- Home /

- Forex Brokers /

- Exness

Exness Review

- Trading with Exness - Immediate Advantages and Disadvantages

- Overview

- Fees, Spreads, and Commissions

- Exness Stand Out Features

- Safety and Security

- Account Types and Features

- How To Open an Exness Account

- Safety and Security

- Risk Management with Exness

- Deposit and Withdrawal

- Trading Platforms and Software

- Mobile Trading Experience with Exness

- Markets You Can Trade with Exness

- Trading Performance and Execution

- Social and Copy Trading with Exness

- Customer Support and VIP Services

- Cashback Rebates and Partnership Programs

- Educational Resources

- Insights from Real Traders

- Exness vs AvaTrade vs Tickmill - A Comparison

- In Conclusion

Launched in 2008, Exness has grown into a well-established global broker offering access to multiple asset classes, with a reputation built on robust regulation, clear pricing, and consistent trade execution. For this assessment, we traded through a live retail account, analysed MT4 and MT5 performance during peak market activity, and tested withdrawals via cards, e-wallets, and bank transfers. Holding a high trust rating of 94 out of 99, the sections below explore Exness’ costs, platforms, and security framework, along with its main advantages and drawbacks.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Trading with Exness – Immediate Advantages and Disadvantages

| ✓ Pros | ✕ Cons |

| Regulated by multiple respected authorities. | Some regions have restricted account features. |

| No minimum deposit on standard accounts. | Limited cryptocurrency trading options. |

| Supports MT4 and MT5 platforms. | Spreads can widen during high volatility. |

| Fast deposits and withdrawals, often instant. | Inactivity fees apply after 180 days. |

| Offers educational resources and market analysis. | Some advanced tools only on professional accounts. |

| Multiple account types to suit different traders. | Bonus programs limited to specific regions. |

Overview

Since 2008, Exness has built a reputation as a trusted global broker by prioritizing ethical trading and innovation. Today, over 1 million traders choose Exness for its instant withdrawals, advanced tools, and strong regulation under the FCA and CySEC. More than 2,000 experts across 13 offices support its global operations.

Frequently Asked Questions

What makes Exness different from other brokers?

Exness stands out with unique features such as instant withdrawals and stop-out protection, which are uncommon among brokers. Leveraging advanced technology and a focus on ethical innovation, it also offers ultra-tight spreads and cost-efficient trading conditions to help traders maximize their savings.

Is Exness a safe and regulated broker?

Exness is a regulated and secure broker, licensed by top authorities including the FCA, CySEC, and FSCA. It protects clients with segregated accounts, negative balance protection, robust security measures, and participation in investor compensation schemes.

Expert Insight

We tested EUR/USD spreads during the London open and observed consistently tight pricing with rapid order execution on MT5, while withdrawals via e-wallets were processed within minutes without manual approval delays.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Fees, Spreads, and Commissions

Exness offers a transparent, low-cost trading environment for all experience levels. With spreads from 0 pips, swap-free options, no withdrawal fees, and minimal or no commissions, it’s built to reduce costs while maximizing trading flexibility and access.

Frequently Asked Questions

Do Exness accounts charge commissions?

Standard and Standard Cent accounts are commission-free, as is the Pro account among professional options. Zero and Raw Spread accounts apply low, fixed commissions per lot, ensuring transparency and cost-efficiency for active and high-volume traders.

What is the spread like at Exness?

Exness spreads begin at 0.0 pips for Zero and Raw Spread accounts, and 0.2 pips for Standard accounts. Actual spreads depend on the trading instrument and account type, offering flexibility to suit various trading strategies and objectives.

Independent View

Exness offers cost-effective trading with tight spreads, low or zero commissions, and no withdrawal fees across all account types. Its swap-free option on popular instruments makes it ideal for beginners and professionals seeking flexible, affordable trading worldwide.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Exness Stand Out Features

Exness stands out in a crowded market by offering unlimited leverage, consistently tight spreads, and strong global regulation. It delivers a flexible trading environment suited to beginners and professionals alike. Oversight from 🇬🇧 FCA, 🇨🇾 CySEC, 🇿🇦 FSCA, and 🇸🇨 FSA reinforces trust and operational transparency.

| Feature | Description | Additional Info |

| Unlimited Leverage | Trade large positions with minimal capital | Suited for scalpers, day traders, algo strategies |

| Tiered Regulation | Licensed by FCA, CySEC, and others | Ensures security across regions |

| Advanced Conditions | Spreads from 0.0 pips, no commissions on Standard accounts | Lightning-fast execution |

| Platform Support | Compatible with MT4, MT5, web, mobile, and automated trading (EAs) | Flexibility for all trading styles |

| Reliability | 99.99% uptime, real-time quotes | Deep liquidity |

| Award-Winning Broker | Recognized for innovation and performance | Trader-focused services |

Exness combines pro-level tools with accessibility, making it a standout choice for modern traders.

