What is Currency Trading?

This guide introduces currency trading, providing beginners with a clear explanation of how the Forex market works and how to start trading confidently.

- Definition of Currency Trading

- Importance of Currency Trading in the Global Markets

- How Currency Trading Works

- Major Players in the Currency Trading Markets

- How to Analyze the Currency Trading Market

- The Best Currency Trading Strategies

- Risks and Challenges of Currency Trading

- How to Start in Currency Trading

- The Future of Currency Trading

- In Conclusion

Top 10 Forex Brokers (Globally)

10 BEST FOREX BROKERS

| MIN DEPOSIT $100 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $50 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $25 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $200 | SIGN-UP BONUS No | Visit Now |

| MIN DEPOSIT $4 | SIGN-UP BONUS No | Visit Now |

| MIN DEPOSIT $5 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $0 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $20 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $10 | SIGN-UP BONUS No | Visit Now |

| MIN DEPOSIT $1 | SIGN-UP BONUS Yes | Visit Now |

The Definition of Currency Trading

Foreign exchange, or Forex trading, is the buying and selling of various currencies on a global platform. It involves individuals, organizations, and institutions swapping one type of currency for another to generate profits through fluctuating exchange rates.

This highly liquid market operates around the clock, connecting major finance centres worldwide to support international trade and investment activities.

Furthermore, traders can forecast changes in value between different pairs of currencies while pursuing diversification opportunities and financial gain by utilizing this approachable method that fosters global economic growth.

The Importance of Currency Trading in the Global Market

The global economy relies heavily on currency trading, the cornerstone of international finance and trade. It allows businesses to convert foreign sales revenue into local currencies, enabling the exchange of goods and services between nations. This is particularly crucial for importers and exporters managing financial fluctuations.

Enhancing Market Liquidity

Currency trading boosts liquidity in financial markets, attracting greater foreign investment for governments. Investors and multinational corporations also use the forex market to protect against adverse losses caused by fluctuating currencies, making it an essential risk management tool for sustained profits.

Round-the-Clock Market Agility

The Forex market operates 24 hours a day, allowing traders and institutions to quickly adapt to changing global economic conditions. This constant activity helps stabilize currency prices by aligning supply and demand in real-time.

Influence on Economic Stability

Exchange rates, a key indicator of a nation’s economic health, are shaped by currency trading. They impact inflation, pricing for imports and exports, and overall economic growth. Central banks actively participate in the currency market, using their reserves to influence rates and maintain economic stability.

How Currency Trading Works

The purchase and sale of currencies, also known as forex trading or currency trading, occurs on the decentralized global market called the foreign exchange market. This is by far the world’s largest financial marketplace, with daily trade volumes exceeding those of stock exchanges.

Currency trading is vital in facilitating international business and commerce since it lets organizations, states, and individuals convert funds into different currencies for various reasons, such as investment activities and leisure travel purposes.

The Role of Forex Markets

The forex market determines the relative value of currencies, which plays a crucial role in the global economy. This market operates 24/5 and reflects the worldwide economic structure to facilitate trade across different time zones.

The participants include financial institutions and retail brokers that provide access to trading platforms for currency purchases or sales. With high liquidity, prevalent use of leverage, and extended hours of operation, traders find this marketplace attractive.

Therefore, it stands out among others as distinctive due to its features attracting individuals from various sectors who wish to engage in profitable activities.

Currency Pairs Explained

The forex market involves currency exchange in pairs, comparing the value of one against another. Classifying these pairs as majors, minors, and exotics depends on trading volume and liquidity.

Examples include EUR/USD (Euro/US Dollar) and USD/JPY (US Dollar/Japanese Yen). Each pair comprises a base currency and a quote currency, dictating how much quote currency is needed to obtain one unit of base.

Such a comparison allows traders to speculate about the relative strength between different currencies.

Understanding Bid and Ask Prices

Bid and ask prices hold significance in forex trading as they signify different aspects of a currency transaction.

When buyers are willing to pay for a particular currency, it is reflected in its bid price. At the same time, sellers showcase their willingness to sell at an acceptable minimum concerning the asking price.

The difference between these two prices is known as the spread, which equips traders with significant information about potential transaction costs that could arise during trades.

To conduct transactions, specific procedures must be adhered to by all participants. This includes utilizing sellers’ asking prices when purchasing currency and buyers’ bidding numbers when selling.

A comprehensive comprehension of these pricing processes is crucial for traders who wish to make informed decisions about their investment strategies while effectively managing the potential risks associated with foreign exchange markets.

