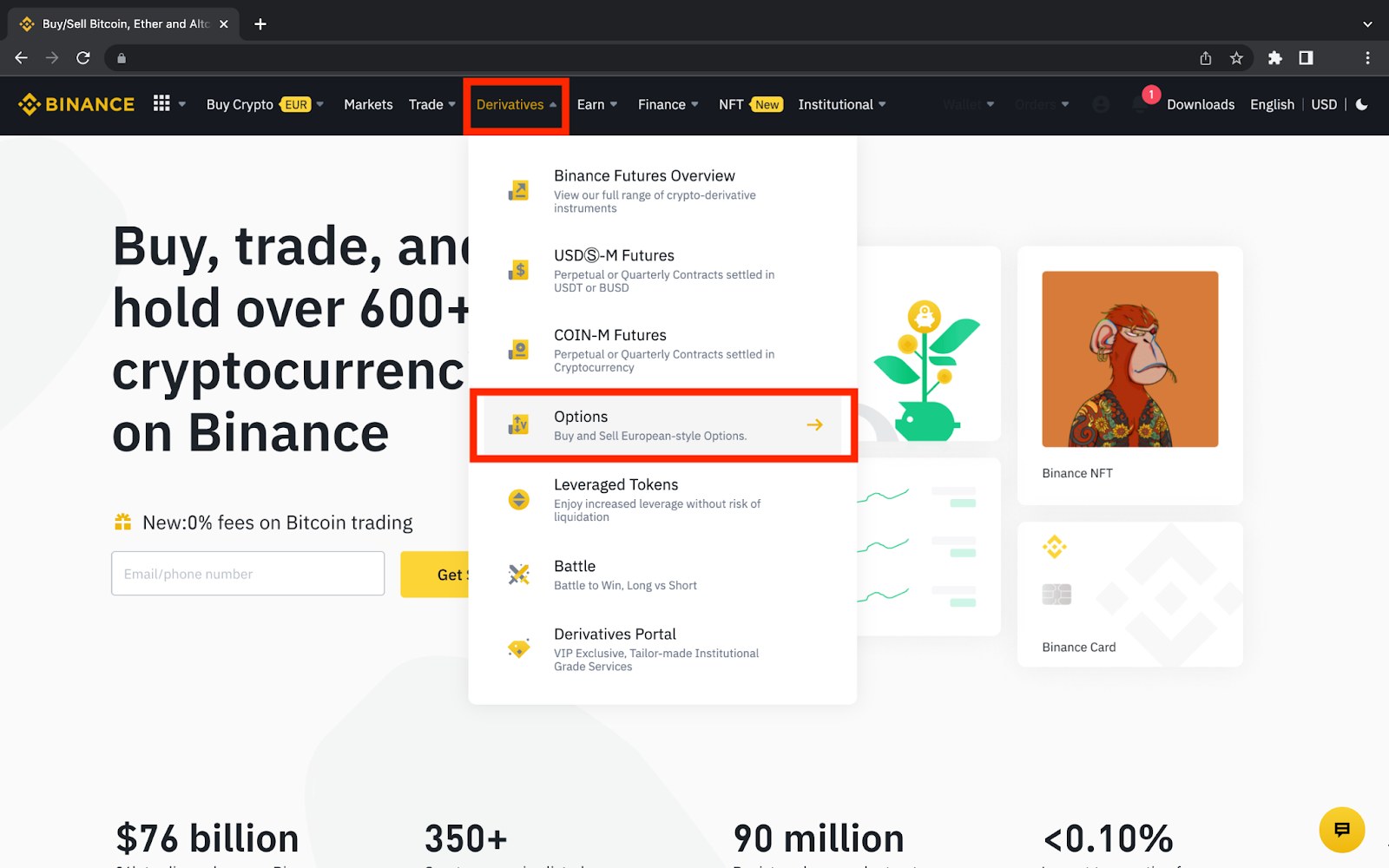

Step 2 – Once logged in, click [Derivatives] – [Options].