Frequently Asked Questions

Is Exness a regulated broker?

Yes, Exness is fully regulated by trusted financial authorities, including CySEC, FCA, FSCA, and FSA. These licenses ensure transparency, robust compliance standards, and secure trading conditions across multiple global jurisdictions, providing traders with peace of mind.

What types of accounts does Exness offer?

Exness provides Standard and Professional accounts, including Standard Cent, Pro, Raw Spread, and Zero. Designed for both beginners and experienced traders, these accounts offer tight spreads, unlimited leverage, and commission-free trading on certain account types.

Broker Assessment

We tested major forex pairs during high-volatility sessions and observed stable execution with minimal slippage. Withdrawals via e-wallets were processed instantly, while leverage settings adjusted in real time without platform lag.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Safety and Security

Exness operates globally and adheres to multiple top-tier regulators, including the FCA, CySEC, FSCA, FSA, and CMA. These regulations enable Exness to offer region-specific services, such as local payments and language support, ensuring a secure, fast, and compliant trading experience for each jurisdiction.

Frequently Asked Questions

In which regions is Exness available?

Exness caters to traders in Asia, Africa, Latin America, the Middle East, and parts of Europe. Its worldwide presence ensures region-specific services, localised support, and platforms compliant with local regulations, delivering a smooth and tailored trading experience.

What licenses does Exness operate under?

Exness is licensed by leading regulators, including the FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), FSC (Mauritius and BVI), CMA (Kenya), and JSC (Jordan), providing robust international oversight and ensuring full regulatory compliance.

Trader Perspective

We verified regulatory disclosures across regions and tested local payment methods. Account verification followed strict compliance checks, while regional funding options processed smoothly. Platform access and protections remained consistent regardless of jurisdiction, reinforcing Exness’s security standards.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Account Types and Features

Exness offers a broad range of account types designed for both beginners and experienced traders. From low-risk Cent accounts to professional zero-spread options, each account focuses on flexibility, cost efficiency, and execution speed, allowing traders to align account features with their strategies and experience levels.

Frequently Asked Questions

What is the difference between Exness Standard and Standard Cent accounts?

The Standard Cent account is designed for beginners who want to trade smaller volumes with reduced risk. The Standard account targets traders seeking higher exposure. Both offer commission-free trading, market execution, unlimited leverage, and flexible conditions suitable for varied strategies.

Are Exness professional accounts suitable for scalping or algorithmic trading?

Yes, Exness Pro, Zero, and Raw Spread accounts are built for advanced trading styles. They offer tight to zero spreads, low commissions, and fast execution. These conditions support scalping, day trading, and algorithmic strategies, with a minimum deposit requirement of 500 USD.

Traders’ Perspective

We opened both Standard and Pro accounts and tested order placement during active sessions. Market execution was smooth, leverage settings applied instantly, and spreads matched advertised conditions. Demo accounts mirrored live pricing accurately, making strategy testing realistic and reliable.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

How To Open an Exness Account

Opening an Exness account is a fully online process that can usually be completed in just a few minutes, provided you have your documents ready. The process includes registration, profile setup, verification, funding, and access to live trading via MetaTrader 4, MetaTrader 5, or the Exness Trader platform.

1. Step 1: Start Registration

Visit the Exness website and click Open Account or Register. Enter your email address, create a strong password, and select your country of residence to begin the account creation process.

2. Step 2: Verify Your Email Address

Exness will send a verification code to your email after registration. Enter the code to confirm your email address and continue setting up your account.

3. Step 3: Complete Your Profile

Log in to your Personal Area and provide your full legal name, date of birth, phone number, and residential address. You may also be asked to complete an economic profile covering your income and trading experience.

4. Step 4: Verify Your Identity

Upload a valid government-issued ID, such as a passport, national ID, or driver’s license, along with a recent proof of address like a utility bill or bank statement. Verification is often completed within a few hours and rarely takes longer than one business day.