Major Players in the Currency Trading Market

A diverse range of participants influences the immense and fluid currency trading market, each bearing its distinctive responsibility in shaping the forex trade’s momentum.

Retail forex traders, institutional traders, and central banks are notably crucial, as they collectively contribute to its richness and liquidity through varying approaches.

Retail Forex Traders

Individuals who trade currencies with their funds on online platforms and via brokers are known as retail forex traders. This group includes inexperienced novices and experienced professionals, all aiming to capitalize on fluctuations in currency values.

Although institutional transactions far exceed single trades made by these individuals, when combined, they have substantial sway over the market due to their sizable diversity and liquidity contributions.

Retail investors employ various methods ranging from short-term day trading to long-range investing approaches that utilize a combination of technical analysis, economic indicators, and industry news insights throughout decision-making processes for maximum profit potential.

Institutional Forex Traders

Institutions engaged in foreign exchange trading encompass banks, hedge funds, and significant financial establishments. These entities conduct transactions with many currencies that heavily impact market dynamics and exchange rates.

Unlike retail traders, institutional ones possess advanced tools and access to sophisticated information, allowing intricate strategies such as algorithmic trading or direct access to the primary marketplace.

Their decisions are typically grounded in extensive research into worldwide economic circumstances, an inclusive analysis of various countries’ interest rate disparities, and geopolitical changes.

Ultimately, they aim to work towards delivering liquidity within forex markets so other participants can execute trades more effortlessly.

Central Banks and Their Impact

The Forex market distinguishes central banks from other entities due to their impact on currency values, monetary policies, and economic stability.

The likes of the US Federal Reserve and European Central Bank may engage in forex trading to manage reserves or influence exchange rates.

Their interventions can significantly affect currency prices by implementing decisions for controlling inflation, boosting economic growth, or stabilizing their respective currencies.

Market observers closely monitor these actions since they have potential implications that could trigger significant adjustments in prevailing trends and tactics adopted while trading currencies.

How to Analyze the Market

A thorough market analysis plays a vital role in currency trading as it aids traders in identifying trends and making knowledgeable trades.

To forecast fluctuations in currency value, varied analytical tools are utilized by traders, such as fundamental, technical, and sentiment analyses, which offer unique perspectives on the forex market. Employing these strategies helps create effective tactics for successful trading.

Fundamental Analysis in Forex

A thorough market analysis plays a vital role in currency trading as it aids traders in identifying trends and making knowledgeable trades.

To forecast fluctuations in currency value, varied analytical tools are utilized by traders, such as fundamental, technical, and sentiment analyses, which offer unique perspectives on the forex market. Employing these strategies helps create effective tactics for successful trading.

Technical Analysis in Forex

On the other hand, technical analysis predicts future market behavior by scrutinizing past price data and volume. This approach involves utilizing statistical indicators and charts to identify trends and patterns in currency movements.

Technical traders firmly believe that fluctuations in the market are not random but can be anticipated based on earlier performance.

To decide when to enter or exit a trade, they rely on moving averages, Fibonacci retracements, and support/resistance levels for guidance. Short-term traders and scalpers resort to this strategy since it simplifies pinpointing their opportunities for entry/exit into markets accurately.

Sentiment Analysis

Market sentiment analysis gauges the collective feelings of traders towards a particular currency or the overall foreign exchange market by scrutinizing various indicators such as news headlines, market commentary, and positioning data like the Commitments of Traders (COT) report.

This method tries to identify whether bullish or bearish sentiments prevail within the marketplace.

Additionally, psychologists use social media and financial journalism monitoring to better comprehend trader perspectives by predicting currency trends based on their expectations for future developments.

Best Currency Trading Strategies

To navigate the forex market successfully, it is essential to have currency trading strategies that align with your preferred style of trading, risk tolerance level, and time commitment.

The four most effective tactics, namely day trading, swing trading, position trading, and scalping, cater to diverse aspects of market dynamics. They enable traders to seize short-term upswings while embracing long-term trends for maximum gains.

Day Trading Strategy

The act of day trading involves executing and closing transactions within the confines of a single trading day to take advantage of fleeting market shifts.

Those who employ this technique aim to generate profit by leveraging volatility while staying clear of potential downsides when holding positions overnight, such as gap events.

To succeed with this strategy requires extensive knowledge regarding market patterns, quick decision-making abilities, and disciplined risk management protocols.