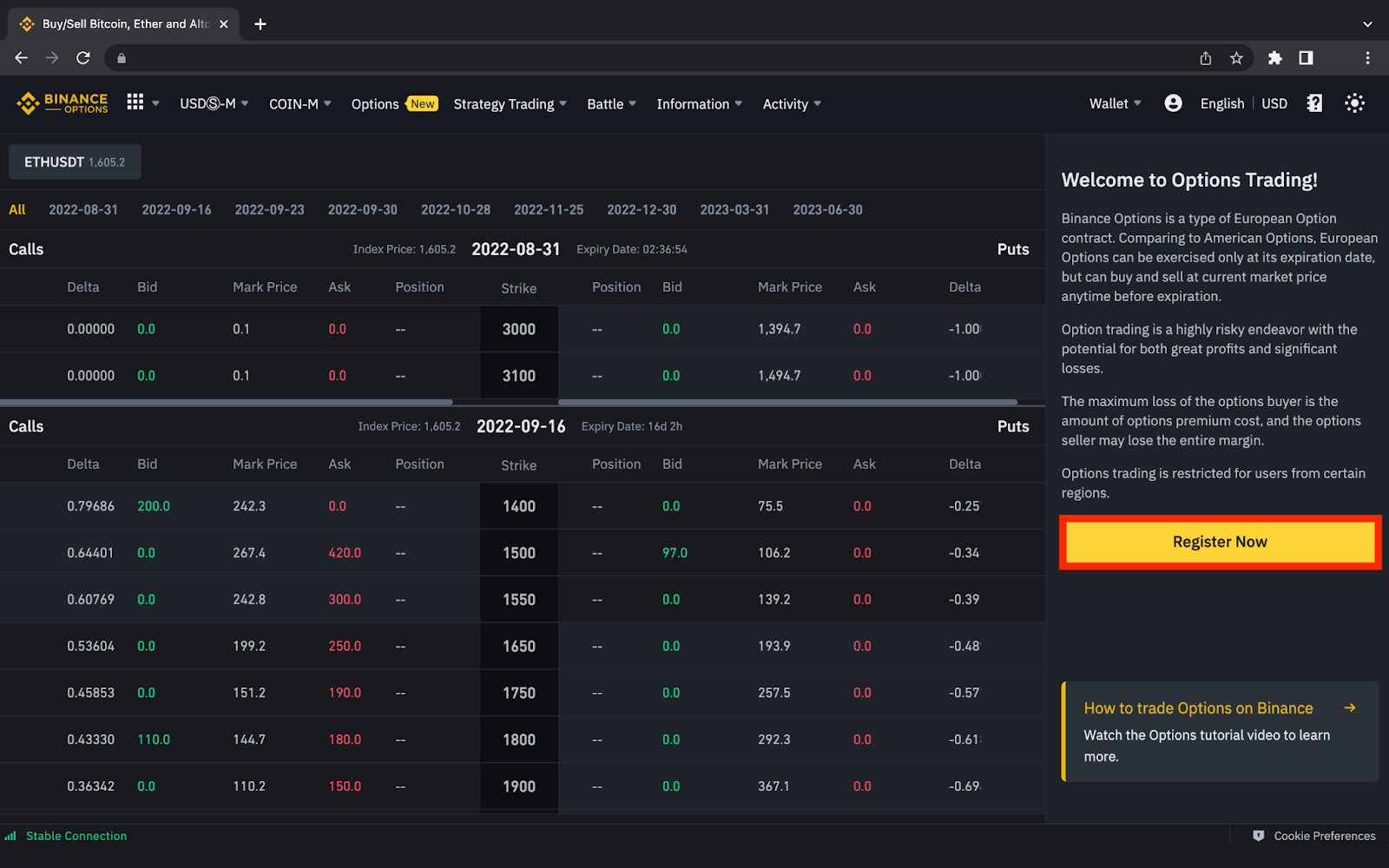

Step 3 – Click [Register Now] to open a Binance Options account.