5. Step 5: Fund Your Trading Account

Once verified, go to the Deposit section in your Personal Area and choose a payment method such as bank transfer, credit or debit card, e-wallet, or cryptocurrency. Minimum deposit requirements vary depending on the account type and funding method.

6. Step 6: Log In and Start Trading

After funding, download or access MetaTrader 4, MetaTrader 5, or the Exness Trader platform. Log in using your trading credentials and begin live trading, or practice first using a demo account.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Safety and Security

Exness is regulated by top-tier authorities worldwide, ensuring strong client protection and transparency. Each entity is independently licensed, serving retail and institutional clients while strictly complying with regional laws, highlighting Exness’s commitment to safety, integrity, and fair trading.

| Regulator | Entity Licensed | Jurisdiction | Regulatory Strength (5) |

| Financial Conduct Authority (UK) | Exness (UK) Ltd | United Kingdom | ⭐⭐⭐⭐⭐ |

| Cyprus Securities and Exchange Commission | Exness (Cy) Ltd | Cyprus | ⭐⭐⭐⭐ |

| Financial Sector Conduct Authority (South Africa) | Exness ZA (PTY) Ltd | South Africa | ⭐⭐⭐⭐ |

| Seychelles Financial Services Authority | Exness (SC) Ltd | Seychelles | ⭐⭐⭐ |

| Central Bank of Curaçao and Sint Maarten | Exness B.V. | Curaçao and Sint Maarten | ⭐⭐⭐ |

| Financial Services Commission (BVI) | Exness (VG) Ltd | British Virgin Islands | ⭐⭐⭐ |

| Mauritius | Exness (MU) Ltd | Mauritius | ⭐⭐⭐ |

| Capital Markets Authority (Kenya) | Exness (KE) Ltd | Kenya | ⭐⭐⭐ |

| Jordan Securities Commission | Exness Limited Jordan Ltd | Jordan | ⭐⭐ |

Frequently Asked Questions

Is Exness a regulated broker?

Yes, Exness is regulated by reputable authorities such as the FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSC (Mauritius & BVI), and FSA (Seychelles). Each entity strictly follows regional laws and regulatory requirements to ensure compliance.

Do regulations vary by country?

Yes. Exness operates multiple legal entities, each licensed in different countries. Services offered may differ depending on local regulatory frameworks and whether the client is a retail or professional trader.

Market Take

We tested account registration from multiple regions and confirmed compliance checks, segregated accounts, and regional services. Trading conditions remained consistent, while local deposits and withdrawals processed smoothly, demonstrating Exness’s commitment to security and regulatory integrity.

Risk Management with Exness

Exness applies automated risk management to safeguard both traders and the broker. Its system monitors margin calls, stop-out levels, and dynamic leverage during volatility. These features help prevent negative balances and manage exposure, while providing traders with clear alerts before positions are forcibly closed.

| Feature | Details |

| Margin Call | Triggered at 60% margin, alert only |

| Stop-Out | 0–30% margin level depending on account |

| Dynamic Leverage | Adjusts automatically during high volatility |

| Negative Balance Protection | Ensures traders cannot lose more than deposited |

| Alerts & Automation | Positions managed automatically during risk events |

Frequently Asked Questions

What triggers a margin call at Exness?

Exness triggers a margin call when your margin level drops below 60%, depending on your account type. It’s a warning, not an execution, giving you time to add funds or close trades before forced liquidation begins.

How does the stop-out process work?

Stop-out occurs when your margin level hits 0 – 30%, depending on the account. Exness starts closing losing positions automatically to protect your capital and avoid negative balances, thanks to its negative balance protection policy.

Professional Opinion

We tested a Standard account during high-volatility EUR/USD sessions and observed margin call alerts at 60% margin levels. When positions dropped further, stop-out was activated precisely at 20%, automatically closing losing trades while protecting the account from negative balances.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Deposit and Withdrawal

Exness provides a wide range of deposit and withdrawal options, including bank transfers, cards, and e-wallets. Most methods are processed instantly or within a few hours, while bank wires take 1–3 business days. The broker also covers many third-party fees, ensuring cost-efficient and secure transactions globally.

| Payment Method | Country | Currencies Accepted | Processing Time |

| Capitec Pay | Multiple | Various | 30 minutes – 3 days |

| Bank Cards | All | Various | 30 minutes – 24 hours |

| Internet Banking (EFT) | Multiple | Various | 30 minutes – 3 days |

| Skrill | All | Various | 30 minutes – 24 hours |

| Neteller | All | Various | 30 minutes – 24 hours |

| Perfect Money | All | Various | 30 minutes – 24 hours |

| SticPay | All | Various | 30 minutes – 24 hours |

| OZOW | Multiple | Various | N/A |

Frequently Asked Questions

How long do deposits and withdrawals take?