Day traders often rely on real-time news updates and technical analysis in their trade determinations, which means it is best suited for those willing and able to invest significant amounts of time during regular trading hours – keeping a close watch over fluctuating markets throughout the process.

Swing Trading Strategy

Swing trading appeals to those who aim to take advantage of market momentum by holding positions for multiple days or weeks to profit from short- and medium-term trends.

The focus is trend-following instead of reacting to immediate market volatility like day traders do. Successful swing trades require patience, an in-depth comprehension of market sentiment swings, and resilience when markets consolidate or decline.

Swingers often employ technical analysis and fundamental research methods to locate potential trade options.

Position Trading Strategy

Position trading refers to a prolonged approach that involves traders holding onto their positions for extended periods, ranging from weeks to years.

With this strategy, investors anticipate capitalizing on significant currency price shifts and thus require in-depth knowledge of macroeconomic factors, central bank regulations, and geopolitical events that may impact the forex market over time.

Furthermore, position traders are less susceptible to short-term volatility than other strategies but necessitate having patience and enough liquidity reserves to handle complex market conditions effectively.

Ideally-suited individuals seeking long-term investment opportunities backed by robust analytical skills will find value in employing these techniques.

Scalping

Scalping refers to a trading method involving executing numerous deals daily to capitalize on small price variations. Scalpers aim to enter rapidly and exit transactions, often in just minutes, resulting in gradual profits over time.

As this approach entails high-volume trading, it demands discipline, quick decision-making skills, and an intricate understanding of market microstructures. Scalping suits traders who can attend the markets continuously and excel under fast-paced conditions.

Risks and Challenges of Currency Trading

Although currency trading offers immense profit opportunities, it comes with various risks and challenges that traders must navigate cautiously. Understanding these potential perils is crucial in developing effective risk management plans.

Some of the most notable hazards include debt-related complications, interest rate fluctuations, geopolitical instability, and liquidity concerns within certain countries.

Leverage Risks

Forex traders utilize leverage to oversee large holdings using minimal cash. Although it can increase profits, this practice also heightens the possibility of significant losses, rendering it a critical risk in Forex trading.

In turbulent markets, exceedingly high leverage increases the likelihood of rapid financial deterioration if market conditions contradict one’s trades.

Cautious implementation of leveraging is essential for profitable gains since an increased opportunity for substantial earnings equates to amplified chances of severe monetary setbacks.

Interest Rate Risks

The currency value is significantly influenced by the interest rates established by central banks.

Countries with higher interest rates typically attract investors looking for higher returns, resulting in an appreciation of their currency. Conversely, countries with lower interest rates may see a depreciation of their currencies.

Traders may incur losses if they fail to anticipate changes in national policies or global economic conditions during international transactions, as rapid fluctuations in interest rates between different nations affect trading strategies and tactics.

Country and Liquidity Risks

The term “country risk” pertains to a nation’s monetary stability and economic prosperity associated with currency exchange. Factors such as political turmoil, financial decline, or regulation changes can lead to currency devaluation.

Traders must stay updated on world events and economic details that may suggest variations in national risk levels.

Inadequate market depth poses liquidity risks during substantial orders’ execution at predetermined prices – commonly faced when markets open or release news updates – causing slippage issues by fulfilling requests below expected rates, affecting trading outcomes.

How to Start in Currency Trading

To succeed in currency trading, novice traders should carefully choose a broker, develop a comprehensive trading plan, and implement effective risk management measures to navigate the complex market, minimize potential losses, and maximize returns.

Choosing the Right Forex Broker

Selecting the right forex broker is crucial for novice traders. Choosing a broker with a good reputation, who is regulated by a reputable authority and adheres to ethical trading standards, is essential.

Factors to consider include transaction fees, spreads, leverage options, currency pairs, platform usability, tools, market analysis support, and access to educational materials. These factors help ensure the safety and ethical conduct of funds.

Setting Up a Trading Plan

A well-organized forex trading strategy involves setting specific goals, well-defined methods, entry and exit criteria, and money management guidelines. This guide encourages logical choices over emotional impulses and regular market monitoring.

Regular performance reviews help traders adjust and sharpen their capabilities for successful trade execution. Following these strategies fosters continual progress by enabling consistent evaluation and updating modifications, ultimately improving overall outcome results from executed trades.

Risk Management Techniques

Effective risk management in Forex trading is crucial due to unstable market conditions. Traders should set stop-loss orders, limit exposure, diversify transactions across currency pairs, and use leverage prudently.