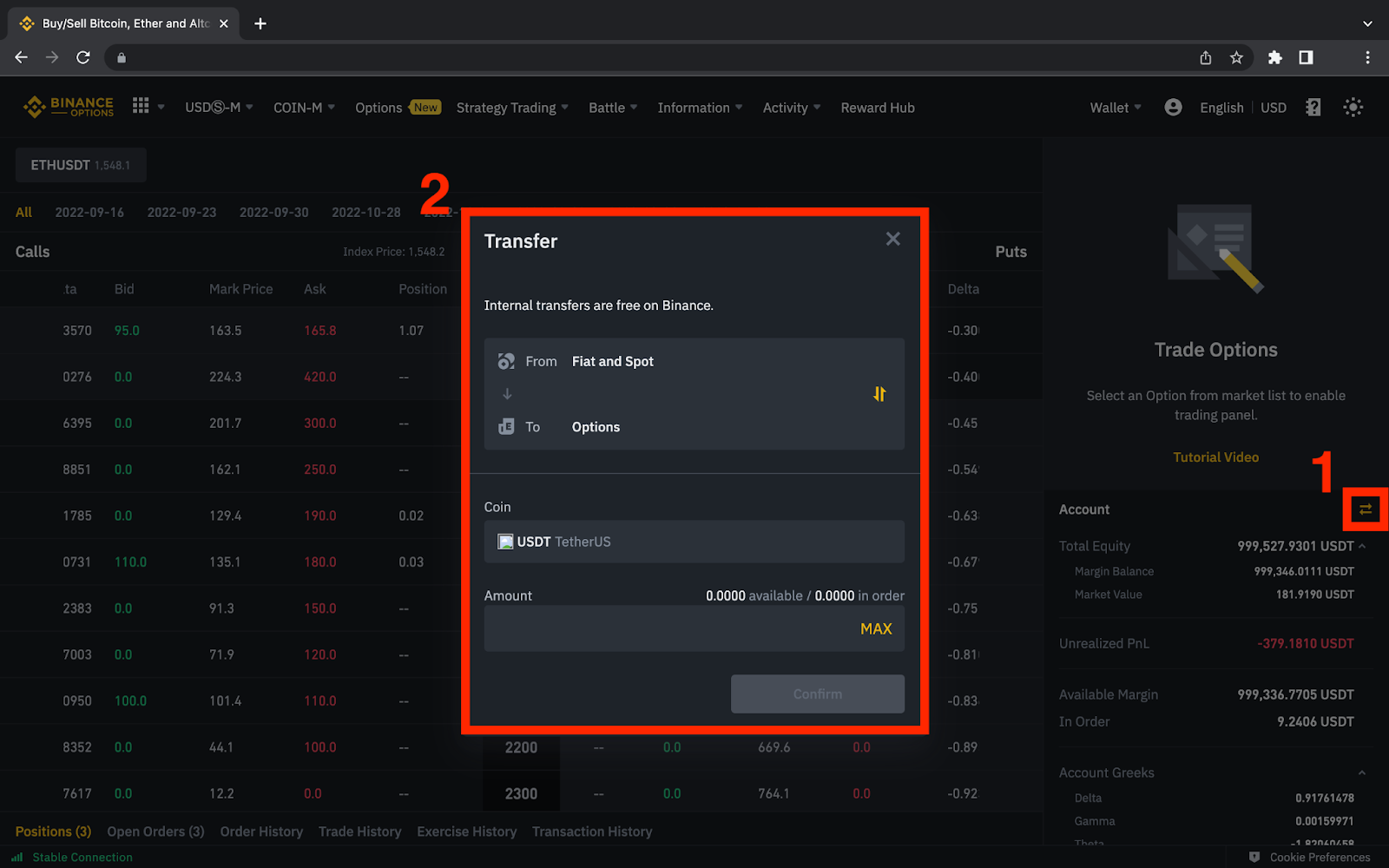

Step 4 – Click [Transfer] to add funds to your Options Wallet.