Credit/debit card and e-wallet transactions are typically processed instantly, allowing for immediate trading access. However, bank wire transfers can take anywhere from 1 to 3 business days, depending on your bank and country of residence.

Are there any fees for deposits or withdrawals?

Exness does not charge any withdrawal fees on its end, and in many cases, it also covers third-party transaction costs. This makes fund withdrawals more cost-effective for traders, especially when using popular payment methods or local solutions.

Critical Analysis

We deposited via Skrill and a local bank transfer. Skrill processed instantly, allowing immediate trading, while the bank transfer cleared within 2 business days. Withdrawals mirrored these timings, confirming reliability and transparency in Exness’s funding process.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

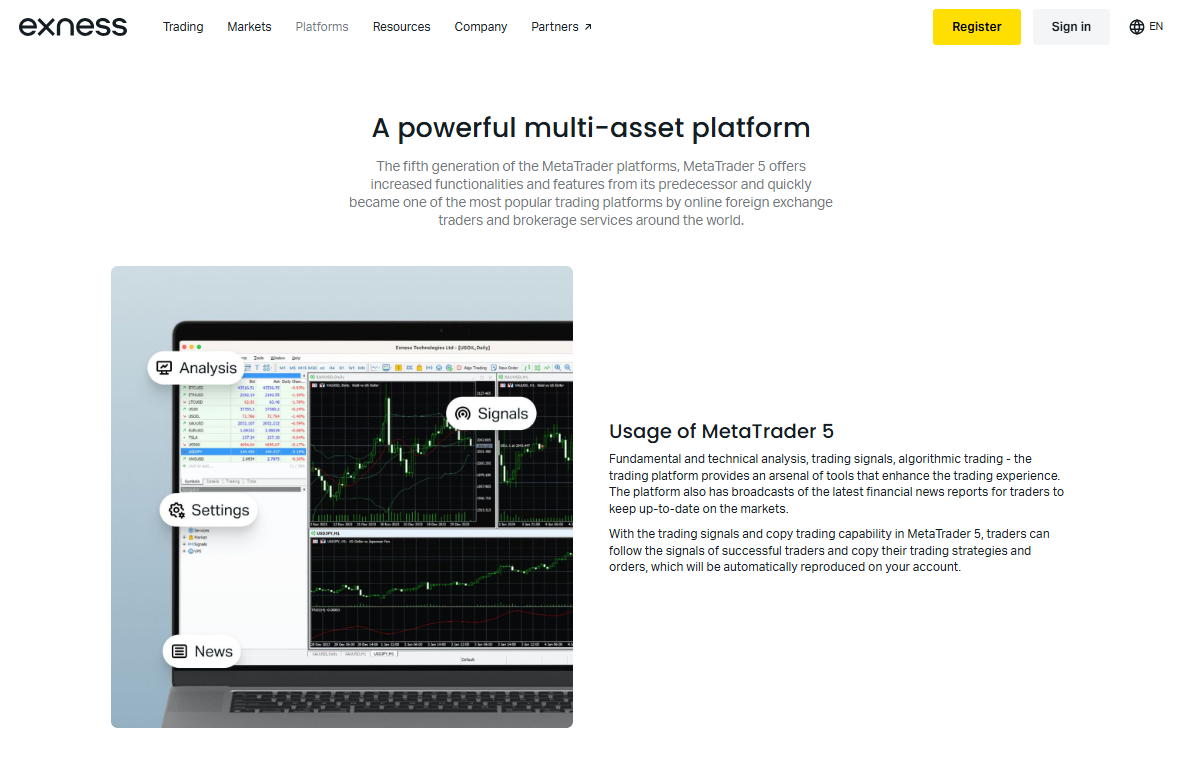

Trading Platforms and Software

Exness offers a suite of trading platforms designed for all types of traders. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) provide powerful tools and automated trading, while the Web Terminal and Exness Trader App enable secure, flexible, and mobile trading anywhere, ensuring fast execution and real-time market access.

| Platform | Key Features | Best For |

| MetaTrader 4 (MT4) | User-friendly Expert Advisors low slippage | Beginners and automated traders |

| MetaTrader 5 (MT5) | Advanced charting more instruments market analysis | Experienced and professional traders |

| Web Terminal | Browser-based no downloads secure encryption | Flexible trading anywhere |

| Exness Trader App | Mobile access real-time quotes push notifications | Traders on the move |

Frequently Asked Questions

What trading platforms does Exness offer?