Market dynamics should be considered and trading tactics adjusted accordingly. By following these practices, investors can protect their portfolios and increase opportunities for favorable returns in the volatile marketplace.

The Future of Currency Trading

The forex market is undergoing significant transformations due to technological advancements, emerging economies, and evolving regulatory guidelines, reshaping currency exchange methodologies and redefining trader participation requirements and strategies. Understanding these developments is crucial for future success.

The Impact of Technology and AI

Advancements in technology and artificial intelligence are transforming currency trading. Machine learning algorithms improve market analysis, trade pattern identification, and currency movement prediction.

Automated robots facilitate high-frequency trades, while blockchain technology and cryptocurrencies offer secure, decentralized transactions. To stay competitive, traders must possess strong tech-savvy skills to navigate these rapidly evolving markets.

Emerging Markets and Their Influence

Emerging markets’ growing importance in the global economy has increased currency trading, as investors seek diversity and higher returns.

However, introducing developing country currencies into forex deals increases profit potential but also adds volatility and risk due to political instability or economic distress. Understanding these regions’ unique dynamics is crucial for predicting global money movements.

Regulatory Changes and Their Implications

The rules surrounding currency trading are constantly in flux as global regulators strive to enhance market openness, protect investors, and thwart financial wrongdoing.

Altered legislation can significantly alter foreign exchange markets by affecting factors such as the methods utilized for exchanging currencies and traders’ approaches overall.

For instance, stricter leveraging limitations or disclosure stipulations may impact profitability or how trades occur. As regulatory compliance becomes an increasingly vital aspect of forex trade, dealing with evolving norms across different countries is essential for practitioners in this field.