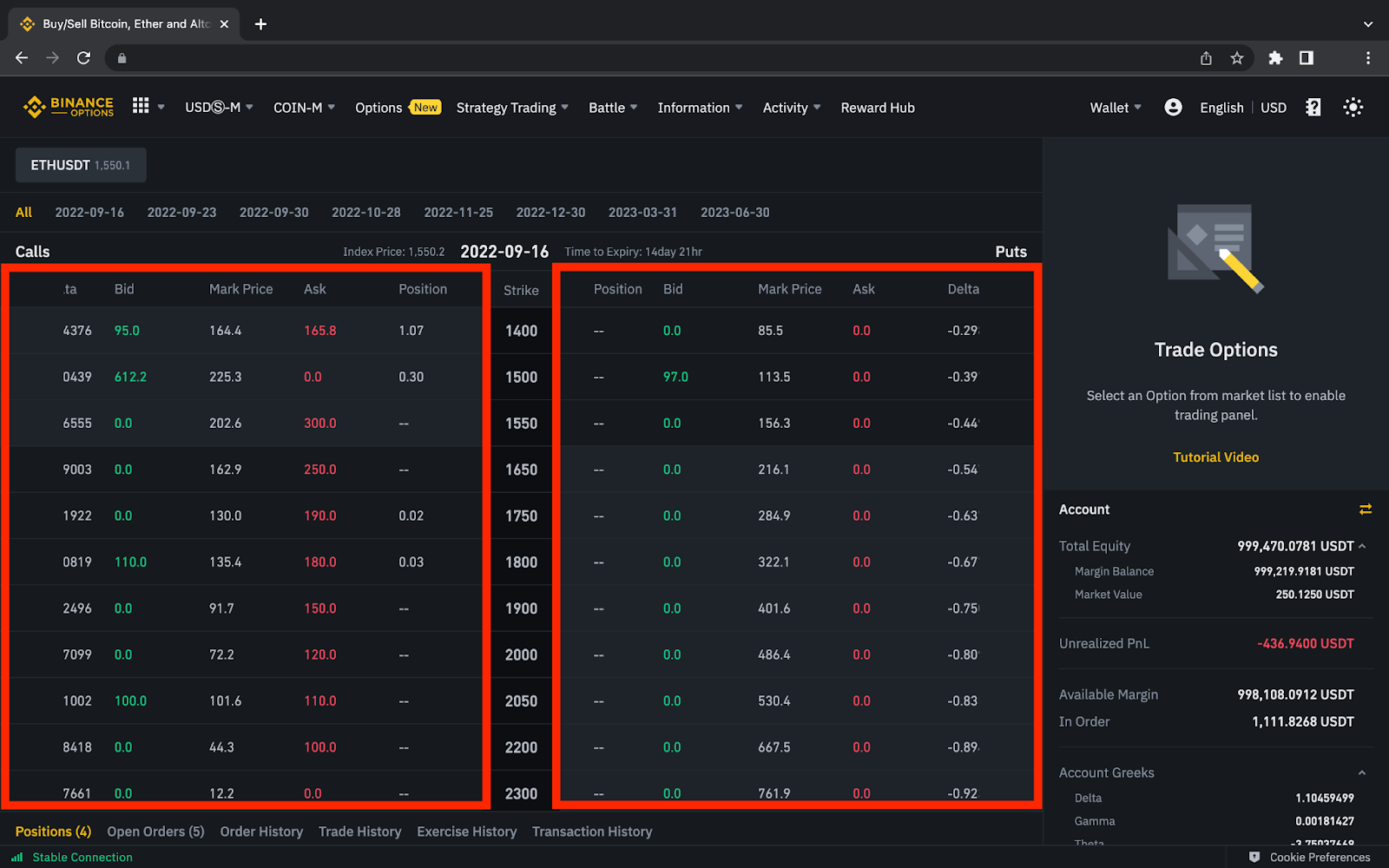

Step 5 – Choose between the different [Call] and [Put] Options available to open a position. Note that Call Options give the holder the right, but not the obligation, to buy the underlying asset at an agreed-upon date and time, while Put Options give the right to sell the underlying asset.