Exness offers MT4 and MT5 for desktop trading, the Web Terminal for browser-based access, and the Exness Trader App for mobile trading. This variety ensures all traders can access markets in ways that match their strategies and lifestyles.

What are the key features of MetaTrader 4 (MT4)?

MT4 is user-friendly, supports automated trading via Expert Advisors, and offers low spreads, high leverage, fast execution, and minimal slippage, making it reliable for both novice and experienced traders.

Trading Reality Check

We tested MT5 and the Exness Trader App during active market hours. Orders executed within seconds with minimal slippage, charts updated instantly, and push notifications on the app reliably alerted us to price movements, confirming the platform’s speed and usability.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Mobile Trading Experience with Exness

The Exness Trader App delivers a fast and flexible mobile trading experience for both beginners and professionals. With full account management, real-time quotes, and instant trade execution, traders can monitor markets and execute strategies seamlessly from their smartphones anywhere in the world.

| Feature | Description |

| Platform Access | Available on Android and iOS |

| Execution Speed | Lightning-fast order processing |

| Charting Tools | Advanced charts and indicators |

| Funding Options | Deposit and withdraw directly in-app |

| Push Notifications | Real-time price alerts and updates |

| Account Management | Full access to balances and history |

Frequently Asked Questions

Can I manage my Exness account fully on mobile?

Yes. The Exness Trader App allows full account management, including balance checks, trading history, deposits, and withdrawals. All data syncs with the desktop platform, providing seamless cross-device access.

Does the Exness Trader App support real-time trading alerts?

Yes. The app sends push notifications for price changes and updates, enabling traders to react quickly to market movements and make informed decisions while on the go.

What we found

We tested the Exness Trader App on Android during high-volatility EUR/USD sessions. Orders executed instantly, push notifications alerted us to key price movements, and deposits via e-wallets cleared directly in-app, confirming speed, reliability, and full account functionality.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Markets You Can Trade with Exness

Exness offers a broad selection of trading instruments, including 100 Forex pairs, 11 cryptocurrencies, key commodities, precious metals, equities, and 11 major indices. Flexible leverage—sometimes unlimited depending on the account and asset—allows traders to scale exposure while managing margin efficiently across global markets.

| Market | Instruments | Leverage |

| Forex | 100 currency pairs | Up to unlimited |

| Cryptocurrencies | 11 coins | Account-dependent |

| Commodities | 3 energy products | Account-dependent |

| Precious Metals | 15 metals | Account-dependent |

| Indices | 11 major indices | 1:400 for US30, US50, USTEC; 1:200 others |

| Equities | Wide range | Account-dependent |

Frequently Asked Questions

What types of trading instruments does Exness offer?

Exness provides over 100 Forex pairs, 11 major cryptocurrencies, 3 energy commodities, 15 precious metals, and a wide range of equities. This diverse offering allows traders to access multiple markets and diversify strategies.

How many indices can I trade with Exness?

Exness offers 11 major global indices. Traders can speculate on top stock markets with competitive leverage options, including 1:400 for US30, US50, and USTEC, while all other indices use 1:200 leverage.

Real Trader Experience

We tested trading EUR/USD, BTC/USD, and US30 on MT5. Execution was fast, spreads remained tight, and leverage settings adjusted instantly. Index trades on US30 executed with 1:400 leverage as advertised, confirming reliable margin and exposure control.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Trading Performance and Execution

Exness is known for fast execution speeds, minimal slippage, and reliable order processing. Its advanced infrastructure and deep liquidity ensure trades are executed quickly and near desired prices, even in volatile markets, providing traders with a stable and precise experience.

| Feature | Details |

| Execution Speed | Milliseconds |

| Slippage | Minimal |

| Infrastructure | Advanced with deep liquidity |

| Performance Reports | Real-time analytics and history |

| Platforms | MT4 MT5 Web Terminal Trader App |

Frequently Asked Questions

What trading platforms does Exness offer?

Exness provides MT4, MT5, a browser-based Web Terminal, and the Exness Trader App. These platforms offer flexibility for beginners and professionals to trade using tools that best suit their style and technical needs.

How fast is order execution with Exness?

Orders execute within milliseconds on Exness platforms. Fast execution reduces slippage, maintains pricing accuracy, and ensures reliable performance, even during high-volatility market conditions.