10 Best Currency Trading Forex Brokers (2026)

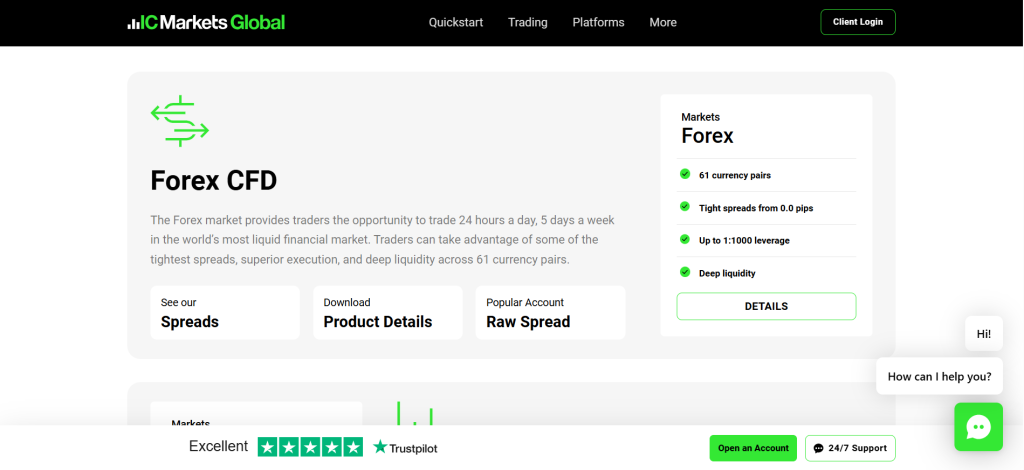

- IC Markets – Overall, The Best Currency Trading Forex Broker

- Vantage – Low spreads and fast execution times

- Axi – Tight spreads and low latency execution

- VT Markets – Support for MetaTrader 4/5 and TradingView

- GO Markets – Options for commission-free trading

- Exness – Multiple user-friendly platforms

- IG – Comprehensive educational resources

- Forex.com – Competitive spreads and advanced account features

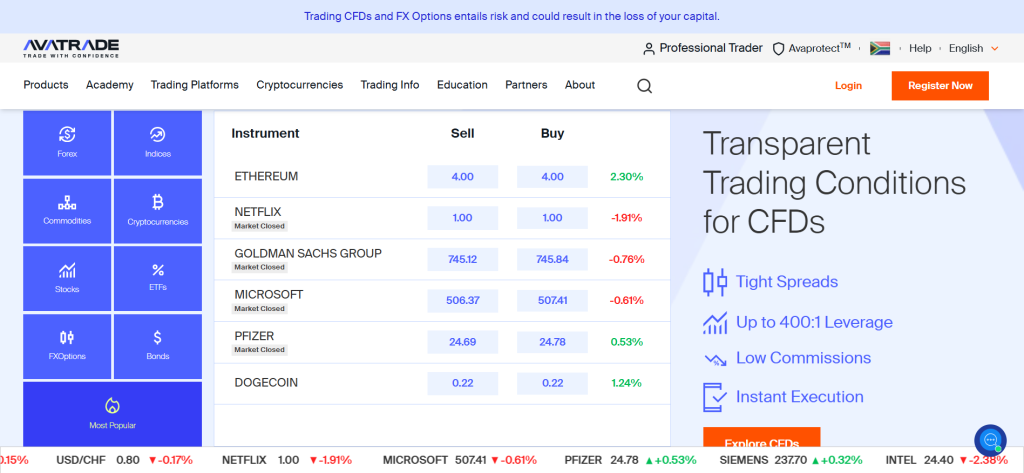

- Saxo Bank – Powerful trading platforms like SaxoTraderPRO and SaxoTraderGO

- AvaTrade – Innovative risk management tool AvaProtect

1. IC Markets

IC Markets is a globally recognized CFD and currency trading broker, established in 2007 and registered in Australia. The broker provides access to forex, indices, commodities, stocks, bonds, and cryptocurrencies via MetaTrader 4, MetaTrader 5, and cTrader.

Frequently Asked Questions

Is IC Markets an authorized broker?

Yes, IC Markets is an authorized broker. It is regulated by several top-tier financial authorities, including the ASIC (Australia), CySEC (Cyprus), and the SCB (Bahamas), ensuring a secure and compliant trading environment.

What trading platforms does IC Markets offer?

IC Markets offers three main trading platforms: the popular MetaTrader 4 (MT4), its successor MetaTrader 5 (MT5), and the advanced platform cTrader. They also support an integration with TradingView, providing traders with a wide range of options.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Minimum deposit of $200 may be higher than some brokers. |

| Ultra-low spreads | No fixed spread accounts |

| Supports a wide range of trading platforms | Limited investor protection for non-EU clients |

| Access to over 2,000 CFDs | No proprietary trading platform |

| Segregated client funds and negative balance protection | Customer support can be slow during peak times |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets is an authorized CFD and currency trading broker known for tight spreads, advanced platforms, and reliable execution. While it lacks strong investor protection in some regions, it remains a top choice for serious traders.

2. Vantage

Vantage is an approved CFD and currency trading broker founded in 2009, regulated by ASIC, FCA, and CIMA. It offers tight spreads from 0.0 pips, high leverage up to 1:500, and supports trading on MetaTrader 4, MetaTrader 5, and its proprietary mobile app.

Frequently Asked Questions

What is the minimum deposit at Vantage?

The minimum deposit at Vantage is $50 for most account types, including the Standard and Raw ECN accounts. However, more advanced accounts, such as the Pro ECN, require a higher minimum deposit of $10,000.

What platforms does Vantage support?

Vantage supports the most popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They also offer a proprietary trading app and have integration with TradingView, providing a variety of options for all types of traders.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit broker authorized by multiple regulators | Limited investor protection for non EU/UK clients |

| Very low spreads | Inactivity fees apply |

| High leverage | Customer support can be inconsistent at peak hours |

| Wide range of CFDs | Swap fees can add up for overnight trades |

| Strong trading tools with MT4/MT5 and copy trading options | No fixed spread account options |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Vantage is a legit currency trading and CFD broker offering tight spreads, advanced platforms, and high leverage. While protection schemes vary by region, it remains a strong choice for both beginners and experienced traders.

3. Axi

Axi is a trusted CFD and currency trading broker established in 2007 and registered in Australia. It is regulated by ASIC, FCA, and DFSA, offering competitive spreads from 0.0 pips with fast execution. Axi provides trading on MetaTrader 4 with access to forex, indices, commodities, shares, and cryptocurrencies.

Frequently Asked Questions

Is Axi a legal broker?

Yes, Axi is a legal and well-regulated broker. It is overseen by multiple top-tier financial authorities globally, including the FCA (UK) and ASIC (Australia), which ensures a high level of client protection and transparency.

What platforms does Axi support?