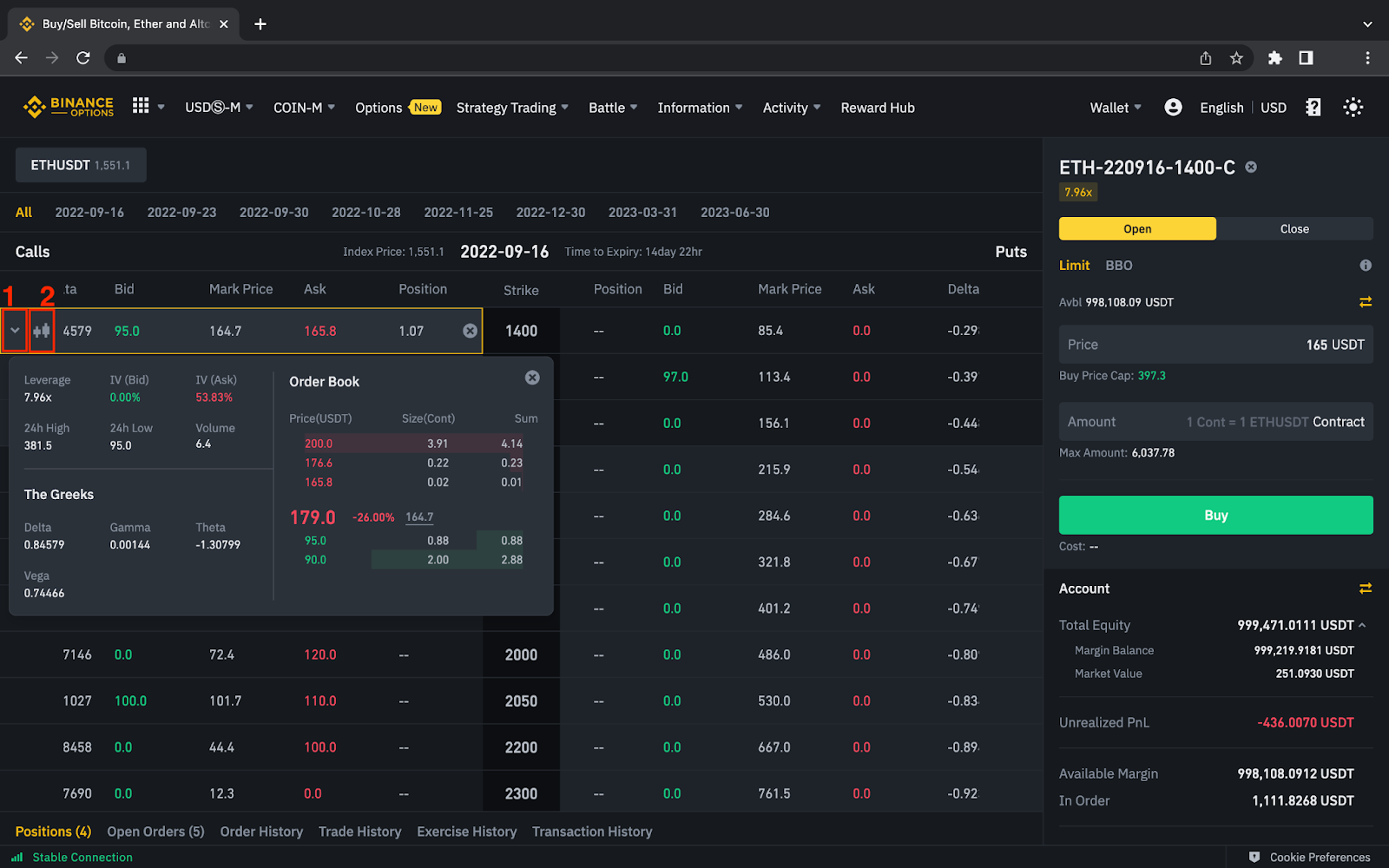

Step 6 – Once you have selected a Call or Put Option, the [Trading Panel] will be enabled. You can also click on the arrow to check for more market details or click on the candlestick symbol to switch the trading interface.

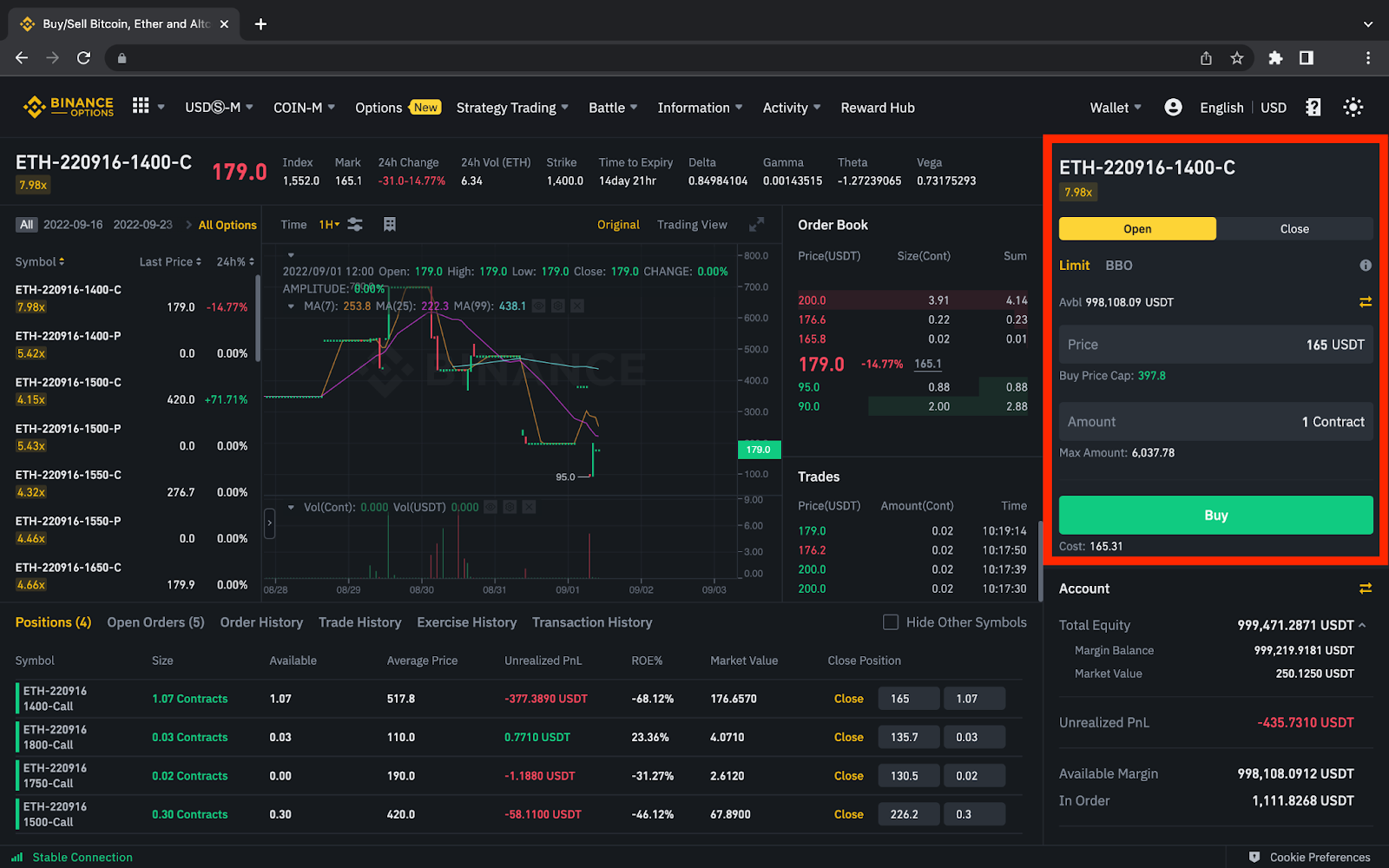

Step 7 – Select [Order Type], input [Price] and [Amount], and click [Buy] to open a position.