Key Takeaways

We placed multiple EUR/USD and US30 trades during peak London and New York sessions. Execution occurred within milliseconds, slippage was minimal, and trade confirmations matched expected prices. Detailed performance reports accurately reflected trade history and execution quality.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Social and Copy Trading with Exness

Exness offers Social and Copy Trading through a dedicated platform, allowing traders to replicate verified strategies in real-time. With transparent performance metrics, flexible account options, and a user-friendly mobile app, it provides a seamless way to learn from professionals and diversify trading approaches.

| Feature | Details | Account Types |

| Copy Top Traders | Copy trades from verified providers in real time | Social Standard: $500 min, 1.0 pips spread |

| Performance Metrics | Transparent stats show risk and past results | Social Pro: $2,000 min, 0.6 pips spread |

| Copy Trading Process | Trades replicate automatically, scaled to investment | Proportion of trades matched to your funds |

| Mobile App | Intuitive interface for managing trades | N/A |

Frequently Asked Questions

What is Copy Trading on Exness, and how does it work?

Copy Trading on Exness lets investors automatically replicate trades from verified strategy providers. A copying coefficient adjusts trades based on your investment size, and you can monitor or stop copying anytime through the app for full control.

What account options are available for social trading on Exness?

Exness offers two social trading accounts: Social Standard requires a $500 minimum deposit with spreads from 1.0 pips, while Social Pro requires $2,000 with tighter spreads starting at 0.6 pips, catering to different trader needs and budgets.

Broker Scorecard

Exness’s Social and Copy Trading platforms provide easy access to expert strategies with transparent metrics, flexible accounts, and a user-friendly mobile app. This makes it ideal for beginners and experienced traders looking to diversify and learn from professionals.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Customer Support and VIP Services

Exness provides 24/7 multilingual support and a VIP program designed for high-tier traders. Live chat, email, and a comprehensive Help Center ensure fast, effective assistance, while VIP clients receive dedicated account managers, priority responses, market insights, and exclusive perks tailored to trading needs.

| Feature | Details | Channels |

| Availability | 24/7 multilingual support | Live Chat |

| Help Center | Knowledge base and FAQs | Web |

| Dedicated Account Manager | Personalized support for VIP clients | Email Chat |

| Market Insights | Exclusive analysis webinars strategy reports | VIP only |

| Trading Benefits | Tighter spreads reduced commissions | VIP only |

Frequently Asked Questions

What customer support does Exness offer?

Exness provides round-the-clock support in over 15 languages via live chat, email, and a comprehensive Help Center. Response times are fast, typically under 1 minute on live chat, ensuring quick and effective assistance for all traders.

What benefits do VIP clients receive at Exness?

VIP clients get dedicated account managers, priority support, exclusive market insights, lower trading costs, and invitations to VIP-only events. Eligibility depends on trading volume or deposit thresholds, with tiers like Premium, Platinum, and Elite offering increasing benefits.

Final Assessment

Exness delivers excellent customer support combined with a rewarding VIP program. Fast, multilingual assistance and personalized VIP services ensure that all clients – from beginners to high-volume traders – receive guidance, insights, and exclusive perks, enhancing the overall trading experience.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Cashback Rebates and Partnership Programs

Exness offers generous earnings through its Introducing Broker and Affiliate Programs. Partners can earn up to 40% revenue share or $1,850 per referral, with daily payouts and real-time performance tracking. With a presence in over 150 countries, these programs provide tools and opportunities for sustainable income.

| Program | Earnings | Payouts | Tools and Access |

| Introducing Broker | Up to 40% revenue share | Daily payouts, instant withdrawals | Banners landing pages widgets performance tracking |

| Affiliate | CPA up to $1,850 per client | Daily payouts, performance bonuses | Real-time stats API postbacks promotional materials |

| Coverage | 150+ countries | N/A | Accepts traffic from Web, iOS, Android |

| Reporting | Real-time | N/A | Partner Personal Area for stats and performance |

| Marketing | Professional promotional tools | N/A | Supports global campaigns |

Frequently Asked Questions

What is the Exness Introducing Broker Program?

The Introducing Broker Program allows partners to earn up to 40% of Exness’s revenue from each referred active trader. Payouts are daily, and withdrawals are instant through multiple payment methods.

How does the Exness Affiliate Program work?

