Prices Forecast: Technical Analysis

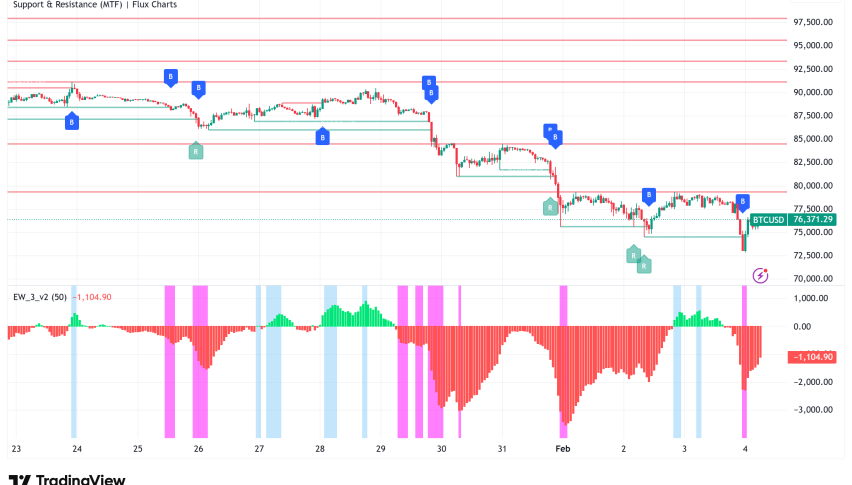

For the upcoming trading day, Bitcoin is forecasted to close at approximately $75,659.55, with a potential range between $73,000 and $78,000. Over the week, we anticipate a closing price around $76,500, with fluctuations expected between $72,000 and $80,000. The current RSI of 25.52 indicates that Bitcoin is in oversold territory, suggesting a potential rebound could occur soon. However, the ATR of 3,399.41 indicates high volatility, which could lead to significant price swings. The pivot point at $75,913.64 suggests that if Bitcoin trades below this level, it may face further downward pressure. Conversely, if it breaks above resistance levels, we could see a bullish trend. The bearish sentiment in the market, combined with the recent price action, suggests caution for traders. Overall, while a short-term recovery is possible, the broader trend remains bearish until a clear reversal pattern emerges.

Fundamental Overview and Analysis

Bitcoin has recently experienced a downward trend, with prices dropping significantly over the past few weeks. Factors influencing its value include market sentiment, regulatory scrutiny, and macroeconomic conditions. Investor sentiment appears cautious, with many traders adopting a wait-and-see approach amid ongoing volatility. The potential for technological advancements and increased adoption remains, but competition from other cryptocurrencies poses a challenge. Additionally, regulatory hurdles could impact Bitcoin’s scalability and future growth. Currently, Bitcoin appears undervalued based on its historical performance, but the market’s reaction to external events will be crucial. The asset’s valuation is closely tied to its perceived utility and acceptance in mainstream finance, which could drive future price movements.

Outlook for Bitcoin

The future outlook for Bitcoin remains uncertain, with current market trends indicating a potential for both recovery and further declines. Historical price movements show significant volatility, which could continue in the near term. Key factors influencing Bitcoin’s price include economic conditions, regulatory developments, and technological advancements. In the short term (1 to 6 months), we could see Bitcoin testing the $80,000 mark if bullish momentum builds. However, if bearish sentiment persists, prices could dip below $70,000. Long-term forecasts (1 to 5 years) suggest potential growth as adoption increases, but risks such as market crashes and regulatory changes could hinder progress. External events, including geopolitical tensions and economic downturns, could significantly impact Bitcoin’s price trajectory.

Technical Analysis

Current Price Overview: The current price of Bitcoin is $75,659.55, which is slightly lower than the previous close of $75,729.47. Over the last 24 hours, Bitcoin has shown a bearish trend with notable volatility, indicating a potential for further declines. Support and Resistance Levels: Key support levels are at $72,818.36, $69,977.17, and $66,881.90, while resistance levels are at $78,754.83, $81,850.10, and $84,691.29. The pivot point is at $75,913.64, and Bitcoin is currently trading below this level, indicating a bearish outlook. Technical Indicators Analysis: The RSI at 25.52 suggests a bearish trend, indicating oversold conditions. The ATR of 3,399.41 reflects high volatility, while the ADX at 34.35 indicates a strong trend. The 50-day SMA and 200-day EMA show no crossover, suggesting a continuation of the current trend. Market Sentiment & Outlook: Sentiment is currently bearish, as indicated by price action below the pivot point, the downward direction of the RSI, and the strong ADX reading.

Forecasting Returns: $1,000 Across Market Conditions

The table below outlines potential investment scenarios for Bitcoin, providing insights into expected price changes and estimated returns on a $1,000 investment.

| Scenario | Price Change | Value After 1 Month |

|---|---|---|

| Bullish Breakout | +10% to ~$83,125 | ~$1,100 |

| Sideways Range | 0% to ~$75,659 | ~$1,000 |

| Bearish Dip | -10% to ~$68,093 | ~$900 |

FAQs

What are the predicted price forecasts for the asset?

The predicted daily closing price for Bitcoin is approximately $75,659.55, with a potential range between $73,000 and $78,000. For the weekly forecast, we anticipate a closing price around $76,500, with fluctuations expected between $72,000 and $80,000.

What are the key support and resistance levels for the asset?

Key support levels for Bitcoin are at $72,818.36, $69,977.17, and $66,881.90. Resistance levels are at $78,754.83, $81,850.10, and $84,691.29, with the pivot point at $75,913.64.

What are the main factors influencing the asset’s price?

Factors influencing Bitcoin’s price include market sentiment, regulatory scrutiny, and macroeconomic conditions. Additionally, technological advancements and competition from other cryptocurrencies play a significant role in shaping its value.

What is the outlook for the asset in the next 1 to 6 months?

In the short term, Bitcoin could test the $80,000 mark if bullish momentum builds. However, if bearish sentiment persists, prices could dip below $70,000. The outlook remains uncertain, influenced by various market dynamics.

What are the risks and challenges facing the asset?

Risks facing Bitcoin include market volatility, regulatory changes, and competition from other cryptocurrencies. Additionally, external events such as geopolitical tensions could significantly impact its price trajectory.

Disclaimer

In conclusion, while the analysis provides a structured outlook on the asset’s potential price movements, it is essential to remember that financial markets are inherently unpredictable. Conducting thorough research and staying informed about market trends and economic indicators is crucial for making informed investment decisions.