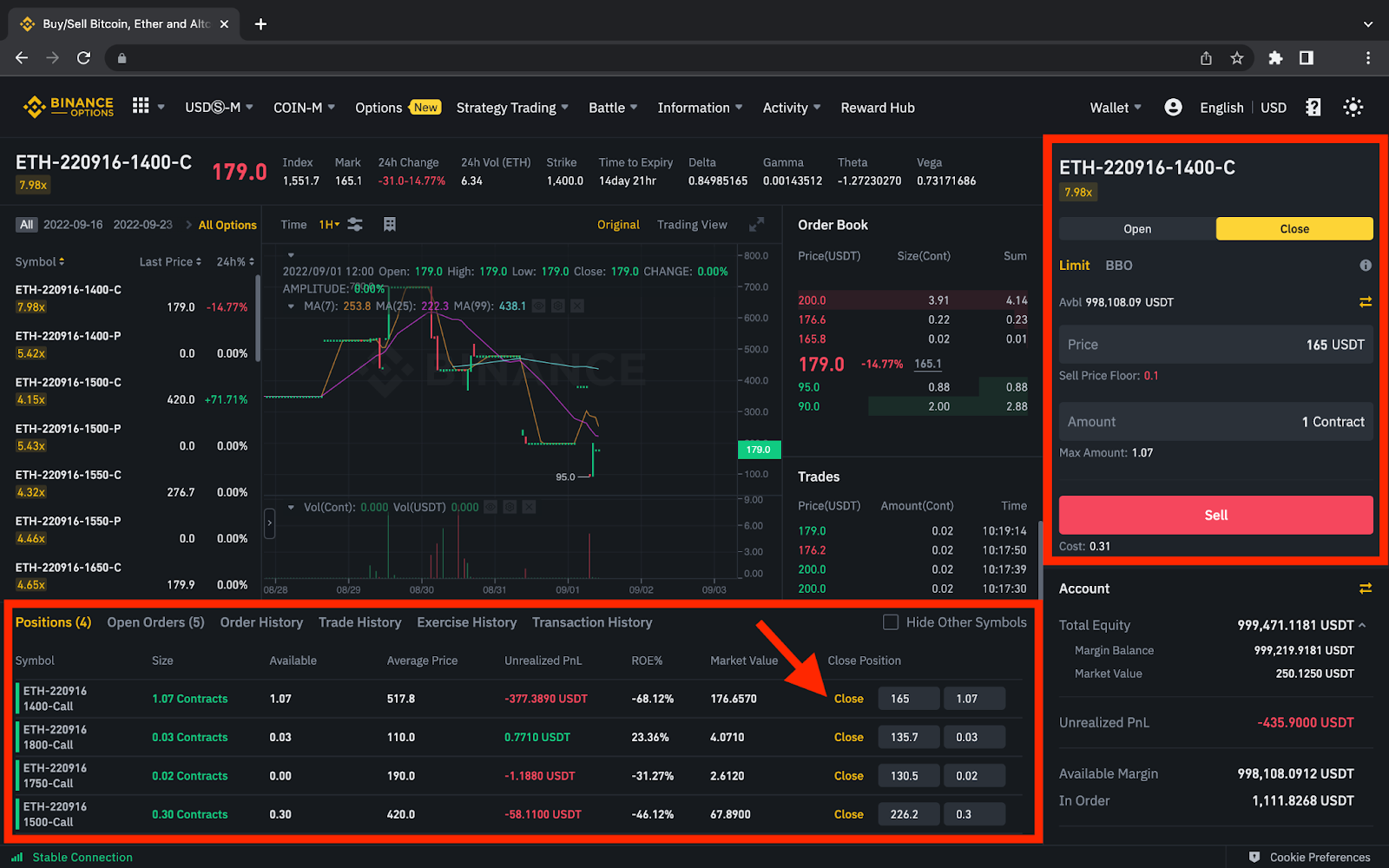

Step 8 – To close the position, you have the choice to:

- Hold until expiration;

- Switch to the [Close] mode in the Trading Panel, select [Order Type], input [Price] and [Amount], and click [Sell];

- Or click [Close] directly under [Positions].

How to trade options contracts on the Binance mobile app

1. Step 1: Download the Binance App

Download the Binance mobile app for iOS or Android. Once installed, log in to your Binance account. If you are new to Binance, you can create an account in just a few minutes.