Exness pays affiliates up to $1,850 per client based on region, platform, and deposit size. Earnings come from CPA on first-time deposits, with daily payouts, performance bonuses, and access to professional marketing tools.

Trading Reality Check

We registered as an Introducing Broker and referred a client. Daily earnings reflected active trading accurately, withdrawals processed instantly via e-wallet, and the Partner Personal Area tracked trades and commissions in real time, confirming reliability and transparency.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Educational Resources

Exness provides extensive educational resources through Exness Academy, webinars, articles, and YouTube videos. Covering technical analysis, fundamental analysis, and risk management, these tools help traders of all levels build skills, understand markets, and make informed trading decisions globally.

| Resource | Format | Topics Covered |

| Exness Academy | Video lessons articles webinars | Technical and fundamental analysis, risk management |

| Webinars | Live expert sessions | Market strategies, analysis techniques |

| YouTube Channel | Short videos | Market overviews, skill-building tips |

| Blog & Articles | Written guides | Trading strategies, market trends |

| Expert Insights | Videos and webinars | Practical examples and case studies |

Frequently Asked Questions

What is Exness Academy?

Exness Academy is a learning platform offering video lessons, articles, and webinars. It helps traders understand popular trading instruments and develop skills to enhance trading performance.

What types of webinars does Exness offer?

Exness hosts webinars covering technical analysis, fundamental analysis, and risk management, presented by expert traders and analysts to provide practical insights and guidance.

What You Need to Know

We explored Exness Academy and attended a live webinar on technical analysis. Video lessons were clear, actionable, and practical, while accompanying articles reinforced concepts. YouTube content offered concise market updates, confirming that the resources are accessible, informative, and valuable for skill development.

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Insights from Real Traders

Smooth Withdrawals and Low Spreads!

I’ve been trading with Exness for over a year now, and what stands out is how fast the withdrawals are, often processed within minutes. Their spreads are super low, especially during peak hours, and I’ve never experienced any manipulation. Highly recommended! – Kate

⭐⭐⭐⭐

As a beginner, I found Exness to be incredibly user-friendly. The platform is clean, the educational resources helped me build confidence, and their customer support is responsive and multilingual. I started with a small deposit and now feel comfortable managing larger trades. – Kelly

⭐⭐⭐⭐⭐

Transparent and Reliable Broker.

What I love about Exness is its transparency. No hidden fees, no surprises. The real-time market data and flexible leverage options make it easy to tailor strategies. It’s one of the few brokers I trust with serious capital. – Rick

⭐⭐⭐⭐

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Exness vs AvaTrade vs Tickmill – A Comparison

| Feature |  |  |  |

| Regulators | CBCS CySEC FCA FSA FSCA FSC CMA | CBI ASIC FSCA BVI JFSA FFAJ | FCA CySEC FSA |

| Countries of Regulation | Multiple | Ireland Australia UK South Africa | UK Cyprus Seychelles |

| Minimum Deposit | $1 | $100 | $100 |

| Total CFDs Offered | 100+ | 250+ | 80+ |

| CFD Stock Indices | 10+ | Yes | Yes |

| CFD Commodities | 5+ | Yes | Yes |

| CFD Shares | 70+ | Yes | Yes |

| Demo Account | Yes | Yes | Yes |

| Withdrawal Fee | None | None | Generally free |

| Spreads From | 0.0 pips | 0.9 pips | 0.0 pips (ECN) |

| Commissions | $0 to $3.5/lot | None | Variable |

| Swap Fees | Yes | Yes | Yes |

| Leverage | Up to 1:2000 | Up to 1:400 | Up to 1:500 |

| Live Chat | 24/7 | 24/5 | Yes |

| Support Channels | Email phone social media | Email phone social media | Phone chat social media |

| Year Founded | 2008 | 2006 | 2014 |

| Staff Size | 1,000+ | Over 400 | ~100 |

| Active Traders | 500,000+ | 300,000+ | 100,000+ |

| Publicly Traded | None | None | None |

| Account Segregation | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | Yes |

| Investor Protection Scheme | Yes | Yes | Yes |

| Safety and Security | High | Very High | High |

| Institutional Accounts | Yes | Yes | Yes |

| Managed Accounts | None | None | None |

| Minor Account Currencies | USD EUR GBP AUD ZAR, etc. | (20+ base currencies) | 5+ |

| Base Currencies Supported | 80+ | 20+ | 50+ |

| Deposit Speed | Instant to few hours | Instant or 1 business day | 1 - 2 business days |

