Gold’s Attraction Remains Strong Amid Growing Fears of Banking Crisis and Uncertainty over Fed’s Interest Rate Decision

The price of [[gold]] (XAU/USD) rose to a six-week high of $1,937 before experiencing a corrective dip during the Asian trading.

•

Last updated: Thursday, March 16, 2023

The price of GOLD (XAU/USD) rose to a six-week high of $1,937 before experiencing a corrective dip during the Asian trading session. Despite the temporary decline, GOLD remains attractive due to growing fears of international banking trouble caused by the recent Credit Suisse debacle and tension over the Federal Reserve’s interest rate decision next week.

While the S&P 500 futures recovered slightly following a sell-off on Wednesday, investors are still cautious amid the unpredictability surrounding the banking industry.

During the Asian trading session, the US Dollar Index fluctuated within a tight range of 104.60, with the effect of the banking sector upheaval on the Dollar Index fading. Investors are beginning to underestimate the likelihood of a change in monetary policy at next week’s meeting, with the CME FedWatch tool indicating that the probability of a 25 basis point rate hike by Federal Reserve Chair Jerome Powell is now greater than 70%. However, 30% of the population is likely to support keeping interest rates the same.

The weaker Consumer Price Index (CPI), weaker Retail Sales, lower Producer Price Index (PPI) and higher Unemployment Rate statistics in the United States support the Fed’s current monetary policy.

The weaker Consumer Price Index (CPI), weaker Retail Sales, lower Producer Price Index (PPI) and higher Unemployment Rate statistics in the United States support the Fed’s current monetary policy.

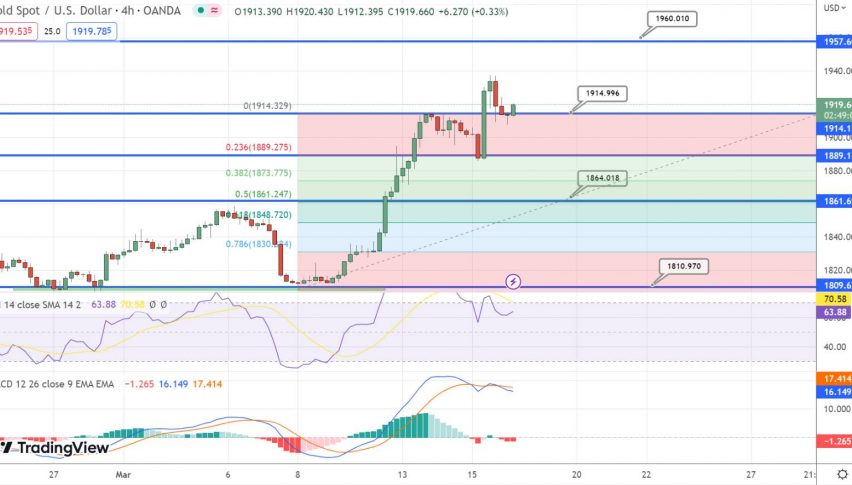

Technical analysis shows that the price of GOLD corrected lower following a downward divergence on a two-hour time frame, indicating a loss of upside momentum. However, as the asset has not yet breached the higher high higher low pattern, the upside bias remains solid. The price of GOLD has reverted back toward its 20-period EMA, currently around $1,915, after moving perpendicularly.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.

Related Articles

Sidebar rates

HFM

Related Posts

Pu Prime

XM

Best Forex Brokers

Join 350 000+ traders receiving Free Trading Signals