2. Step 2: Activate Your Futures Account

Binance Options is linked to your Binance Futures account. If you have not activated a Futures account yet, enable it in the app. When it is active, you can start using options trading.

3. Step 3: Start Trading Options Contracts

Open the Trades tab and select Options at the top.

Check that you have funds in your Futures Wallet. If you need to move funds, tap the arrow icon in the top right to transfer money from your Exchange Wallet.

Choose an expiry time for your option: 10 minutes, 30 minutes, 1 hour, 8 hours, or 1 day. Select the option you want to buy.

For example, buying a 1-hour call option means you expect the price to increase within the next hour.

Enter the contract size in the Quantity field. The size is measured in the underlying asset (such as BTC), while the premium is paid in USDT. When everything is set, tap Buy Call. Review the confirmation screen and tap Confirm to place your order.

4. Step 4: Monitor and Close Positions

View your active options under the Positions tab. You will see the remaining time before expiry and your estimated unrealized profit or loss (PnL).

To close a position early or exercise the option, tap Settle next to the position, then tap Confirm. Your previous options trades can be found in the History tab.

Common Strategies for Beginners

| Strategy | How It Works | Best Market Conditions | Why Beginners Use It | Risks / Drawbacks |

| Trend-Following | Trade in the direction of the overall trend (Calls in uptrend, Puts in downtrend). | Strong, clear trends. | Simple logic, higher probability entries. | False reversals can cause losses. |

| Support & Resistance | Enter Calls at support and Puts at resistance. | Ranging or mildly trending markets. | Easy to identify price levels; predictable reactions. | Levels can break unexpectedly. |

| Breakout Strategy | Trade Calls or Puts when price breaks out of a consolidation range. | High volatility or news periods. | Captures large moves quickly. | Fake breakouts can trap traders. |

| Momentum Strategy | Trade in direction of short-term momentum using recent candles. | Fast-moving markets. | Works well with short expiries (5–15 min). | Very timing-sensitive; quick reversals common. |

| News-Reaction Strategy | Trade immediately after major announcements. | High-volatility news events. | Can produce big profits quickly. | Extremely risky; unpredictable spikes. |

| Risk-Management Strategy | Use small positions, control emotions, and trade only high-quality setups. | All market conditions. | Protects account and reduces emotional mistakes. | Not a profit strategy alone, supports all others. |

Frequently Asked Questions

Are Binance Options good for total beginners?

No, derivatives like options are generally not recommended for total beginners. They involve leverage, time decay, and complex pricing models (Greeks) that can lead to large, fast losses. Beginners should start with spot trading to learn market fundamentals before risking capital on options.

How much money do I need to start trading Binance Options?

The minimum trade order size on Binance is typically 1 USDT. Since the cost is the option’s premium, which is very small relative to the asset’s value, you can start with a small deposit (often $10 USD equivalent or less) to cover the initial premium.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Very short expiries | Very high volatility can lead to quick losses |

| Limited risk | Short expiries make emotional trading easy |

| No complex Greek calculations required | Limited types of options compared to traditional markets |

| Easy interface compared to traditional options | Requires strong timing skills |

| Useful for small accounts due to low minimum trade size | Beginners may overtrade due to simplicity |

Our Insights

For beginners, Binance Options strategies like trend-following, support/resistance, momentum, and careful news-based trades provide simple, structured approaches. Coupled with strong risk management, these strategies help manage losses while building trading confidence.

Common Mistakes Beginners Should Avoid

Here’s a clear, beginner-focused guide on Common Mistakes Beginners Should Avoid When Trading Binance Options:

| Common Mistake | Why It’s a Problem | How to Avoid |

| Ignoring Risk Management | Can lead to large, uncontrollable losses | Set position size limits and define maximum risk per trade |

| Overtrading | Leads to repeated losses and stress | Trade only quality setups; avoid chasing every movement |

| Misunderstanding Time Decay | Value of options erodes rapidly | Understand expiry effects; choose expiries wisely |

| Trading Without a Plan | Increases impulsive mistakes | Create a clear entry, exit, and risk plan |

| Ignoring Market Conditions | Low-probability trades | Analyze trends, support/resistance, and volatility before trading |

| Focusing Only on Short-Term Profits | Encourages reckless trades | Prioritize learning and consistency over immediate gains |

| Trading Emotional or Impulsive | Poor decision-making | Stick to the plan; manage fear and greed |

| Not Using Demo or Small Accounts First | High learning cost | Start with demo or small trades to build experience |

Frequently Asked Questions

What is the biggest mistake beginners make with Binance Options?

The biggest mistake is selling (writing) unhedged options. Beginners are often lured by the premium received but expose themselves to unlimited loss potential if the market moves sharply against them, requiring complex margin management that is unsuitable for novices.