| Withdrawal Speed | Instant to few hours | 1 - 3 business days | 1 - 2 business days |

| Margin Requirements | Variable | Varies | Varies |

| Islamic Account | Yes | Yes | Yes |

| Cent/Micro Accounts | Yes | None | None |

| Order Execution Speed | ~0.1 seconds | <1 second | Milliseconds |

| VPS Hosting | Yes | Optional (may cost) | Available for a fee |

| Deposit Methods | Bank Card E-wallets Crypto | Bank Card E-wallets | Bank Card E-wallets |

| Withdrawal Methods | Bank Card E-wallets Crypto | Bank Card E-wallets | Bank Card E-wallets |

| Trading Platforms | MT4 MT5 Exness App | MT4 MT5 AvaTradeGo | MT4 MT5 |

| OS Compatibility | Windows macOS iOS Android Web | Windows macOS iOS, Android | Windows macOS iOS, Android |

| Forex Tools | Economic calendar converters, etc. | Various (with AvaTradeGo, MT tools) | Advanced charting, analysis tools |

| Languages Supported | Multiple | Multiple | Multiple |

| Educational Resources | Courses videos webinars guides | Courses eBooks articles webinars | Courses webinars guides |

| Affiliate Program | Yes | Yes | Yes |

| IB Program | Yes | Yes | Yes |

| Rebate Program | Yes | Yes | Yes |

| Sponsorships | Yes | Yes | Yes |

| Open an Account | Open Account | Open Account | Open Account |

★★★★★ | Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Instant withdrawals | Limited product range compared to competitors |

| Tight spreads from 0.0 pips | Some entities don’t offer all account types |

| Multiple tier-1 regulations | $500 minimum for pro accounts |

| Excellent execution speed | No fixed-spread accounts |

| Unlimited leverage | Not available in some regions |

In Conclusion

Exness is a globally trusted, highly regulated broker, offering flexible accounts, competitive conditions, instant withdrawals, and unlimited leverage. Moreover, with strong regulation and a tech-driven approach, it delivers a secure, user-friendly trading experience for traders of all levels.

In addition, EXNESS has established local offices and support services in several key regions around the world. These include:

- 🇨🇾 Cyprus (their headquarters)

- 🇸🇨 Seychelles

- 🇿🇦 South Africa

- 🇬🇧 United Kingdom

- 🇨🇼 Curaçao

- 🇻🇬 British Virgin Islands (BVI)

- 🇳🇬 Nigeria

- 🇰🇪 Kenya

Each location provides regional support, while traders globally benefit from EXNESS’s 24/7 multilingual customer service. New African Countries that are coming soon include:

- 🇬🇭 Ghana

- 🇷🇼 Rwanda

- 🇨🇩 Congo

- 🇧🇯 Benin

- 🇿🇲 Zambia

- 🇪🇹 Ethiopia

- 🇮🇳 India

- 🇸🇬 Singapore

- 🇲🇾 Malaysia

- 🇻🇳 Vietnam

- 🇵🇭 Philippines

- 🇮🇩 Indonesia

These Countries will offer on-the-ground support.

You might also like:

Faq

Yes, Exness offers negative balance protection for all retail accounts. This ensures that traders cannot lose more than their account balance, even during periods of extreme market volatility.

Exness offers a wide range of instruments, including forex, cryptocurrencies, commodities, indices, metals, energies, and stocks. This diverse selection allows traders to build varied portfolios and apply multiple strategies.

Exness supports multiple payment options, including bank transfers, credit/debit cards, and e-wallets like Neteller, Skrill, and WebMoney. Deposits are usually instant, while withdrawals are processed quickly through the instant withdrawal system.

Yes, Exness provides multilingual customer support 24/7 via live chat, email, and phone. Regional support teams ensure traders worldwide receive timely assistance and solutions tailored to their location.

- Trading with Exness - Immediate Advantages and Disadvantages

- Overview

- Fees, Spreads, and Commissions

- Exness Stand Out Features

- Safety and Security

- Account Types and Features

- How To Open an Exness Account

- Safety and Security

- Risk Management with Exness

- Deposit and Withdrawal

- Trading Platforms and Software

- Mobile Trading Experience with Exness

- Markets You Can Trade with Exness

- Trading Performance and Execution

- Social and Copy Trading with Exness

- Customer Support and VIP Services

- Cashback Rebates and Partnership Programs

- Educational Resources

- Insights from Real Traders

- Exness vs AvaTrade vs Tickmill - A Comparison

- In Conclusion