Axi primarily supports MetaTrader 4 (MT4), which is available on desktop, web, and mobile. They also have their own proprietary mobile trading app, “Axi Trading Platform,” and, in some regions, offer MetaTrader 5 (MT5).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal broker regulated by top-tier authorities | Limited range of platforms |

| Competitive spreads | Investor protection schemes not as strong outside UK/EU |

| No minimum deposit | No proprietary trading platform |

| Strong trading tools with MT4 and advanced plugins | Commissions apply on Pro accounts |

| Segregated funds and negative balance protection for client safety | Educational resources less detailed |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Axi is a legal CFD and currency trading broker offering tight spreads, advanced tools, and secure fund protection. While it only supports MT4, its low barriers to entry make it appealing to many traders.

Top 3 Currency Trading Forex Brokers – IC Markets vs Vantage vs Axi

4. VT Markets

VT Markets is a regulated CFD and currency trading broker established in 2011, authorized by ASIC (Australia) and VFSC (Vanuatu). The broker offers tight spreads from 0.0 pips on ECN accounts, leverage up to 1:500, and trading via MetaTrader 4 and MetaTrader 5 platforms.

Frequently Asked Questions

What trading platforms does VT Markets support?

VT Markets supports a variety of popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They also offer a proprietary WebTrader and a mobile app, as well as an integration with the advanced charting platform TradingView.

What is the minimum deposit at VT Markets?

The minimum deposit for VT Markets is $100 for both the Standard STP and Raw ECN accounts. However, a lower $50 minimum deposit is required for the Cent account.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Limited investor protection outside regulated regions |

| Tight spreads | Commissions apply on ECN accounts |

| High leverage | Fewer trading platforms compared to some competitors |

| Wide range of CFDs | Educational resources are basic |

| Segregated client funds with negative balance protection | Customer support response can vary by region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | 10Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

VT Markets is an approved CFD and currency trading broker offering low spreads, high leverage, and reliable platforms. While protection varies by region, it remains a solid choice for both beginner and professional traders.

5. GO Markets

GO Markets is an established CFD and currency trading broker, registered in 2006 and authorized by ASIC and FSC. It offers MetaTrader 4 and 5 platforms, competitive spreads from 0.0 pips, leverage up to 1:500, and access to forex, commodities, indices, shares, and cryptocurrencies.

Frequently Asked Questions

What is the minimum deposit at GO Markets?

GO Markets has no minimum deposit requirement to open an account. While they don’t enforce a minimum, they recommend an initial deposit of $200 to ensure you have enough margin to begin trading effectively on their platform.

Is GO Markets a registered forex broker?

Yes, GO Markets is a registered forex broker. It is regulated by several top-tier financial authorities, including the ASIC (Australia), CySEC (Cyprus), and the FSC (Mauritius), ensuring a secure and compliant trading environment.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Limited research and educational tools |

| Competitive spreads | Customer support not available 24/7 |

| Supports MetaTrader 4 and MetaTrader 5 platforms | No proprietary trading platform |

| Wide range of CFD and currency trading products | Higher minimum deposit than some rivals |

| Strong client fund security with segregation and negative balance protection | Limited investor protection schemes outside Australia and Mauritius |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

GO Markets is a registered and trusted broker offering currency trading and CFDs with competitive costs, advanced platforms, and strong fund protection. It suits traders seeking reliable regulation and flexible leverage across global markets.

6. Exness

Exness is a globally recognized CFD and currency trading broker, registered in 2008 and regulated by multiple authorities, including FCA, CySEC, and FSCA. It offers ultra-low spreads from 0.0 pips, leverage up to 1:2000, and popular platforms like MetaTrader 4 and 5.

Frequently Asked Questions

What trading platforms does Exness offer?

Exness offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms for desktop and mobile. They also provide their own proprietary platforms, the Exness Terminal (web-based) and the Exness Trade mobile app.

What is the minimum deposit at Exness?

The minimum deposit at Exness is $10 for most Standard accounts. However, Professional accounts like the Raw Spread and Zero accounts require a higher first-time deposit, typically starting at $200 depending on the region.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated | No bonuses or promotions for traders |

| Very low spreads | Limited educational resources |

| High leverage | Customer support not fully available 24/7 in all languages |

| Fast deposits and withdrawals with multiple methods | Investor protection schemes vary by region |

| Wide asset range including forex, stocks, crypto, and indices | Some advanced tools only available to professional clients |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness is a legit and globally regulated broker offering currency trading with tight spreads, high leverage, and reliable platforms. Its flexible accounts and fast withdrawals make it a strong choice for both beginners and experienced traders.