Is practicing on a demo account really necessary?

Yes, practicing on a demo account is essential with binary options. It lets you understand the high risk, high reward nature and rapid execution of trades without risking real capital. You need to perfect your timing and strategy.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Reduces losses and preserves capital | Requires patience and discipline |

| Builds consistent trading habits | May slow down initial gains |

| Improves decision making and discipline | Can feel restrictive to impulsive traders |

| Increases long-term profitability potential | Learning curve still exists even with caution |

| Boosts confidence for future trades | Must constantly monitor trades and market conditions |

Our Insights

Avoiding common beginner mistakes, like overtrading, ignoring risk, and trading impulsively, helps traders preserve capital, build discipline, and gain confidence. With careful planning and practice, Binance Options can be traded more safely and effectively.

What are Binary Trading Options?

Binary Trading Options are a type of financial instrument where traders predict whether the price of an asset will be above or below a specific level at a set time. The outcome is binary; you either win a fixed payout or lose your entire stake.

How They Work

- You choose an asset (e.g., currency pair, stock, crypto).

- Predict whether the price will go up (Call) or go down (Put).

- Select an expiry time (seconds to hours).

- If your prediction is correct, you receive a fixed profit.

- If you’re wrong, you lose the amount you invested in that trade.

Key Features

- All-or-nothing outcome

- Very short-term expiry times

- Simple to understand

- High risk, especially for beginners

- Often marketed as fast-profit trading, but losses can accumulate quickly

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From what the difference between Binance options and futures is to how to choose the strike price, we provide straightforward answers to help you understand Binance options.

Q: What is the difference between Binance Options and Futures contracts? – Anna L.

A: Binance Options grant the right, but not the obligation, to buy/sell for a premium. Futures represent the obligation to buy/sell at a set price and date, requiring margin and mandatory settlement.

Q: How do I choose a strike price and expiration when trading Binance options? – John M.

A: Choose the strike price based on your price forecast; ‘in-the-money’ (ITM) has a higher probability (Delta 1). Select expiration based on your time forecast for the move. Longer times cost more premium but reduce the effect of time decay (Theta).

Q: Can I short sell options on Binance even if I don’t own the option? – Sophie T.

A: Yes, you can sell options you don’t own, this is called selling to open (or writing) an option. When you sell an option, you receive the premium upfront but assume the obligation to buy or sell the asset if the option is exercised, which carries unlimited risk and requires margin.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Limited Risk for Buyers | Fast Time Decay |

| Beginner-Friendly Structure | Short-Term Focus |

| Flexible Expiries | Limited Strategy Variety |

| No Margin Required | Premium Prices Can Be High |

| Quick Execution & High Liquidity | Requires Good Timing |

You Might also Like:

In Conclusion

Binance Options provide a simple, low-risk way for beginners to trade short-term market movements using fixed premiums and flexible expiries. While accessible and easy to learn, successful trading still requires timing, discipline, and a solid understanding of option behavior.

Faq

Binance Options, which are European-style, offer a variety of expiries, including Daily (which have a three-day trading life), Weekly (expiring Friday), Monthly (last Friday of the month), and Quarterly (Mar, Jun, Sep, Dec).

No, they differ primarily in the underlying asset (crypto vs. stock) and settlement style. Binance Options are typically European-style (exercised only at expiry) and cash-settled. Traditional stock options are often American-style (exercised any time) and physically settled.

Yes, but only for the seller (writer). Options buyers pay a fixed premium, limiting their maximum loss and preventing liquidation. However, sellers must post margin to cover potential losses and face liquidation risk if the market moves against them and their margin is depleted.

Yes, you can close any open option position on Binance before its expiration date. You close the position by executing an offsetting trade, selling an option you bought or buying an option you sold, to realize profit or loss immediately.

Choose a Call option if you believe the asset price will rise before expiration. Choose a Put option if you believe the asset price will fall before expiration. They represent opposite directional bets.

Yes, there are fees for trading Binance Options. They use a Maker/Taker fee structure, charged on the notional value of the trade (quantity X index price), not the premium. For regular users, this fee is typically a low, flat commission (e.g., 0.024%or 0.03%) regardless of the order type.

Yes, Binance Options expire automatically at their designated expiry time (usually 08:00 UTC). Any option that is In-The-Money (ITM) at that moment is automatically cash-settled. Options that are Out-of-the-Money (OTM) automatically expire worthless.

No, Binance Options are not available in all countries. Due to varying financial regulations on derivatives, they are often restricted or banned in major jurisdictions, including the United States, Canada, and certain European countries. Always check local laws.

The biggest risk is the unlimited potential loss faced by the seller (writer) of an option, especially if the position is not hedged. For the buyer, the main risk is losing the entire premium paid due to the option expiring worthless (time decay).