7. IG

IG is an authorized CFD and currency trading broker, founded in 1974 and regulated by top-tier authorities including the FCA (UK), ASIC (Australia), and NFA (US). It offers access to over 80 currency pairs with spreads from 0.6 pips, leverage up to 1:200, and advanced platforms such as IG’s proprietary web platform and MetaTrader 4.

Frequently Asked Questions

Is IG a legal forex broker?

Yes, IG is a highly legal and reputable forex broker. It is regulated by numerous top-tier financial authorities around the world, including the FCA (UK), CFTC/NFA (US), ASIC (Australia), and FSCA (South Africa).

What platforms does IG offer for currency trading?

IG offers its own advanced web-based platform and mobile apps, which are known for their ease of use. It also supports third-party platforms like MetaTrader 4 and the advanced charting software ProRealTime for more experienced traders.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Limited leverage compared to offshore brokers |

| Wide currency trading selection | No cent accounts for micro-trading |

| Transparent pricing | Inactivity fees may apply |

| Reliable trading platforms and advanced tools | Customer support not always 24/7 worldwide |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG is a legal and highly regulated broker offering a wide range of currency trading and CFD products. With strong oversight, reliable platforms, and transparent costs, IG is a trusted choice for both beginner and advanced traders.

8. Forex.com

Forex.com is a legit CFD and currency trading broker, established in 2001 and regulated by top authorities including the FCA, CFTC, ASIC, and IIROC. It offers over 80 forex pairs with spreads from 0.0 pips, leverage up to 1:200, and platforms like MetaTrader 4, MetaTrader 5, and its proprietary Web Trader.

Frequently Asked Questions

What is the minimum deposit at Forex.com?

The minimum initial deposit at Forex.com is $100. While this is the official minimum, they recommend a deposit of at least $2,500 for better trading flexibility and effective risk management, especially for less-experienced traders.

Is Forex.com an approved forex broker?

Yes, Forex.com is an approved and highly-regulated broker. It is overseen by multiple top-tier financial authorities globally, including the FCA (UK), CFTC/NFA (US), and ASIC (Australia), ensuring a secure and transparent trading environment.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Limited product range outside forex compared to some brokers |

| Over 80 forex pairs available for trading | No cent accounts for beginners |

| Tight spreads | Withdrawal fees may apply in certain regions |

| Reliable platforms | Customer support not 24/7 globally |

| Negative balance protection and segregated accounts | High leverage not available in all jurisdictions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Forex.com is an approved and highly regulated broker for CFD and currency trading. With advanced platforms, competitive pricing, and strong oversight, it offers traders a secure and transparent trading environment across global markets.

9. Saxo Bank

Saxo Bank is a licensed multi-asset and currency trading broker, founded in 1992 and regulated by top-tier authorities including the Danish FSA, FCA, and ASIC. It offers over 180 forex pairs with competitive spreads starting from 0.4 pips, leverage up to 1:30 (depending on jurisdiction), and advanced platforms such as SaxoTraderGO and SaxoTraderPRO.

Frequently Asked Questions

What platforms does Saxo Bank offer for currency trading?

Saxo Bank primarily offers its proprietary platforms, SaxoTraderGO (for all devices) and SaxoTraderPRO (for professional desktop traders). It also provides an integration with TradingView but does not support MetaTrader 4 or 5.

Is Saxo Bank a registered forex broker?

Yes, Saxo Bank is a registered and highly reputable forex broker. It is a licensed bank regulated by numerous top-tier authorities, including the FCA (UK), FINMA (Switzerland), and the Danish FSA, ensuring strong client protection.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Customer support response can vary by region |

| Wide currency trading selection | Leverage limited to 1:30 for retail clients in some regions |

| Competitive spreads | Platform complexity may be challenging for beginners |

| Advanced platforms | Fees can be higher for small accounts |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

Saxo Bank is a registered and highly regulated broker offering currency trading and CFDs with professional platforms, strong investor protection, and competitive spreads. It is ideal for serious and institutional traders seeking a secure trading environment.

10. AvaTrade

AvaTrade is an approved CFD and currency trading broker, established in 2006 and regulated by top authorities including ASIC (Australia), BVI FSC, FSCA (South Africa), and FSA (Japan). It offers competitive spreads from 0.9 pips, leverage up to 1:400, and trading on platforms such as MetaTrader 4, MetaTrader 5, AvaTradeGO, and ZuluTrade.

Frequently Asked Questions

What is the minimum deposit at AvaTrade?

The minimum deposit to open a live trading account with AvaTrade is $100. This amount applies to deposits made via credit card, wire transfer, and e-wallets, and is the equivalent amount in other base currencies like EUR, GBP, or AUD.

What platforms does AvaTrade support for currency trading?

AvaTrade offers a variety of platforms for currency trading, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They also support their own proprietary platforms like AvaTradeGO and AvaSocial for mobile and social trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Limited educational resources |

| Competitive spreads | Withdrawal fees may apply depending on payment method |

| High leverage | Platform options may be complex for beginners |

| Wide asset range | Some regions have restricted leverage |

| Segregated client funds and negative balance protection | Customer support response can vary by region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is an authorized CFD and currency trading broker offering competitive spreads, diverse assets, and reliable platforms. Its strong regulatory oversight and client fund protection make it suitable for both beginner and professional traders.

Criteria for Choosing a Zero Spread Forex Broker

| Criteria | Description | Importance |

| Regulation & Authorization | Ensures the broker is licensed and regulated by recognized authorities to protect traders. | ⭐⭐⭐⭐⭐ |

| Trading Costs & Spreads | Includes spreads, commissions, and fees; lower costs improve profitability. | ⭐⭐⭐⭐⭐ |

| Leverage & Margin | Determines the potential for larger positions; high leverage increases both risk and reward. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Platform reliability, speed, and features (MT4, MT5, proprietary platforms). | ⭐⭐⭐⭐⭐ |

| Range of Currency Pairs | Variety of major, minor, and exotic pairs for trading flexibility. | ⭐⭐⭐⭐☆ |

| Account Types | Availability of standard, ECN, micro, or swap-free accounts to suit different traders. | ⭐⭐⭐⭐☆ |

| Deposit & Withdrawal Options | Convenient and secure methods for funding and withdrawing from accounts. | ⭐⭐⭐⭐⭐ |

| Customer Support | Quality, availability, and responsiveness of support services. | ⭐⭐⭐⭐☆ |

| Research & Educational Tools | Availability of market analysis, tutorials, and educational content for informed trading. | ⭐⭐⭐⭐☆ |

| Security of Funds | Segregation of client funds and negative balance protection. | ⭐⭐⭐⭐⭐ |

| Execution Speed & Order Types | Fast order execution with multiple types of orders to manage risk effectively. | ⭐⭐⭐⭐⭐ |

| Mobile Trading & User Experience | Quality of mobile apps and ease of trading on smartphones or tablets. | ⭐⭐⭐⭐☆ |

Top 10 Currency Trading Forex Brokers – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From currency pairs to risk management, we provide straightforward answers to help you understand currency trading and choose the right broker confidently.

Q: What is the best way to start trading currencies as a beginner? – David M.

A: Start by educating yourself on the basics of the market. Then, choose a regulated broker and practice with a free demo account to develop a strategy before risking any real money. Always begin with a small initial investment.

Q: Which currency pairs should beginners focus on? – Jessica L.

A: Beginners should focus on major currency pairs like EUR/USD, GBP/USD, and USD/JPY. These pairs are highly liquid, have the tightest spreads, and are easier to analyze due to the extensive amount of available information and news.

Q: How can I manage risk effectively when trading forex? – Thomas W.

A: To manage risk effectively in forex trading, always use stop-loss orders to limit potential losses. Determine your risk-reward ratio and use proper position sizing, risking only a small percentage (1-2%) of your capital on any single trade.

Q: Can carry trading generate steady profits in forex? – Emily K.

A: Yes, but not always steadily. While carry trading can generate consistent profits when interest rate differentials are stable, it is highly susceptible to sudden interest rate changes and market volatility, which can lead to significant and rapid losses.

Q: How often should I review and adjust my trading strategy? – James B.

A: You should review your strategy weekly or bi-weekly to assess performance against your goals. Only adjust it when you identify a clear flaw in your approach or when major market conditions change. Avoid frequent, impulsive changes based on short-term results.

Pros and Cons

| ✓ Pros | ✕ Cons |

| High Liquidity | High Risk |

| 24-Hour Market | Market Volatility |

| Leverage Opportunities | Complexity |

| Diverse Currency Pairs | Emotional Pressure |

| Accessibility | Costs and Fees |

| Potential for Profit in Both Directions | Fraud Risk |

| Advanced Tools & Technology | No Guaranteed Income |

You Might also Like:

In Conclusion

Currency trading offers high liquidity, flexible hours, and profit opportunities with diverse pairs, but carries significant risk, volatility, and costs. Success requires skill, discipline, and careful broker selection to trade safely and effectively.